Why Every Bank Needs a Financial Super App in 2025

- David Ho

- 0 Comments

Financial super apps have been around for at least half a decade, but their impact continues to grow, especially in Asian markets like China, Vietnam, Indonesia, and Singapore, where they are becoming the norm. These super financial apps are reshaping financial services by integrating banking, payments, and lifestyle solutions into a single platform. These apps are reshaping financial services by integrating banking, payments, and lifestyle solutions into a single platform.

So, what is driving the rise of financial super apps and their growing influence in the digital economy? How do they benefit both consumers and businesses, and what risks do they pose? This article explores the key factors fueling their growth, their transformative effects, and the potential challenges that come with this evolving digital finance ecosystem.

I. Definition and Scope of Financial Super Apps

A financial super app—also referred to as a super financial app—is a mobile platform that integrates multiple financial services, such as banking, payments, investments, and insurance, into a single, seamless experience. Unlike standalone apps that focus on one function, super apps create an interconnected ecosystem, allowing users to manage their finances effortlessly while also accessing lifestyle services like shopping, travel bookings, and ride-hailing.

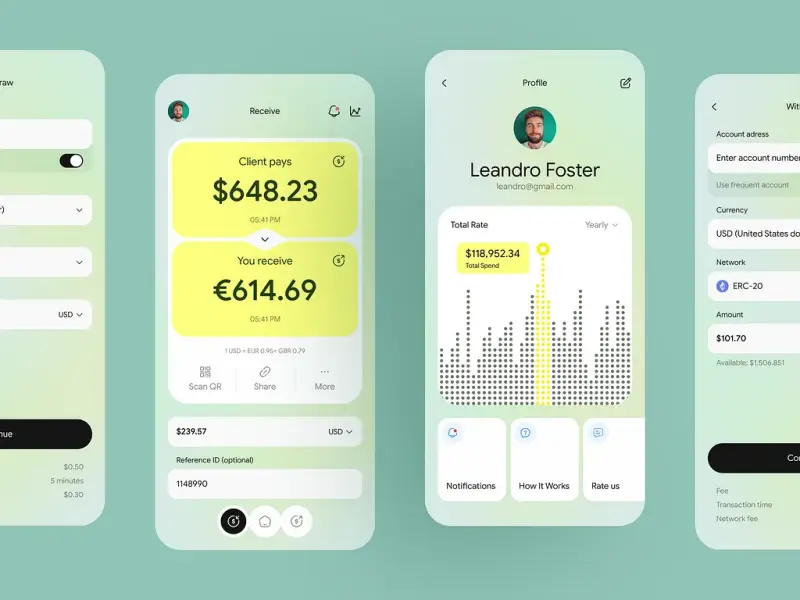

Financial app

By leveraging big data and AI-driven personalization, these apps enhance user engagement, transaction speed, and customization, making financial management more intuitive. A prime example is WeChat, which evolved from a messaging app into a full-fledged digital ecosystem with financial transactions, loans, and e-commerce, serving over 800 million users monthly. Other notable super apps include Grab, Gojek, and Alipay, each offering a mix of financial and lifestyle services tailored to their markets.

II. Market Overview: The Rise of Financial Super Apps

The concept of the super app was first introduced in 2010 by Mike Lazaridis, the founder of BlackBerry. He described it as an “ecosystem of apps that people rely on daily thanks to a seamless, integrated experience.” Today, this definition remains highly relevant, as financial super apps—or super financial apps—continue to reshape the way consumers interact with digital finance.

In Asia, super apps have already taken center stage, dominating multiple markets with their all-in-one approach.

-

WeChat (China) – Originally launched as a social app, WeChat has since expanded into a full-fledged digital ecosystem. With over 1.2 billion users, it offers services ranging from online shopping and food delivery to banking and group payments via WeChat Pay.

-

Alipay (China) – Founded by Alibaba Group in 2004, Alipay is the most widely used mobile payment platform in China, processing over 100 million daily transactions for 1.3 billion users. Its digital wallet enables seamless cashless payments, making financial transactions more accessible.

