A Deep Look into eWallet App Development Guide (Must Read in 2025)

- TECHVIFY Team

- 0 Comments

Mobile wallet apps have become very popular in recent years. They offer a convenient and secure way for users to manage their financial transactions. People are adopting these apps because they are easy to use and provide better security than cash or credit cards.

eWallet app development can be challenging. The main difficulties include dealing with complexities, compliance laws, and competition. However, this guide will simplify the process of developing a digital wallet. It is especially useful for startup founders, serial entrepreneurs, tech executives, or anyone interested in learning how to develop an eWallet app.

I. Mobile eWallet App Industry Statistic

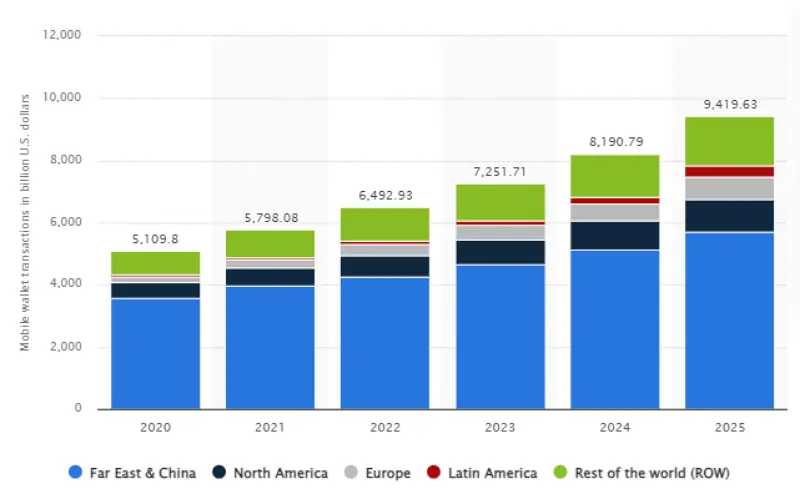

Various industry statistics show that the eWallet app market is experiencing significant growth. Revenue and user numbers are increasing every quarter, and eWallet apps are seeing more usage. Let’s delve into some key statistics to better understand this burgeoning market.

eWallet App Industry

Digital Payment Market to Reach $10 Trillion by 2026

With the rise of mobile payment technology, digital payments for shopping have become increasingly convenient. 2020 the digital payment market was valued at around $4 trillion. According to Statista, this market is projected to reach $10 trillion by 2026, driven by technological advancements.

eWallet App Market Size to Hit $567.2 Billion by 2032

The eWallet market, a dynamic niche within the digital payment industry, is expanding rapidly. The market size was approximately $85.6 billion in 2022 and grew to $105.5 billion in 2023. If this trend continues, it is expected to reach $567.2 billion by 2032, with a compound annual growth rate (CAGR) of 23.40%, according to Marketresearchfuture.

Over 4 Billion eWallet App Users by 2025

In 2020, about 2.8 billion people used eWallet apps. Juniper Research predicts that this number will grow to 4 billion by 2025, highlighting the increasing adoption of these apps.

Popularity of Apps like Apple Pay and Google Pay to Double by 2025

Apps such as Apple Pay, Google Pay, and Samsung Pay are already popular in the United States. Forecasts suggest that the use of these apps will double between 2020 and 2025, indicating robust market growth and rising demand.

Digital Wallet Transactions to Reach $16 Trillion by 2028

Digital wallet apps are widely used today, and future trends suggest even more growth. According to Juniper Research, digital wallet transactions are projected to reach $16 trillion by 2028, underscoring the significant expansion of this market.

More App Development Insights:

II. Different Types of eWallet Apps

eWallet apps come in several types, each with unique functionalities. Understanding these types is crucial if you plan to create an eWallet app.

Closed Wallets

Closed wallets are designed to make payments to a specific party only.

For example, a brand like McDonald’s can develop its eWallet app. Users can use these apps to pay exclusively at McDonald’s outlets. Amazon Pay is another example of a closed wallet.

