Your Guide to Digital Wallet App Development That Converts

- TECHVIFY Team

- December 26, 2024

- Knowledge, Guides

- 0 Comments

The global digital payments market is on an unstoppable rise, with revenue projections reaching impressive new heights. Even more remarkable, two-thirds of adults worldwide now use digital payments, with a staggering 89% adoption rate in the United States alone.

As businesses and customers alike embrace the convenience, security, and efficiency of digital payments, the demand for digital wallet app development is skyrocketing, as companies aim to deliver cutting-edge payment solutions.

Leading the charge are industry giants like PayPal, Samsung Pay, Google Pay, and Apple Pay, which are setting the standard for digital wallet app development while pushing the market forward. With mobile shopping predicted to account for up to 80% of all online purchases in the coming years, the future of digital payments is not just promising—it’s transformative.

But what exactly is a digital wallet, and how can it revolutionize your business? Let’s explore.

I. What Is a Digital Wallet?

A digital wallet, also known as an electronic wallet, is a secure financial transaction application designed to operate on connected devices like smartphones, tablets, and computers. It acts as a digital hub where users can securely store payment information in the cloud and streamline transactions.

More than just a payment tool, digital wallets offer versatility and security. They allow users to:

- Store payment methods like credit and debit cards.

- Track transaction histories for better financial management.

- Securely verify identity with advanced features like biometric authentication (e.g., Face ID, Touch ID), multi-factor authentication, and strong password encryption.

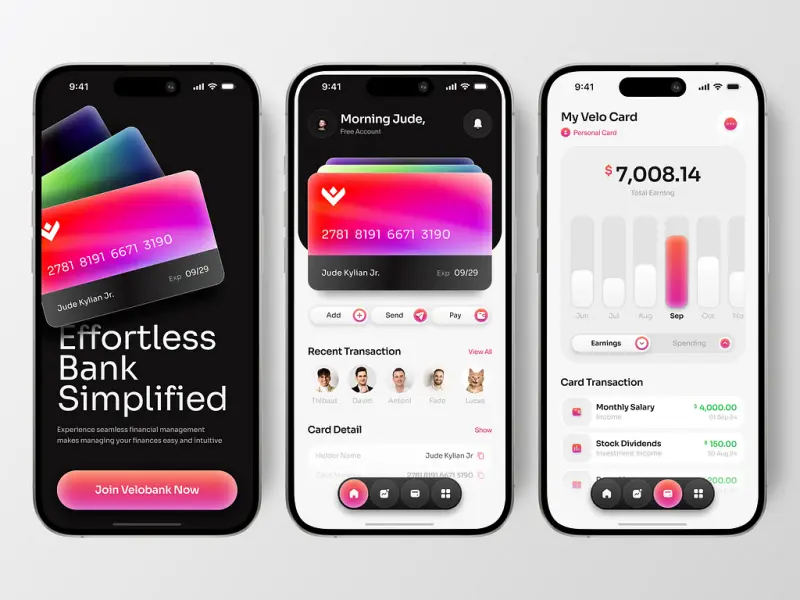

Digital wallet app development

Beyond payments, digital wallets support the storage of other essentials such as:

- Gift cards and loyalty cards

- Coupons and membership cards

- Event tickets and transit passes

- Proof of age for restricted purchases (e.g., alcohol)

In short, a digital wallet is much more than a transaction tool—it’s an all-in-one solution for convenient, secure, and efficient digital interactions.

Learn more on:

II. Why Invest in Digital Wallets: Market Insights

Wondering why investing in a digital wallet app in 2025 is a smart move? The numbers paint a clear picture:

- Digital Wallet Adoption is Surging: In 2024, cash transactions account for just 12.7% of point-of-sale spending, while digital wallets are projected to dominate with 33.4%, according to the FIS Global Payments Report.

- Explosive Mobile Payments Growth: Mordor Intelligence forecasts a 29.5% growth in mobile payments between 2021 and 2026, while Juniper Research predicts a 60% increase in digital wallet transaction value by 2026.

