CRM in Banking – A Game Changer for Banking Industry

- TECHVIFY Team

- 0 Comments

Today’s banking customers are using their mobile devices more than ever to manage their money. Whether they’re getting pre-approved for a loan on their smartphone or checking out credit card options on their laptop, people have come to rely on the convenience that digital banking offers.

But with so many options available, it’s not unusual for customers to use services from multiple banks. For example, someone might have their mortgage with one bank, a personal loan with another, and several credit cards from different banks or stores.

Because customers expect so much and competition is tougher than ever, banks need to adopt a more modern, customer-focused way of doing business. This is where CRM in banking becomes more important than ever.

I. What is a CRM in Banking?

A Customer Relationship Management (CRM) system is a key tool for any industry that puts customers first. For banks, it’s especially helpful for reaching sales goals, improving marketing efforts, and meeting customer expectations.

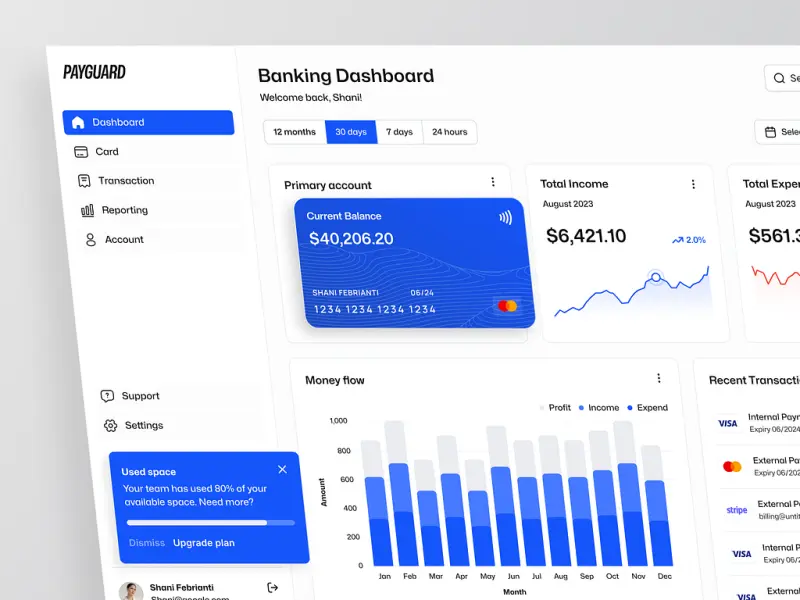

Customer relationship management in banking

Bank CRM systems help them focus on the customer. Using one system, bank employees can:

- Store customer details like contact info, products they use, and past interactions.

- Schedule appointments, send personalized emails, and reply to social media messages.

- Instantly refresh customer profiles with new details or notes as they become available.

- Monitor and handle leads as they progress through each stage of the sales cycle.

- Create reports that show customer behavior, the success of marketing campaigns, and more.

Perhaps most importantly, the return on investment (ROI) from a CRM is impressive. Nucleus Research found that for every dollar spent on a CRM, banks earn $8.71 in return.

Still want to see more CRM Systems articles? Check here:

II. The Benefits of Using a CRM in Banking

CRMs are useful in many industries, but they are especially valuable in banking, where they help banks provide more personalized and customer-focused experiences.

A global study by Accenture on financial service customers found that 67% of people are willing to share more personal information with their bank if it means they’ll get new benefits. Another 71% said they would be comfortable using fully automated support for their banking tasks.

Since customers are open to sharing their data, banks have no reason not to use a CRM, which can bring the following benefits:

1. Get a Complete View of Every Customer

A CRM in banking is a system that brings together data from your other banking tools to give you a full picture of each customer. Whether a customer is making a deposit at an ATM or asking about a loan, every action they take can be stored in the CRM. This makes it easy and fast to see patterns in their behavior and preferences, helping you offer the right products to match their financial goals.

2. Increase Customer Loyalty

With more customers choosing online banking over in-person visits, it can be hard for banks to maintain long-term relationships. A CRM in banking gives you access to lots of data that you can use to offer personalized services. Since the CRM lets you store notes and personal details, you can make each customer’s experience better. For example, if a teller notes that a customer was asking about a loan, the loan department can follow up by emailing the customer resources about their loan options. Showing customers that you’re paying attention and working to improve their experience can build stronger loyalty.

