Mobile Banking App Development: From Idea to Launch

- David Ho

- 0 Comments

Creating a mobile banking app has become essential for any financial institution that wants to stay relevant. With over 2.3 billion people using online banking globally, the demand for fast, secure access to financial services keeps rising. To meet these expectations, banks need to focus on digital solutions that are both user-friendly and secure.

Mobile banking app development offers more than just convenience. It can help boost customer loyalty, increase revenue, and reduce service costs. A simple, clear interface makes the app easier to use, while features like customizable templates allow it to adapt as your business grows.

When starting the development of mobile banking tools, it’s important to think about the full user experience. Every part of the design should be focused on making the app easy to navigate and safe to use. With the right approach to mobile application development for banking, you can build a solution that meets customer needs and helps your organization grow.

Mobile Banking App Development Market Overview

The world of banking is changing fast, and mobile banking is leading the way. More people are turning to digital-first services, and the numbers prove how quickly the shift is happening. According to Statista, neobanks, banks that operate entirely online are growing rapidly, showing just how much users value convenience, speed, and 24/7 access over traditional branch visits.

This trend is fueling the rise of mobile banking app development, as financial institutions work to meet evolving customer expectations. People now expect to deposit checks, send money, pay bills, and manage their finances—all from their phones. For banks, mobile services offer an efficient, cost-effective alternative to maintaining physical locations, while also reaching more users.

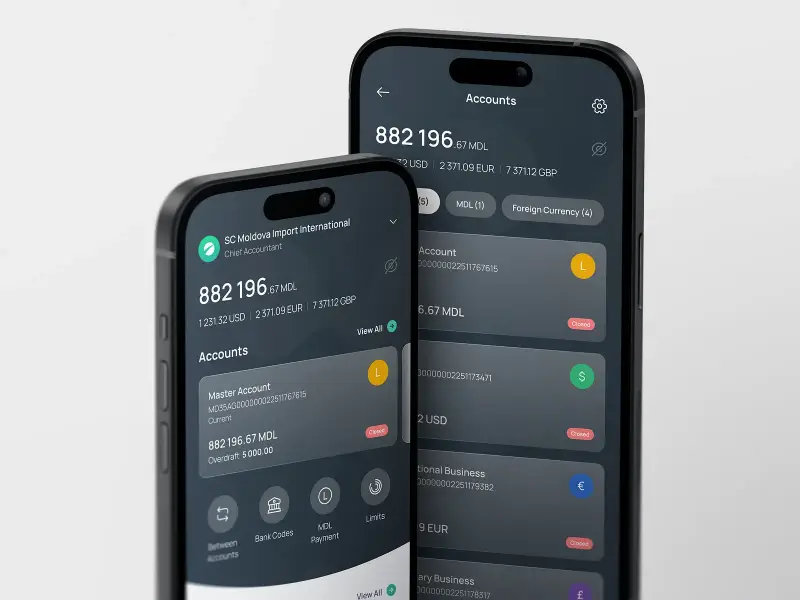

Banking application development

Here’s a quick look at the latest numbers:

- The global mobile banking market is projected to reach $1.36 billion by 2028

- 57% of millennials and 64% of Gen Z have accounts with nontraditional institutions (PwC)

- In emerging markets, mobile money transactions could hit $2 trillion by 2027 (Juniper Research)

With the continued growth in mobile application development for banking, creating a secure, user-friendly app is no longer optional. If you plan to build a banking app, now is the time to invest in the tools and features your customers expect.

Learn More On:

How to Develop an Online Banking Application

Creating a mobile banking app is a lot like building any other digital product—but there’s one big difference: security. Since you’ll be handling sensitive financial data, you need to take extra care during development. Let’s walk through the key steps to get your app off the ground the right way.

Step 1: Do Your Research

At TECHVIFY, every mobile banking app development project starts with thorough research. Before writing a single line of code, we study the market, the competitors, and—most importantly—the users.

Understanding cultural habits is just as important as analyzing data. For example, while developing a banking app for the U.S., we found that over 70% of users have at least one credit card. That insight made it clear we had to include credit-related features from the start.

By the end of this step, you should have:

- A clear user persona

- Market insights and habits

- Defined value proposition.

Step 2: Set Up the Security Foundation

This is where mobile banking app development truly sets itself apart. You’re working with private user data, so everything from login to data storage must be locked down.

Passwords should be hashed and securely stored. Users should be automatically logged out if inactive for more than 15 minutes. Developers should have limited access to sensitive information like tokens or card numbers, and all such data should be stored using secure platforms.

If you’re creating a web app, make sure you have an SSL Certificate. For mobile apps, use SSL Pinning to protect data in transit. On the device level, biometric authentication like fingerprint or Face ID should be enabled, and tools like VGS can help protect card information.