Ideal Users

Closed wallet apps are best suited for brand retail stores and eCommerce platforms. Investing in a closed wallet can enhance a brand’s reputation, reliability, and customer loyalty. It also helps in boosting revenue.

Semi-Closed Wallets

Semi-closed wallets offer more flexibility compared to closed wallets. Users can make payments at partnered merchants and locations. However, these wallets are limited to specific vendors and locations.

Zelle’s business model is a great example of how a semi-closed wallet can generate significant revenue.

eWallet Apps

Ideal Users

Semi-closed wallet apps are ideal for fintech companies, financial institutions, eCommerce businesses, and tech companies. This type of wallet is also a promising opportunity for startups and entrepreneurs.

Open Wallets

Open wallets are a more familiar type of eWallet application. These wallets can be used anywhere, provided the other party uses the same or compatible platform. Open wallets offer features beyond those of closed and semi-closed wallets. They can manage bank accounts, facilitate ATM withdrawals, and send money.

Examples include apps like Revolut, Chime, and MoneyLion.

Ideal Users

Open wallets are ideal for starting a fintech company and generating significant revenue.

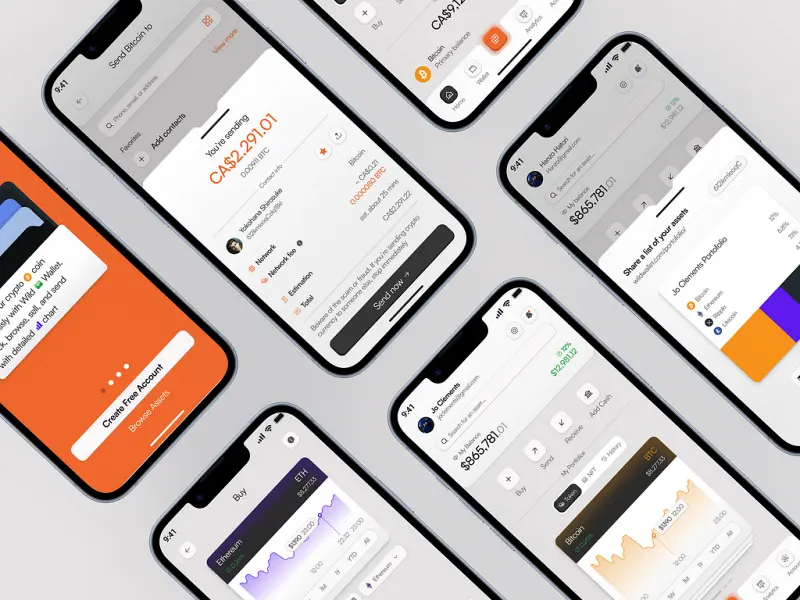

Crypto Wallets

Crypto wallets operate differently from the other types. These wallets allow users to buy, sell, transfer, and trade cryptocurrencies like Bitcoin and Ethereum. Crypto wallets bridge the gap between fintech and blockchain app development.

Ideal Users

Crypto wallets are ideal for cryptocurrency-based companies. Developing a crypto wallet can help your digital currency gain market traction, similar to how Ethereum did.