- Market Value on the Rise: Mobile payments are expected to grow at a 24.5% CAGR, reaching a staggering $5399.6 billion market value by 2026 (Mordor Intelligence).

- Multi-Wallet Usage: A significant 32% of users now use three or more digital wallets, showcasing growing demand and trust in the technology.

- Massive User Base Growth: Juniper Research projects that the global number of digital wallet users will exceed 5.2 billion by 2026, up from 3.4 billion in 2022—a robust growth of 53%.

- Non-Cash Transactions Skyrocketing: By 2025, global non-cash transactions are expected to surpass 1.5 trillion, according to Research and Markets.

With such rapid growth and increasing consumer adoption, the digital wallet market represents a goldmine for businesses looking to innovate in the payment space.

III. How Does a Digital Wallet Work?

Digital wallets simplify transactions by securely transmitting payment information during purchases, whether online or in-person. Here’s how the process unfolds:

- Unlock the Wallet: Users access their wallet app using facial recognition, fingerprint ID, or a PIN code.

- Select Payment Method: They choose their preferred card or payment option stored within the app.

- Complete the Transaction:

- For Online Purchases: Users proceed through the merchant’s checkout process, selecting the desired payment method within their wallet.

- For In-Person Purchases: The device communicates with the point-of-sale (POS) terminal via advanced technologies like NFC, MST, or QR codes.

Technologies Powering Digital Wallet Transactions

Digital wallets use several advanced technologies to ensure seamless, secure transactions:

-

QR Codes: Scanned using a smartphone camera, QR codes store payment details and enable quick in-store purchases. For example, PayPal generates QR codes for simple checkout experiences.

-

NFC (Near-Field Communication): NFC-enabled devices (like smartphones) tap against compatible POS terminals for secure, contactless payments. Popular wallets like Apple Pay and Google Pay rely on NFC.

-

MST (Magnetic Secure Transmission): MST generates a magnetic signal similar to swiping a traditional card, enabling payments even on older POS systems. Samsung Pay utilizes MST technology, compatible with about 90% of merchant payment terminals in 2022.

-

UPI (Unified Payment Interface): A real-time payment system for peer-to-peer interbank transfers, UPI enables fast and secure payments with minimal data entry. Apps like Google Pay and Amazon Pay use UPI to simplify transactions.

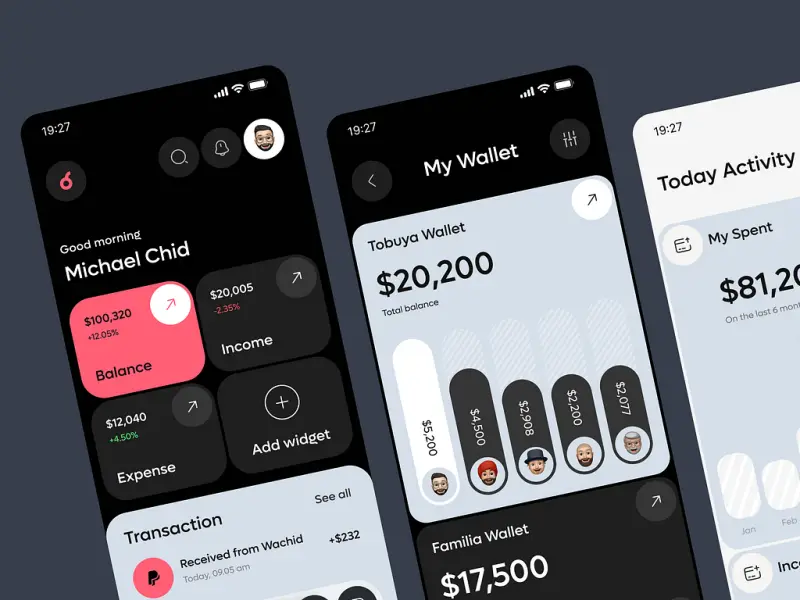

Digital wallet mobile app development

Payment Processing

Once a transaction is initiated:

- The chosen payment method is transmitted via QR code, NFC, MST, or UPI technology to the POS terminal.