Security is non-negotiable in mobile banking app development. Building trust starts with protecting every point of contact.

Step 3: Build and Test a Prototype

From my experience in mobile banking app development, one thing is clear: the more you interact with real users early on, the more successful your final product will be. That’s why building a prototype is so important.

A prototype is a simplified version of your app. It shows how the app is structured, how users will move through it, and what it will look like. It won’t be perfect, but it will help you test your ideas, gather feedback, and make smart changes before you invest in full development.

If you want to validate your concept, design, and user experience all at once, this is the way to do it.

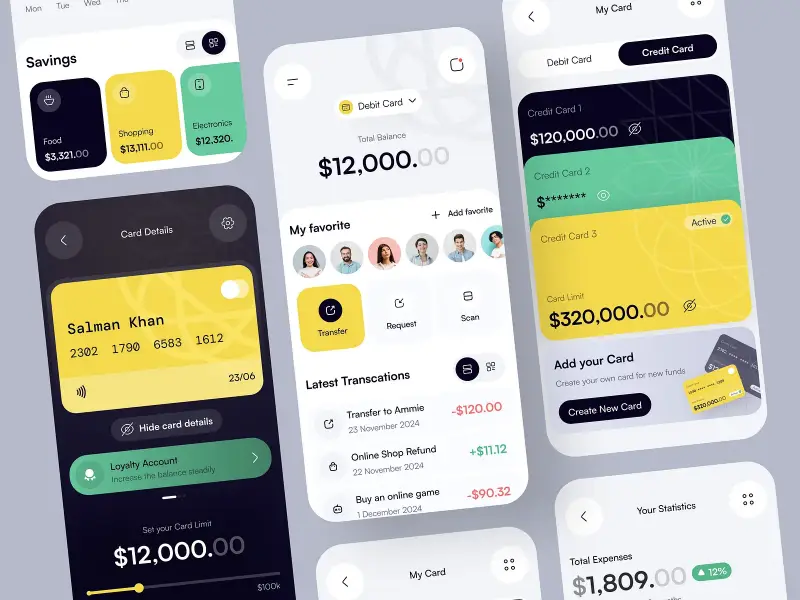

Development of mobile banking

Step 4: Design the UX and UI

Once you gather feedback from early users and research, it’s time to design the app.

UX stands for “user experience.” It’s about how easy and enjoyable it is to use the app. UI stands for “user interface.” That’s what people see and interact with on their screens.

When it comes to money, people want to feel safe and in control. A user-friendly interface helps with that. It should be simple, clear, and easy to navigate. A good design makes users feel confident when transferring money, checking balances, or applying for a loan.

Keep menus clean, buttons easy to find, and instructions clear. A well-designed banking app reduces stress and builds trust.

Step 5: Start Mobile Banking App Development

Now it’s time to turn the design into a real, working product.

This is the core of mobile banking app development. First, choose how you want to build the app. If you’re building for iPhones, use Apple’s tools (Swift and XCode). For Android devices, use tools like Java or Kotlin with Android Studio. These are called native development tools, and they help create apps that run smoothly and securely on each device.

Native apps are often more secure than apps built with cross-platform tools like React Native. That’s why many banks choose them.

This stage is where developers write the code, connect the design to the backend, and make everything work together.

Step 6: Add Third-Party Services

You don’t need to build everything from scratch. You can add outside tools to your app to save time and improve features. These are called third-party services.

For example, you can use a tool that checks a user’s identity. Another tool might let users connect their bank accounts from other apps. You can also add features like in-app chat or helpful notifications.

Before adding any tool, make sure it’s secure, reliable, and updated often. A trusted third-party service can make your app better without extra work — and speed up the mobile banking app development process too.

Step 7: Launch, Maintain, and Improve

Once the app is ready, it’s time to launch. But launching is not the end.

After users start using your app, you’ll get feedback. Some features may need to be improved. New problems might show up. You might also get requests for new features.

This is normal. Keep updating the app to fix bugs, improve speed, and add helpful features. Mobile banking app development is an ongoing process. The best apps are the ones that grow with their users.

Have a Project Idea in Mind?

Get in touch with experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Core Features of a Mobile Banking App

Whether your bank operates fully online or has physical branches, you need to include key features in your app. These features help users manage their money easily and safely. They also make your app more useful and trustworthy.

When you build a banking app, it’s important to focus on what users expect and need. Here are the core features that every banking app should have.

Secure Login and User Verification

When it comes to money, security is everything. That’s why modern apps use more than just a password. Many banks now use multi-factor authentication, which means users need more than one step to log in—like a password plus a text code or a fingerprint scan.

Some apps also support biometric authentication, such as face recognition or fingerprint unlocking. These tools help protect user accounts and keep your app in line with industry rules. This is a must-have in mobile banking app development.