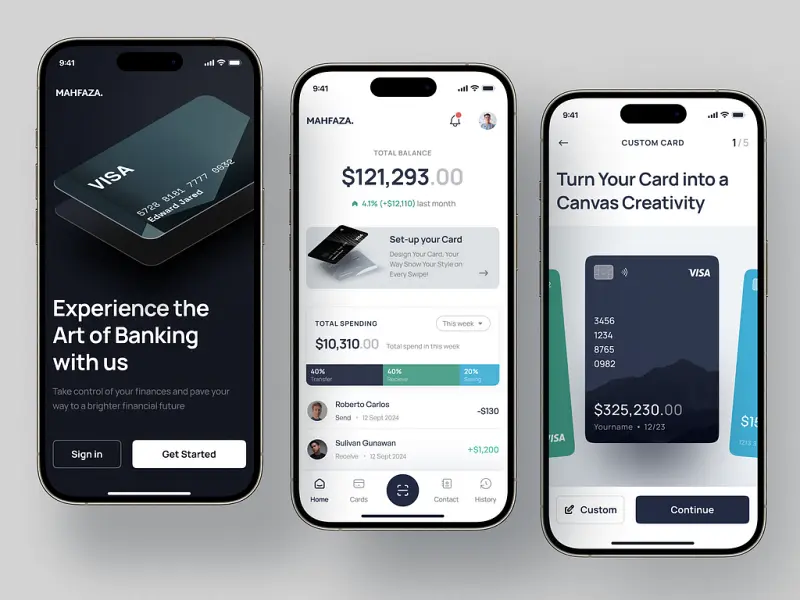

Mobile Banking Apps

Mobile banking apps are widely used for managing bank accounts, debit cards, credit cards, and other financial products. A well-known example is the Bank of America app.

Ideal Users

Due to the growth in the fintech industry, every financial institution and bank will likely develop a mobile banking app in the future. If you are part of this sector, creating a mobile banking app is a smart move.

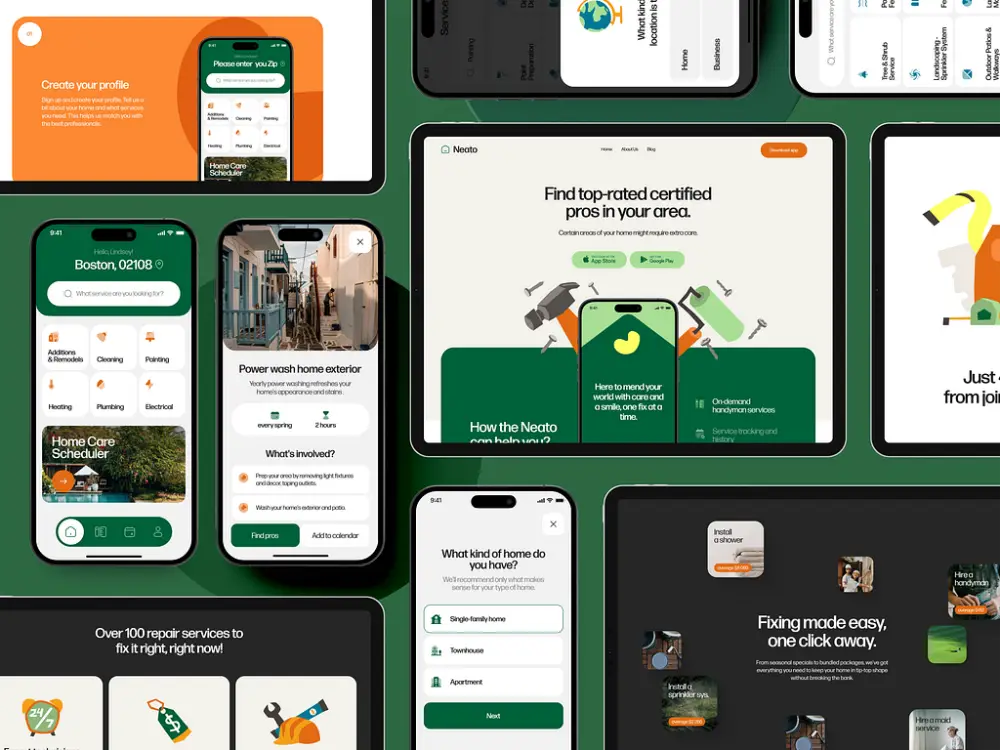

Digital Wallet Super Apps

Digital wallet super apps offer an all-in-one solution. These apps combine the functionalities of banking apps, cash advances, NFC mobile payments, and more. Popular examples include N26 and Bolt.

Ideal Users

There are no specific businesses that should exclusively develop super apps. Instead, these apps are ideal for platforms that manage similar niche companies.

Super apps provide everything in one place, offering superior value to users.

These are the popular forms of mobile wallet applications.

Have a Project Idea in Mind?