- The terminal communicates with payment processors, which route the data to issuing and acquiring banks.

- Banks approve or decline the transaction, completing the purchase.

This seamless integration of cutting-edge technologies ensures that digital wallets deliver not only efficiency but also security and reliability, making them indispensable for modern businesses and consumers.

Have a Project Idea in Mind?

Get in touch with experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

IV. 6 Steps to Success In Digital Wallet App Development

So, we’ve arrived at the most exciting part: how to approach digital wallet app development and build a solution tailored to your business needs. Here’s a step-by-step guide to help you navigate the process smoothly.

Step 1: Define Your Goals and Features

Before diving into development, clarity is key. Start by answering these questions:

- What is the purpose of your digital wallet? Is it for online shopping, peer-to-peer payments, or multi-currency transactions?

- Who is your target audience? Tech-savvy millennials? Businesses? Everyday consumers?

- What features will it offer? Will it support loyalty cards, store multiple currencies, or include payment tracking?

Clearly defining your objectives and features ensures a solid foundation, especially if you’re partnering with a trusted digital wallet development company. This step will also help identify the technologies, resources, and tools you’ll need for your project.

Step 2: Choose a Platform and Technology

Next, decide where your digital wallet will live: iOS, Android, or web-based platforms. Each platform has its own audience and technological requirements, so your choice should align with your target users.

For example:

- iOS App: Ideal if your audience heavily uses Apple devices.

- Android App: Perfect for reaching a broader global audience.

- Web-based Solution: Useful for cross-platform access.

You’ll also need to select a programming language, such as Java, Swift, or Python, based on your platform choice. Skipping this discovery stage could lead to costly mistakes, such as building a product with no market fit.

Step 3: Create a User-Friendly Interface

Your digital wallet’s user interface (UI) is what users will interact with, making it one of the most critical aspects of digital wallet app development.

Did you know? 52% of users lose trust in an app due to a poor mobile experience. That’s why hiring a professional UX/UI designer is a must.

Your UI should:

- Be intuitive and easy to navigate.

- Provide quick access to account details, payment options, and transaction history.

- Use a minimalist design with clear icons, buttons, and text.

Step 4: Integrate Payment Gateways

Payment gateways are the backbone of any digital wallet, enabling users to make secure transactions. Popular options include:

- PayPal

- Stripe

- Braintree

When selecting a gateway, prioritize security, reliability, and ease of integration. Users are entrusting you with sensitive financial data, so it’s critical to deliver a trustworthy experience.

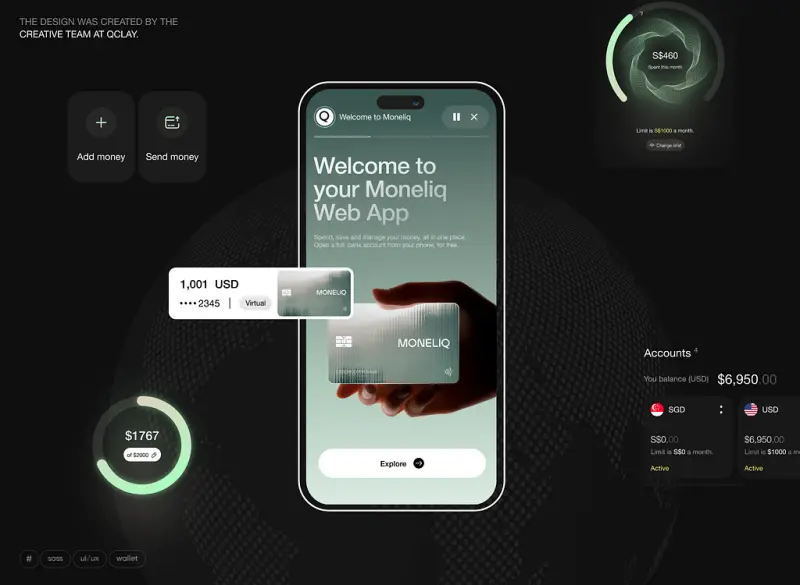

Digital wallet app development process

Step 5: Implement Robust Security Measures

Security is non-negotiable in the fintech world. Here’s how you can protect user data and prevent fraud:

- Two-Factor Authentication (2FA): Add an extra layer of security by requiring a second form of verification, like a code sent via SMS.

