The insurance industry is fiercely competitive, and to stay ahead, you need the right tools to capture, nurture, and convert prospects effectively.

Growth doesn’t just happen. You need a structured process that ensures no lead is missed, no follow-up is delayed, and no opportunity is lost. The key to achieving this is effective communication, which is only possible with the right CRM for insurance agents.

Insurance agents and brokers manage multiple responsibilities every day. From calling prospects and closing deals to scheduling appointments and maintaining client relationships, the workload can be overwhelming.

Relying on manual processes or scattered systems can lead to missed opportunities and inefficiencies. Without a structured workflow, critical tasks can slip through the cracks, affecting both customer relationships and revenue.

I. How Best CRMs for Insurance Agents Help Businesses Improve ROI?

If you think a CRM is just about automating workflows, think again! The best CRM for health insurance agents does much more—it streamlines operations, boosts productivity, and ultimately drives higher ROI.

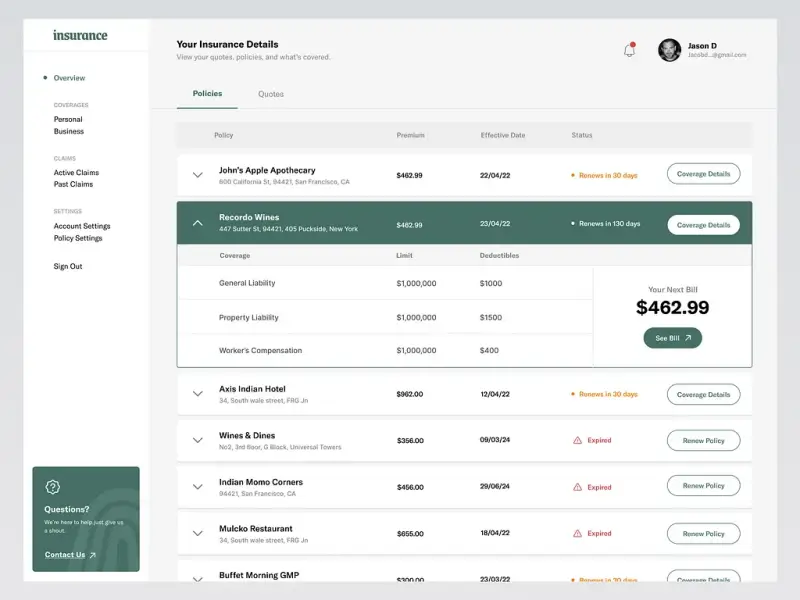

Best CRM for health insurance agents

And the numbers back it up. A well-implemented CRM can:

- Increase productivity by 55%

- Boost sales quotas by 45%

- Cut labor costs by 60%

- Strengthen customer relationships by 58%

These statistics prove that a CRM isn’t just a tool—it’s a game-changer for business growth and revenue. So, why wait? Investing in the right CRM means unlocking new levels of efficiency and profitability.

But here’s the key: not all CRM software for insurance agents is created equal. To maximize results, choose one that aligns with your business goals and meets the needs of your team.

Learn More On:

II. Why Insurance Agents Need a CRM

As an insurance agent, you’re not just selling policies—you’re building relationships and earning trust. But with client acquisition, retention, and endless paperwork on your plate, how do you keep everything organized?

That’s where the best CRM for health insurance agents comes in. It simplifies your workflow, helps you stay connected with clients, and ensures no opportunity slips through the cracks.

Smarter Lead Management

Insurance is a numbers game—the more leads you manage efficiently, the better your conversion rates. A CRM for insurance agents keeps your leads organized, tracks follow-ups, and even scores prospects based on their likelihood to buy, improving conversion rates. No more missed opportunities.

Higher Customer Retention

Did you know retaining an existing customer is five to twenty-five times cheaper than acquiring a new one? The best CRM for health insurance agents helps you stay on top of policy renewals, send timely reminders, and maintain seamless communication—ensuring your clients always feel valued.

Personalized Client Experience

In today’s world, 80% of customers say their experience with a company is just as important as the product itself. A CRM for insurance agents lets you tailor your communication based on client history and preferences, making every interaction meaningful and personalized.

When clients feel heard and understood, they’re more likely to stay loyal—giving you a competitive edge in the ever-evolving insurance industry.