Get in touch with experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

III. How to Build A Payment Mobile App: A Comprehensive Guide

To ensure your payment mobile platform development is resilient, stable, and viable, let’s elaborate on each step.

Step 1: Discovery Phase

The discovery phase, also known as the scoping phase, is where the development team, led by Project Management, identifies the technical requirements to align the app idea with the business model. This phase is essential for understanding the complexity of the solution and effectively utilizing the tech stacks.

An ideal discovery phase should include:

- Uncovering the founder’s motivation and objectives

- Researching the target users

- Creating a project workflow

- Developing a project blueprint

Let’s break down each point:

1. Understand the Mobile App Idea

The business analyst and project manager meet, working closely with the client to grasp their app concept and the distinctive aspects of their solution. Notes from these meetings are then shared with the entire team.

2. Research Target Users

Conduct in-depth research on the preferences of target users. This informs the UI/UX designer on suitable colors, buttons, and icons, and guides other business-centric decisions.

3. Create a Project Workflow

The project workflow outlines the tasks required to achieve the expected deliverables. The CTO or tech lead identifies the necessary features and functionalities to complete the project.

4. Create a Blueprint

The blueprint is a comprehensive document detailing the software development requirements, including systems and hardware. It outlines all features, functionalities, milestones, and deadlines, providing an actionable guide for team members, clients, and management.

This step is critical as it establishes the foundation for development, ensuring the team understands the objectives, competitor analysis, and target users, and optimizing the product’s impact.

Beyond generic information gathering, focus on these technical aspects during the discovery phase:

| Aspect | Description |

|---|---|

| Regulatory compliance | Identify relevant regulatory laws and ensure deliverables comply with them. |

| Data safety | Draft measures to protect sensitive information exchanged in transactions. |

| Risks identification and reduction | Map out potential risks during development, launch, or scaling, using techniques such as Root Cause Analysis, NGT Technique, Affinity Diagram, and SWOT Analysis. |

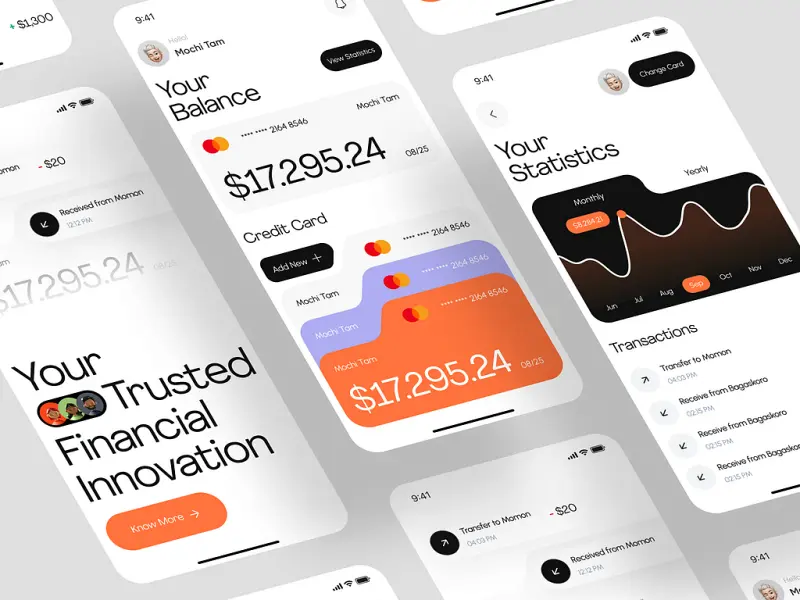

Step 2: UI/UX Design

The UI/UX design phase involves creating visual representations of the app’s interfaces and the user experience. This stage is crucial as it guides mobile developers during the coding process.

Key Activities in the UI/UX Design Phase

| Activity | Description | Required Hours |

|---|---|---|

| Mindmapping | Brainstorming and organizing ideas to form a clear and comprehensive design strategy. | 20 |

| UI Design | Designing the visual elements of the app, including icons, buttons, and overall layout for different operating systems. | 40 |

| UX Design | Crafting the user experience by creating wireframes that detail the app’s flow and interaction patterns. | 60 |

Total Hours for Design: 120 hours

Deliverables

- User Interface Design: Detailed designs for various operating systems.