- Biometric Authentication: Enable fingerprint or facial recognition for quick and secure access. (Note: Face ID on Android lacks full security—opt for fingerprint authentication instead.)

- End-to-End Encryption: Protect sensitive payment data during transmission.

Remember, building user trust is as much about functionality as it is about protecting their data.

Step 6: Test and Launch Your Digital Wallet

Thorough testing is essential before going live. Here’s what to focus on:

- Security Testing: Check for vulnerabilities and ensure data protection.

- Usability Testing: Make sure the app is easy to use and bug-free.

- Performance Testing: Verify that the wallet performs well under different conditions, such as high user loads.

Once testing is complete, you’re ready to launch! Partnering with a reliable digital wallet app development company can streamline this process and ensure long-term success. However, the real work begins post-launch. Expect to handle:

- Bug Fixes: Address issues quickly to maintain user satisfaction.

- Feedback Collection: Understand user needs and preferences.

- App Maintenance: Continuously improve your app and release updates.

Pro Tip: If you invest in thorough development and testing upfront, you’ll minimize post-launch headaches and create a stable, scalable digital wallet.

Learn more on:

V. Challenges in Creating a Digital Wallet Application

Building a digital wallet app can deliver undeniable benefits, but navigating the challenges is critical to ensuring your product succeeds. Here’s what to consider:

1. Security Concerns

Protecting user data is paramount. Digital wallets handle sensitive information, including payment details and personal data, making them prime targets for cyberattacks. Here’s what you need to do:

- Implement robust encryption protocols to safeguard data.

- Use multi-factor authentication and biometric security measures.

- Comply with global data protection regulations to avoid costly penalties.

When users feel their data is secure, they’re more likely to trust and recommend your app.

2. Legal Compliance

Digital wallets must comply with location-specific regulations, which can be complex and vary significantly. For example:

- United States: Adhere to the Bank Secrecy Act, USA PATRIOT Act, and Dodd-Frank Act.

- European Union: Follow GDPR, PSD2, and AMLD requirements.

- Saudi Arabia: Obtain a license from SAMA and comply with e-commerce, cybercrime, and data protection laws.

- UAE: Meet the Central Bank’s stringent payment safety and user rights guidelines.

Understanding and navigating these regulations is essential to avoid legal complications and ensure market access, which is why working with an experienced digital wallet development company can make all the difference.

3. Device Compatibility

Your app must be compatible across various devices and operating systems. Ensure your software remains updated to support the latest technologies and maintain a seamless user experience. Failing to do so could discourage adoption and negatively impact your app’s performance.

4. Enhanced Functionality

Basic transactional features are no longer enough. To stand out, analyze your competitors and stay updated on market trends. Consider adding:

- Loyalty programs.

- Integration with e-commerce platforms.

- Advanced analytics for tracking expenses.

This keeps your app relevant and competitive in the fast-paced world of digital wallet app development.

Conclusion

The digital wallet market is booming, and businesses have a prime opportunity to tap into its immense potential. With increasing consumer demand, transformative technological advancements, and surging adoption rates, digital wallets are the future of payments. However, navigating this lucrative space requires a clear strategy, innovative features, and a focus on security and compliance.

Ready to bring your digital wallet vision to life? Contact TECHVIFY today for a free consultation and let us help you design and develop a cutting-edge digital wallet app tailored to your business needs. Our team of experts ensures a seamless development process, from concept to launch.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666