III. 6 Best Insurance CRM Software in 2025

Finding the best CRMs for insurance agents can transform the way you manage leads, automate workflows, and connect with clients efficiently. Whether you’re looking to streamline your sales process or improve customer retention, the right insurance CRM can help you work smarter, not harder.

Here are the top CRM software options for insurance agents in 2025.

CRM for insurance agents

1. Salesmate

Salesmate is a powerful and versatile CRM designed to automate the entire customer journey. It helps insurance agents manage client data, track deals, optimize workflows, and automate sales, marketing, and customer experience processes—all in one place.

What makes Salesmate stand out is its high level of customization, allowing you to tailor the platform to fit your specific needs.

Key Features:

- Sales and marketing automation

- Contact management

- Built-in calling and power dialer

- Email marketing

- Workflow management

- Meeting scheduler

- Live chat

Pricing: Starts at $23 per user per month.

2. Radiusbob

Radiusbob is built specifically for insurance agencies, offering an easy-to-use platform that automates sales and marketing processes. With integrated VoIP, agents can make calls directly from the CRM, ensuring seamless communication with clients and prospects.

Key Features:

- Lead management

- Built-in telephony solution

- Sales automation

- Marketing automation

- Autoresponders

Pricing: Starts at $34 per month.

3. Insureio

Insureio is designed to help insurance agencies grow their book of business with advanced sales and marketing automation. One of its biggest strengths is the ability to quote over 40 leading carriers for various insurance products, including life, disability, LTC, and annuities.

Key Features:

- Lead management and tracking

- Application fulfillment

- Pre-built email marketing templates

- Access to 30+ carriers

- Quoting widgets

Pricing: Starts at $25 per month.

Have a Project Idea in Mind?

Get in touch with experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

4. Insly

Insly is a cloud-based CRM that acts as an instant broker portal, allowing insurance agents to easily add and manage clients. With Insly, you can oversee all your products, policies, claims, and installment schedules in one place, making policy management effortless.

Key Features:

- Client management

- Unified data management

- Claims tracking

- Insurance policy management

- Estimates and quotes

Pricing: Starts at $59 per user per month.

5. Oracle

Oracle is a cloud-based CRM built specifically for the insurance industry. It helps agencies create seamless insurance journeys, automate billing and policy processes, and enhance customer experiences—all from a single platform.

Key Features:

- Account and contact management

- Pipeline management

- Marketing automation

- Customer support portal

- Reporting and analytics

Pricing: Not publicly listed.

6. AgencyBloc

AgencyBloc is an easy-to-use CRM designed specifically for insurance agencies. It simplifies client and prospect management while helping teams streamline workflows with powerful automation features.

Key Features:

- Contact management

- Task assignment and activity tracking

- Email marketing

- Document management

- Actionable reports

Pricing: Starts at $70 per month.

IV. How to Choose the Right CRM for Your Insurance Agency

Now that you know the common challenges, the next step is finding the best CRMs for insurance agents that fit your business needs and help you scale efficiently. Not all CRMs are designed for insurance, so it’s important to choose one that aligns with your goals.

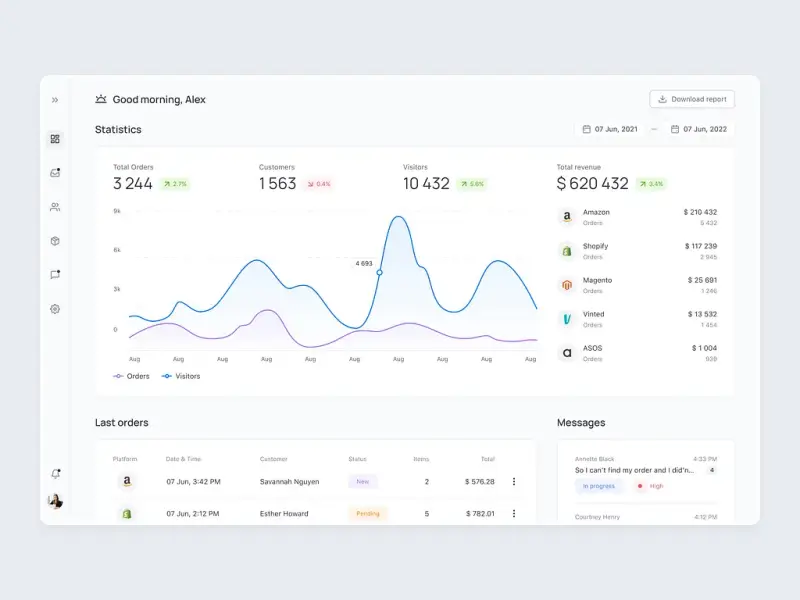

CRM software for insurance agents

Start by Asking Yourself These Key Questions:

- What are my core business goals? If customer retention is a priority, look for a CRM with strong relationship management features. If lead generation is your focus, choose a system with robust tracking and automation.

- How large is my team? A small agency might need a simple, cost-effective CRM, while a growing agency could benefit from a more advanced system with scalable features.

- What integrations do I need? Make sure the CRM works seamlessly with email marketing tools, claims management software, or any other platforms you already use.

Once you have a clear understanding of your needs, you can narrow down your options and choose a CRM that helps you overcome challenges, streamline operations, and grow your business.

Learn More On:

V. Challenges Insurance Agents Face Daily (And How to Overcome Them)

The insurance industry is highly competitive, and as an agent, you’re constantly juggling multiple challenges—from managing leads to keeping clients engaged and staying ahead of competitors. It’s a fast-paced environment where even minor delays can cost you potential business.

To help you navigate these hurdles, let’s break down the most common challenges insurance agents face and how you can overcome them.

Intense Competition in the Market

Have you ever received an inquiry from a client, only to find out the next day that they’ve already chosen a competitor? It happens more often than you think.

Today’s consumers expect quick responses and seamless service. A slight delay in follow-up, and they’re gone. Insurance agents are already stretched thin with daily tasks, making it difficult to respond instantly to every lead.

How to Overcome It:

Automation is the key. By using a CRM system, you can automate follow-ups, send instant responses, and streamline client interactions—giving you a competitive edge without adding to your workload.

Fragmented Sales Process

Spreadsheets and manual data entry might seem like a reliable way to store client information, but over time, they lead to fragmented and inconsistent data. Missing or outdated information can impact client relationships, slow down response times, and create confusion in your sales process.

How to Overcome It:

A centralized CRM software for insurance agents eliminates data fragmentation by keeping all client information, policy details, and interactions in one place. This ensures quick access to accurate data, making communication and decision-making smoother.

Inefficient Workflows Impacting Revenue

Managing policies, renewals, follow-ups, and client communication manually can be overwhelming. When workflows are inefficient, tasks pile up, productivity drops, and revenue takes a hit.

How to Overcome It:

A CRM with automation capabilities can handle repetitive tasks like policy renewals, appointment scheduling, and follow-ups—freeing up your time to focus on building relationships and closing deals. The more streamlined your workflow, the more revenue you can generate.

Struggles with Lead Generation

Clients are more likely to engage with companies that offer seamless, value-driven experiences. If your lead generation process involves multiple steps and unnecessary friction, potential customers may lose interest before even reaching a decision.

How to Overcome It:

A CRM that integrates with lead capture tools, marketing automation, and AI-driven insights can help you attract, nurture, and convert leads more effectively. The easier you make the process for potential clients, the higher your chances of closing deals.

Difficulty Retaining Customers

A high churn rate can be discouraging. If you’re losing customers, it’s a sign that there are gaps in your follow-up process, customer engagement, or service quality.

How to Overcome It:

A CRM with customer retention tools—such as automated reminders, personalized communication, and loyalty tracking—can help you maintain strong relationships with your clients. When customers feel valued, they’re more likely to stay with your agency long-term.

Conclusion

The right CRM for insurance agents is more than just a tool—it’s the key to streamlining operations, improving customer relationships, and driving revenue growth. With automation, client management, and advanced analytics, a well-chosen CRM can give you the competitive edge you need in today’s fast-paced insurance market.

But choosing the best CRM isn’t always easy. That’s where TECHVIFY comes in.

Looking for a CRM that perfectly fits your business needs? Our experts at TECHVIFY specialize in custom CRM development tailored for insurance agencies like yours. We’ll help you implement a powerful, intuitive, and fully integrated CRM solution that enhances your workflow and maximizes efficiency.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666