3. Speed Up Customer Service

A unified system allows any employee to quickly access a customer’s profile and get up to date on their account. For instance, if a customer calls the service center, the employee can update the CRM in real time. When that customer visits the branch later, the teller can see the notes from the previous interaction, preventing any repeated conversations. This gives the teller a complete view of the customer’s situation, making service faster and more efficient.

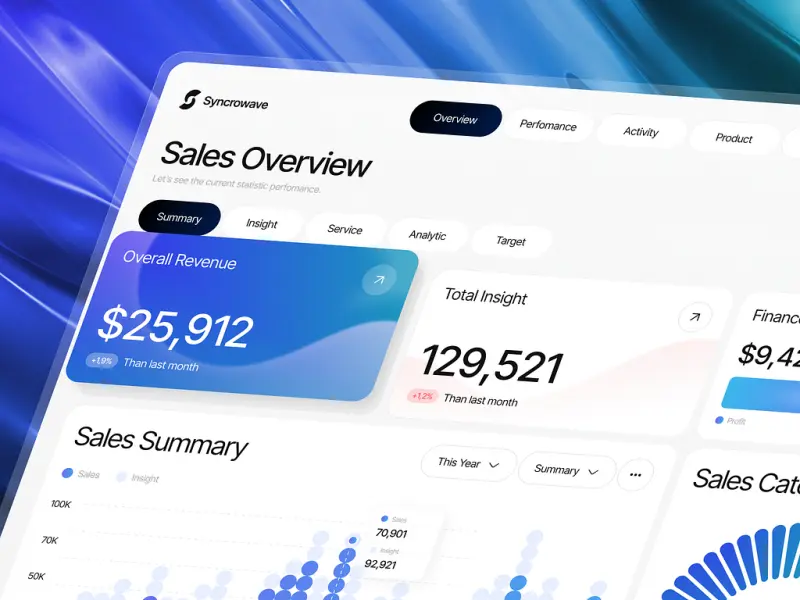

4. Use Data to Improve Sales and Marketing

The data in your CRM can be turned into reports, allowing you to see things like customer trends, successful marketing efforts, and areas that need improvement. This helps you anticipate customer needs and fine-tune your future marketing plans. You can also use customer profiles to spot chances to promote both cross-sell and upsell opportunities. For instance, when a customer makes a deposit at the bank, the teller can check their profile and suggest products that fit their needs, like a platinum credit card.

CRM for banking industry

5. Make Employees More Efficient

With all customer info stored in one CRM system, employees don’t have to waste time searching through emails or switching between multiple platforms to find answers. This cuts down on repetitive tasks and allows staff to focus more on building customer relationships. According to a study from Nucleus Research, sales representatives saw a 26.4% boost in productivity when they used CRM systems with social and mobile features. Plus, since CRM systems can be accessed from any device—such as a laptop, desktop, or smartphone—employees can check and update information anytime, anywhere.

III. Important Features to Look for in a Customer Relationship Management in Banking

When choosing the right CRM for your bank, it’s important to focus on features that help streamline work. CRMs offer lots of tools, but if you don’t pick one that fits your team’s needs, you might end up paying for features you won’t use. Here are some key features to look for:

- Analytics: Your CRM should give you access to real-time customer data and insights on sales, team performance, customer satisfaction, and areas where you can improve.

- Automations: A good CRM will let you set up automations to handle repetitive tasks like sending out emails or setting reminders, helping you save time on manual work.

- Integrations: Make sure the platform connects with the tools you already use, like marketing software, banking systems, and customer service platforms.

- Mobile Access: Bankers often work on the go, so your CRM should work on mobile devices. Look for a CRM with a strong mobile application, allowing you to retrieve your data no matter where you are.

- Security: Since banks handle sensitive data, your CRM must meet security standards. Look for features like encryption, access controls, and regular security updates.

- Document Sharing: Your CRM should make it easy to store, share, and collaborate on important files like contracts, quotes, and other documents.

- Lead Management: A CRM should help your sales team track potential customers and manage leads, ensuring they follow up regularly and nurture client relationships.