Easy Money Transfers and Account Management

Users log in to check their balance, send money, and view past transactions. These are the most-used features in any banking app.

Your app should make it simple to:

- View account balances

- Send money to others

- Set up regular payments, like bills or rent

- See a full list of past transactions

This kind of smooth access is a key part of banking application development.

In-App Customer Support

Sometimes users have questions or problems. Your app should offer quick ways to get help.

This might be a simple tap-to-call feature that connects the user to a support agent. Or it could be a chatbot that answers common questions right in the app. Giving users fast support builds trust and improves their experience.

Learn More On:

Find Nearby ATMs and Branches

Many banks use geolocation in their apps. This means the app can show users nearby ATMs, bank branches, or payment terminals based on their location.

It’s especially helpful when someone is traveling or in a new area. This is a common feature in the development of mobile banking tools.

Push Notifications

Users don’t always have the app open. But they still want to know what’s going on with their money.

Push notifications let the app send updates, alerts, and reminders. For example, users can get a message right away when a payment is made or when their balance changes. This keeps them informed and in control.

Contactless Payments (NFC)

Many new apps support NFC, or near-field communication. This lets users tap their phones at checkout to pay, without needing a physical card. It’s fast, safe, and convenient. NFC is becoming more popular in mobile application development for banking, especially for younger users who want fast digital payments.

Mobile application development for banking

Digital Wallets

A digital wallet stores credit and debit card details inside the app. This means users don’t need to carry plastic cards anymore. These wallets usually work with NFC to support contactless payments. They also make it easier to manage multiple cards in one place.

QR Code Payments

Some apps also support QR code scanning. This lets users scan a code at a store or on a bill to pay quickly. It’s simple to use and doesn’t require any extra tools. QR features are growing in popularity, especially in places where contactless cards aren’t common.

Online Payments

Most people expect to make payments online. Your app should support popular services like PayPal or Stripe. This lets users pay for things directly through the app. Adding online payments is a key part of any successful mobile banking app development project.

Full Control Over Transactions

Modern apps give users full control of their finances without going to a bank branch. This is called mobile transaction management.

Users can track spending, block or freeze cards, and control how their accounts are used. Some apps even help users manage their budget by analyzing their spending habits.

This type of control is becoming a must-have in banking application development, especially for digital-first banks.

When you’re figuring out how to build a mobile banking application, you may run into some common fintech challenges. Fortunately, many of them can be solved with the right planning, tools, and team.

Why Building a Banking App Can Be Challenging (And How to Solve It)

What are the main reasons why creating your own banking app can be difficult? Based on the experience of many developers and product teams, here’s what you need to know:

- Designing for All Users Can Be Difficult

Not everyone who uses your app will be comfortable with new technology. Some users may find it hard to navigate complex menus or unclear layouts. That’s why your design needs to be simple and easy to use. Creating a clean, user-friendly interface is one of the biggest challenges in mobile banking app development, but working with skilled UI/UX designers can make it much easier. - Strict Identity and Fraud Checks Are Required

To follow financial laws, you must include tools like KYC (Know Your Customer) and AML (Anti-Money Laundering). These tools help verify each user’s identity and prevent fraud. Without them, your app could face legal trouble or fines. Choosing the right partner for secure mobile application development for banking is key to building trust and staying compliant. - Data Protection Standards Are High

Banking apps handle private financial information, which means security must be a top priority. Your app needs to follow strict data privacy laws, and these rules often change. This can be hard to manage, but experienced developers who focus on banking application development can help keep your app secure and up to date. - Real-Time Card Blocking Is a Must

If something suspicious happens, users need to block their cards instantly. That means your app must connect with bank systems in real time. This feature adds complexity to the development of mobile banking apps, but it helps protect users and builds trust in your product. - Legal and Accessibility Rules Can’t Be Ignored

Your app must do more than just meet security standards. It also needs to follow regulations for accessibility and usability. For example, it should be easy to use for people with vision or motor disabilities. Following these rules isn’t just required—it also helps you reach more users when you build a banking app. - High-Tech Features May Require Specialized Developers

If you want to include advanced technology like blockchain or AI, you’ll need a team with the right skills. These features can make your app stand out, but they require deep technical knowledge. Partnering with experienced developers ensures you get the results you want without delays.

Conclusion

Building a mobile banking app isn’t just about writing code. It’s about understanding your users, solving real problems, and creating something they trust enough to use every day. That takes more than just a good idea, it takes the right team.

At TECHVIFY, we help you shape that idea into a working product. We’ll guide you through the process, help you avoid common mistakes, and build a secure, user-friendly app that does exactly what your users need. Reach out to TECHVIFY for a free consultation. We’ll help you figure out what to build and how to build it right.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666