-

Grab (Southeast Asia) – Initially a ride-hailing service, Grab has evolved into a multi-service platform that includes food delivery, insurance, and digital banking. Operating across Singapore, Malaysia, Indonesia, Vietnam, and other nations, Grab now serves around 187 million users.

-

Gojek (Indonesia) – What started as a call center for ride-hailing services has grown into a comprehensive financial and lifestyle platform. With 170 million users, Gojek offers everything from digital payments and BNPL (Buy Now, Pay Later) services to food ordering and medical appointments.

-

Paytm (India) – Aiming to bring 500 million unbanked Indians into the digital economy, Paytm has become India’s leading payment and financial services app. With 350 million users, it allows everything from bill payments and mobile recharges to microloans and travel bookings.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

III. Key Features for Financial Super Apps

Financial super app functionality can be based on three main banking innovations:

1. Personal Financial AI-Assistant

A Fintech super app should serve as a highly personalized financial assistant, offering insights tailored to each user’s needs through AI, automation, and predictive analytics. It must proactively notify users about important financial matters, help improve their financial health with smart recommendations, and forecast future needs with customized solutions. AI-driven advancements will soon enable users to conduct financial operations via voice, gestures, neurotechnology, VR, and AR, while behavior-based predictive analytics will allow the app to anticipate and offer financial products at the perfect moment.

2. Financial Super App as a Platform for Integrations

To provide a comprehensive banking experience, financial super apps must integrate third-party services, utilizing external banking infrastructure for seamless payments and financial management. By merging financial solutions with retail services, these apps allow users to manage all aspects of their financial and private lives from a single platform. Achieving a true bank-as-a-platform model requires open APIs and cloud storage for scalability, while transaction speed and security are enhanced through blockchain technology.

Financial super apps

3. Next Level Personalization

A major challenge in traditional banking is the need for lengthy and complex forms, which can frustrate users. A Fintech super app should minimize this inconvenience by automating up to 90% of the process, creating a seamless and efficient experience. AI-driven credit scoring can analyze not only a user’s banking and credit history but also their social and offline activity, enabling the app to generate pre-approved financial offers before the user even requests them. This approach enhances user experience while ensuring faster, more personalized access to financial services.

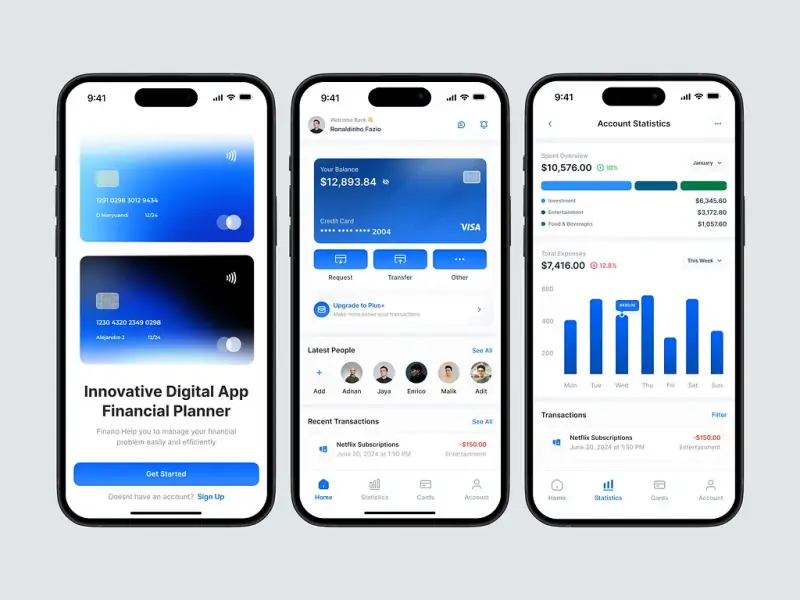

To provide a seamless and engaging financial experience, a super financial app must include:

- Effortless Authorization

Using biometrics such as facial recognition and fingerprint scanning, users can quickly and securely access their accounts, eliminating the need for traditional passwords. - Key Data Visibility

Essential financial information, such as account balances and recent transactions, is displayed prominently on the dashboard, enabling users to access critical data at a glance. - Comprehensive Financial Insights

Users can view a detailed overview of their financial status, including income, expenses, savings, and investment performance. This helps them make informed financial decisions by understanding their financial health in real time. - Spending Insights

The app analyzes user spending patterns to provide personalized insights and recommendations that promote better financial habits and savings. By categorizing expenses, users can easily track where their money is going and identify areas for improvement. - Versatile Account Management

A financial super app should support various types of financial accounts, such as checking, savings, and credit cards, allowing users to manage them all from a single platform. This consolidates banking into one convenient location, providing a seamless experience. - Social Media-Inspired Activity Feed

Transforming traditional transaction history into an engaging, interactive feed, the app presents financial activities similarly to social media updates. This makes financial tracking more intuitive and visually appealing. - Detailed Transaction Information

Users should have easy access to comprehensive details for each transaction, including merchant information, date, time, and amount. This ensures transparency and allows users to review their spending with complete clarity. - Quick Payments

A financial super app should facilitate instant and easy money transfers, including peer-to-peer payments and bill payments, making financial transactions more convenient. Users should be able to send money with just a few taps. - Automated Bill Payments

Leveraging AI, the app can manage and schedule regular bill payments, reducing the risk of missed payments and late fees. This automation ensures that users stay on top of their financial obligations effortlessly. - Conversational Banking

By implementing AI-powered voice assistants, the app allows users to conduct banking transactions and inquiries using natural language commands. This feature makes financial management more accessible and intuitive. - Unlimited Financial Marketplace

The app should provide access to a wide range of financial products and services, such as loans, insurance, and investment opportunities, all within a single platform. This creates an all-in-one financial hub tailored to users’ needs. - Personal Finance Management

With built-in tools, the app helps users budget, track spending, set financial goals, and manage their overall financial health. AI-driven insights and recommendations support users in making smarter financial decisions.

IV. The Future of Banking with Super Apps

The future of banking lies in the seamless integration of financial and lifestyle services, with financial super apps serving as the bridge between the two. These super financial apps are redefining how users interact with money, offering an all-in-one digital ecosystem. These platforms are transforming digital banking by offering a unified experience that simplifies financial management while catering to users’ everyday needs. As financial institutions adopt this model, the boundaries between banking and daily life will fade, creating a new era of convenience, personalization, and engagement.

super financial app

By leveraging cutting-edge technology and strong UX design, financial super apps provide a highly efficient and tailored experience that extends beyond traditional banking. As these platforms evolve, they will redefine digital financial services, offering users unprecedented accessibility and value. This shift represents more than just a trend—it signifies a fundamental transformation in how people interact with their finances.

Banks embracing the super app model will gain a competitive advantage, delivering unmatched value and setting new standards for the industry. The rise of super apps is reshaping the financial landscape, ensuring that banking is no longer just a service but an integrated part of everyday life.

Conclusion

The rise of financial super apps is revolutionizing the way people bank, pay, and manage their finances, offering an unmatched level of convenience, integration, and personalization. As these platforms continue to evolve, businesses that embrace this trend will gain a significant competitive edge, providing seamless financial solutions tailored to modern consumer needs.

Get ready to build a cutting-edge financial super app that transforms the user experience and drives business growth. TECHVIFY specializes in custom financial app development, ensuring seamless integration, robust security, and an intuitive user experience.

TECHVIFY – Global AI & Software Solutions Company

For MVPs and Market Leaders: TECHVIFY prioritizes results, not just deliverables. Reduce time to market & see ROI early with high-performing Teams & Software Solutions.

- Email: [email protected]

- Phone: (+84)24.77762.666