By focusing on these key features, you can make sure your CRM not only improves efficiency but also helps your bank provide better service to your customers.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

IV. 5 Most Popular Banking CRM Software in 2025

1. Salesforce Financial Services Cloud

Salesforce Financial Services Cloud is a flexible CRM built for sales, marketing, and customer support within the financial sector. It allows you to store and manage data for banking, wealth management, and insurance all in one place. This powerful tool equips financial teams with everything they need to make smarter decisions about customer relationships. With Salesforce Financial Services Cloud, you can easily view customer relationships and key data in one location, helping you identify new service and sales opportunities. The platform’s AI capabilities assist with onboarding, financial discovery, and streamlining the disclosure and consent processes. AI also powers automation that improve customer service and self-service options.

Pricing for Salesforce Financial Services Cloud starts at $300 per user, per month, with multiple plans to choose from based on your needs. A free trial is also available for those who want to test the platform before committing.

Best for: Financial institutions seeking a finance-focused CRM in banking with AI features.

Bank CRM systems

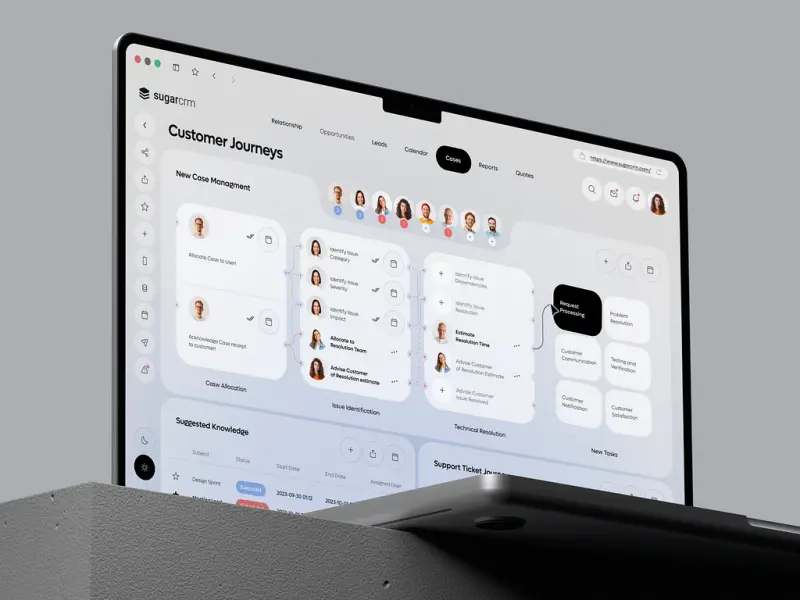

2. SugarCRM

SugarCRM focuses on delivering a better customer experience by using historical data and artificial intelligence to provide actionable insights. This affordable yet powerful platform helps your team drive business growth, automate marketing tasks, and improve customer retention. SugarCRM leverages AI-driven insights to help manage customer relationships and make data-backed predictions. It also emphasizes individual sales, allowing your team to interact more efficiently with clients and finalize more transactions. Additionally, automations are available to nurture leads and optimize the lead qualification process, saving time and effort.

SugarCRM’s pricing starts at $19 per user, per month, with three plans available: Essentials, Advanced, and Premier. A demo is also offered for those interested in seeing the platform in action.

Best for: Financial organizations that want insights to help retain more customers.

3. Creatio

Creatio is a no-code platform that combines CRM and business process management into a single solution. It integrates marketing, sales, and customer service to give financial teams a clear view of the entire customer journey. With Creatio, you can track, capture, and nurture leads within a unified database, while the system helps identify cross-selling and upselling opportunities. The platform provides a 360-degree view of each client, including their history, portfolio, loyalty programs, and wealth management details. Lending processes are simplified with loan application management and automated debt collection tools.

Creatio pricing starts at $25 per user, per month, with three plans to choose from: Growth, Enterprise, and Unlimited. A demo is available for those wanting to explore the platform’s capabilities.

Best for: Banks looking to automate and customize business processes easily.