- UX Wireframe: A structural representation of the app’s interface and user flow.

- Prototypes: Interactive designs for client and development team review, ensuring all milestones are approved before moving to the coding phase.

Build A Payment Mobile App

Step 3: Development and Testing

The development and testing stage is the most technical part of creating a mobile wallet app. Success in this stage depends on the UI/UX design, technology stack, and developers’ expertise. Depending on your objectives, the result of this stage should be either a Minimum Viable Product (MVP) or a fully developed solution.

Activities Involved in App Development and Testing

| Activity | Required Hours |

|---|---|

| QA Testing | 80 hrs |

| Software Architecture | 25 hrs |

| Debugging | 40 hrs |

| Backend Development | 175 hrs |

| Frontend Development | 175 hrs |

Total Development Hours: 495 hours

MVP Features for a Mobile Wallet Application

For a minimal viable product, include the essential features required for basic operations:

| Feature | Description |

|---|---|

| User Profiles | Specific user information enables personalized offerings and identifies the account owner. |

| Pop-up Notifications | In-app messages notifying users of successful or failed transactions are essential during development. |

| Bank and Card Integration | Integration with debit/credit cards or bank accounts to enable deposits and withdrawals. |

| E-Receipts | Proof of payment indicating successful financial transactions on the app. |

| User Authorization | Control restriction feature safeguarding the app to ensure access only by authorized individuals, protecting financial and personal information. Required by law in the US and UK. |

Advanced Features for Full-Service Wallet Payment Apps

For a complete solution, include additional features to enhance user experience:

| Feature | Description |

|---|---|

| Payment Scheduler | Initiates financial transactions before a specific payment date. |

| QR Code Scanner | Enhances security in cross-platform account access with a QR code scanner. |

| Social User Authentication | Allows users to sign in by logging into their social media accounts. |

| Cashback System | Repays users for money spent, depending on your marketing model. |

| Online Currency Conversion | Seamless cross-border payments with online currency conversion, ensuring accessibility across different regions (e.g., Payoneer). |

Team Required for Developing a Digital Wallet Mobile App

The quality of your mobile app largely depends on the skills and versatility of your development team and the technology stacks they use:

| Required Team Member | Job Description |

|---|---|

| Business Analyst | Conducts market research and analysis to ensure the app meets user needs and stays competitive. |

| Mobile Developer | Implements the user interface as per UI/UX designs, integrates APIs from the backend, and ensures all features work according to the project plan. |

| Backend Developer | Develops server-side logic, which forms the core functionality of the application. |

| UI/UX Designer | Designs the visual elements of the app, creating mockups and prototypes to guide development. |

| Project Manager | Oversees the development process, assigns tasks according to team members’ skills, and manages timelines for feature delivery. |

| QA Tester | Tests the application to ensure it meets client expectations, performing various checks to verify its robustness, usability, security, and scalability. |

Tech Stacks for Digital Wallet App Development

Partner with mobile app development services familiar with at least one tech stack from each category:

| Aspect | Tech Stacks |

|---|---|

| Database Management | GraphQL, MySQL, MongoDB |

| Backend Development | Java, Node.JS, Next.JS, Laravel, GoLang, Python |

| Project Management | Confluent, Jira |

| Mobile Development | Kotlin, ReactNative, Swift |

| Hosting | Amazon Web Service, Microsoft Azure, or any alternative |

| UI/UX Design | Principle, Figma, AdobeXD |

Note: This step requires top-notch expertise, experience, and attention to detail. Partnering with an eWallet app development company with verifiable expertise is imperative.

How about Fintech Insights, check these out:

Step 4: Mobile App Launch

The mobile app launch phase involves making your application available on platforms like Google Play Store and Apple App Store, making it accessible for users to download and install on their devices.

Key Aspects of the Mobile App Launch

Hosting on Platforms

- Platforms: Google Play Store, Apple App Store, etc.

- Make the product accessible to users for download on various operating systems.

Product Maintenance

- Ongoing process to keep the application updated, active, bug-free, error-free, and valuable for its intended purpose.

- Collecting feedback on features from users to make regular adjustments and improvements.

- Continuously address any issues and release updates to enhance functionality and user experience.

Scaling an MVP

- If the user experience of the MVP (Minimal Viable Product) meets expectations, the app may be scaled.

- Refer to the previous section’s list of advanced features for full-service web payment apps.

Post-Launch Considerations

- User Engagement: Monitor user engagement and usage patterns to identify areas for improvement.

- Analytics: Use analytics tools to track app performance and user behavior.

- Marketing: Implement marketing strategies to increase visibility and downloads.

- Support: Provide customer support to address user issues and maintain satisfaction.

By carefully managing the app launch and post-launch activities, you can ensure a smooth rollout and ongoing success for your mobile wallet application.

Let’s talk

A consultation with the Client Relationship Manager, who represents TECHVIFY, without any commitment from your side, will give you:

- Structured and clear vision of your future application

- Information about how our software development company guarantees 100% on-time and on-budget delivery

- Recommendations for choosing the tech stack

- Advice on further steps

- Business-side recommendations

- Rough project estimation on software development

TECHVIFY is right where you need. Contact us now for further consultation:

IV. Examples of Successful Digital Wallet Companies

Many companies succeed in the digital wallet market due to innovation, effective business models, and strategic operating regions. Here are some startups that can inspire your offering:

Example #1: PayPal

PayPal is a financial service enabling users to transfer funds to and from other account holders, irrespective of geographic location.

- Established: March 2000

- Acquisition: Acquired by eBay in 2002 for $1.5 billion

Motivation Behind PayPal

Max Levchin started PayPal to provide a secure, fast, and cost-effective alternative to traditional banking methods. The goal was to address the limitations of conventional banking.

PayPal’s Growth Strategy

PayPal’s early success was driven by its referral marketing strategy, which included:

- Initial sign-up bonuses of $20

- Later reduced to $10

- Eventually set at $5

This approach led to a significant daily growth rate in the early 2000s.

Cost of Developing an App Like PayPal

The eWallet app development cost for an app similar to PayPal can cost between $40,000 and $90,000.

eWallet Development

Example #2: Cash App

Cash App is a payment solution that allows users to send and receive money through its mobile application. It also offers various banking services and issues debit cards through its partners.

- Original Name: Square Cash

- Co-Founder: Jack Dorsey

Motivation Behind Cash App

Jack Dorsey was inspired to create Cash App in 2009 when his friend, Jim McKelvey, couldn’t complete a sale because he didn’t accept credit card payments. Cash App was designed to make transactions quick and easy.

Cash App achieves this by offering:

- Standard deposits to bank accounts

- Quick deposits to linked cards

Cash App’s Business Strategy

A key factor in Cash App’s growth is its support for Bitcoin transactions. The company’s Bitcoin revenue grew significantly, reaching over $10 billion in 2021.

- Free Deposits: Processing time of 1-3 days

- Instant Deposits: Transaction fees ranging from 0.5% to 1.75%

This business model helped the company generate substantial revenue in 2021.

Cost of Developing an App Like Cash App

Creating a mobile application similar to Cash App typically costs between $30,000 and $55,000.

Conclusion

The eWallet app market is on the verge of substantial growth in the coming years, propelled by advancements in technology and increasing user adoption. From closed wallets to digital wallet super apps, the variety and functionality of eWallet applications continue to expand, offering immense opportunities for businesses and entrepreneurs.

However, developing a robust and user-friendly eWallet app requires meticulous planning, expert execution, and a deep understanding of market needs and technological capabilities. This is where professional eWallet app development services and consultation from an eWallet app development company become invaluable.

At TECHVIFY, we specialize in creating secure, innovative, and scalable eWallet applications tailored to your business needs.

Contact us today to discuss how we can help turn your vision into a successful digital payment platform. Let’s work together to bring your ideas to life.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666