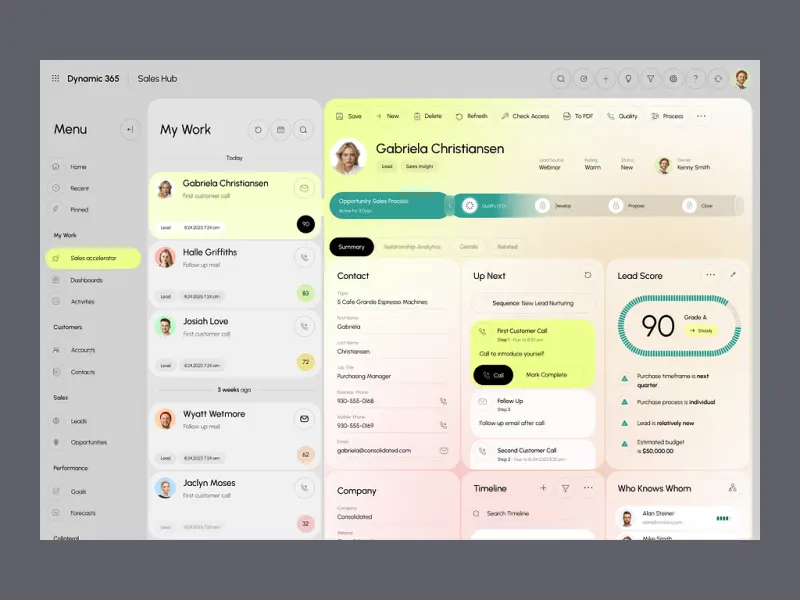

4. Microsoft Dynamics 365

Microsoft Dynamics 365 is a robust CRM in banking that also functions as an ERP (Enterprise Resource Planning) system. It offers advanced analytics and AI tools to help financial teams increase productivity and gain deeper insights into customer behavior. The platform easily integrates with other Microsoft products, allowing seamless data synchronization across systems. Microsoft’s AI tool, Copilot, helps teams create personalized services and close deals by providing relevant insights. Additionally, the platform allows you to automate sales sequences, reducing the need for manual, repetitive tasks and improving overall efficiency.

Pricing for Microsoft Dynamics 365 starts at $65 per user, per month, with multiple plans available depending on your business needs. A free trial is also offered for those who want to test the platform before making a decision.

Best for: Financial teams requiring deep customer data management and business insights.

5. Vymo

Vymo is a sales engagement platform built specifically for financial institutions, with a focus on being mobile-first. It helps manage sales, collections, lending, and insurance services all from one unified platform. Vymo allows teams to manage leads and activities on the go, giving them the flexibility to work from anywhere. The platform also offers digital debt collection tools to handle the entire process efficiently. Vymo identifies actions that relationship managers can take to build and nurture client relationships, while its digital tools help manage early-stage delinquency and debt recovery.

Pricing for Vymo is available upon request, and a demo is offered for those interested in seeing how the platform works.

Best for: Financial institutions looking for a mobile-first CRM for sales engagement.

V. Challenges of Using CRM for Banking Industry

Like many other businesses, banks face several challenges when trying to adopt CRM software.

CRM software for banking industry

Data Security

The banking industry takes data security very seriously and works hard to keep tight control over who can access their records. Along with protecting customers’ personal details and account information, the entire banking system must be shielded from cyber-attacks and harmful software. Modern CRM for banking industry providers understand these concerns and offer robust security measures, including access controls based on user roles, and regular data backups to ensure a high level of data protection.

Integration with Existing Technology

Most banks and financial organizations still use older IT systems that may not easily connect with modern CRM platforms. Many of these legacy systems weren’t designed to work with today’s CRM tools, which means banks could face issues when trying to combine new solutions with the old ones. There’s also the risk of losing data or facing system failures during the integration. However, CRM experts like OMI can help banks smoothly add a CRM system into their existing setup, ensuring everything works without problems.

When Should Banks Adopt a CRM?

The answer is simple—banks should adopt a CRM as soon as possible. Without the data visibility a CRM provides, banks may lose clients and revenue. Plus, without enough customer data, banks can’t fully understand customer behavior or offer the quality of service their customers are looking for.

Conclusion

In today’s fast-paced digital world, banks need to stay ahead by adopting tools that help them better understand and serve their customers. A Customer Relationship Management (CRM) system provides the visibility, efficiency, and insights necessary to improve customer service, boost sales, and streamline operations. With features like data integration, AI-driven insights, and mobile access, a well-chosen CRM in banking can transform how your bank interacts with customers, making it easier to offer personalized services and build lasting relationships.

However, adopting a CRM isn’t without its challenges, especially when it comes to data security and integration with existing systems. That’s where TECHVIFY can help.

Contact TECHVIFY today for a free consultation and let us help you develop and integrate the right CRM solution for your financial institution. Our experts are here to ensure a smooth transition, so you can start seeing the benefits of a modern CRM system right away.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666