The Complete Guide to AI Fintech Chatbots: Benefits, Use Cases, and More

- TECHVIFY Team

- 0 Comments

Customers today want smooth, easy digital experiences at every point, and that’s why many fintech companies are turning to AI-powered chatbots to meet these expectations.

Fintechs are known for being quick to innovate, always pushing the boundaries of traditional banking. Their ability to adapt quickly means that adopting conversational AI isn’t just a choice—it’s part of who they are.

According to McKinsey, fintech revenues are set to grow almost three times faster than traditional banks between 2023 and 2028. This growth is being driven by major shifts in the banking industry, faster digital adoption, and the eCommerce boom in developing economies. Fintech companies must keep up with this rapid pace, and finance AI chatbots are becoming vital tools to help them do that.

So, does your fintech company need an AI fintech chatbot? Let’s take a closer look at how they can benefit your business and what they’re capable of.

I. What are Chatbots and How Do They Fit into Fintech?

A fintech chatbot is a modern alternative to speaking with human agents, helping banking and financial firms save more than $7.3 billion in operating costs by 2023. By using text, voice commands, or buttons, users can have conversations with a chatbot that feel almost human, making it easier to access various financial services.

From handling payments and transfers to managing accounts and applying for loans, these AI-powered assistants are streamlining how clients interact with their banks. Plus, since they’re available 24/7, chatbots reduce wait times, help customers save time, and let people complete financial tasks from anywhere—all while keeping their information safe.

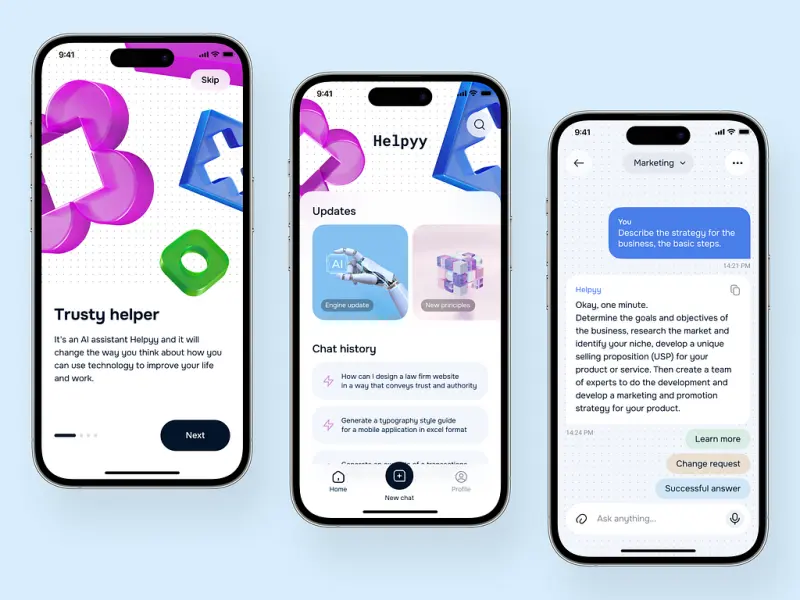

Chatbots in fintech

Even though the financial services industry is still going through its digital transformation, the number of people using fintech solutions keeps growing. In fact, it jumped from 2.5 billion in 2020 to 5.3 billion in 2024 and is expected to hit 6.8 billion by 2028.

Because of this growing demand, AI fintech chatbots are becoming a must-have for financial institutions that want to stay ahead of the curve.

Find out more insights about Banking, Financial Services, and Insurance industry:

II. Why Fintech Chatbot Matter: Key Benefits for Fintech Companies

According to The Economist, 46% of banks believe AI can assist them in reaching their business objectives.

Almost 60% of these banks use AI to combat fraud, 54% use it to streamline IT operations, and others rely on it for things like digital marketing, risk management, or enhancing the customer experience.

These use cases show how fintech companies can benefit in several ways:

Better Customer Experience

A study by Boston Consulting revealed that nearly 43% of customers would switch banks due to poor digital customer service. Interestingly, the same percentage of U.S. customers now use chatbots instead of visiting a bank in person for their financial needs.

That’s why it’s crucial to implement chatbots that deliver:

- Around-the-clock availability: Customers can always get help, no matter the time of day or what time zone they’re in.

- Quick responses: People prefer using chatbots because they don’t have to wait in line for answers; they can get the help they need right from home.

- Personalized service: As chatbots learn more about customer preferences, they can tailor responses to feel more personal and engaging.

Lower Operating Costs

Providing excellent customer service without chatbots means hiring a lot of staff to cover all the shifts in your contact centers, which can get expensive. But messaging clients and offering support through chatbots can cut those costs.

- Automate routine tasks: Chatbots can assist with tasks like checking balances or answering frequently asked questions, allowing human agents to focus on more complicated tasks.

- Better use of resources: By letting chatbots handle repetitive tasks, your human experts can focus on delivering higher value services, which boosts your return on investment (ROI).

Boosted Efficiency

Let’s compare a human agent to a chatbot: while a person can only focus on one task at a time, chatbots can handle hundreds or even thousands of requests simultaneously. With AI-powered chatbots managing simple service tasks, your team can focus on more complex issues.

- Streamlined processes: Chatbots can help speed up things like onboarding new clients or processing loan applications by guiding users through each step.

- Enhanced efficiency: Chatbots can spot problem areas, suggesting ways to improve your systems and services.

- Data insights: By analyzing customer conversations, chatbots can identify trends and pain points, giving you valuable insights to inform your product and marketing strategies.

Wider Accessibility

Your customer service team should reflect the diversity of your clients, which means supporting a wide range of languages. But with chatbots, this becomes much easier. They can overcome language obstacles and ensure financial services more accessible to everyone. This allows you to reach new markets and promote financial inclusion.

- Global reach: Chatbots offer multilingual support, making it possible for clients around the world to access services anytime.

- Inclusivity: Financial chatbots help companies cater to a broader audience, ensuring services are available to everyone, regardless of their tech skills or language proficiency.

Gaining a Competitive Edge

You can gain an edge over your competition both internally and externally. While many of these benefits focus on customers, chatbots can also help your employees. They can serve as virtual assistants, providing quick answers to financial advisors or helping staff navigate internal processes like document sharing or task tracking.

- External benefits: Your customers will appreciate the simplicity that chatbots bring to the table by offering instant, personalized help.

- Innovative experience: Fintech companies using chatbots show they are committed to cutting-edge, customer-focused technology, giving them a leg up over traditional competitors.

Looking to Outsource Development?

Contact TECHVIFY, Vietnam’s Leading Offshore Software Development & Outsourcing Company, for a consultation and development services.

III. Step-by-step Guide on How to Make a Fintech Chatbot

1. Define the Chatbot’s Purpose

The first step in building an effective fintech chatbot is to clearly define its purpose. This will shape the bot’s personality, core functionality, and even its design. To get started, take a close look at your company and ask yourself:

- What specific services do we provide?

- What information or processes need to be explained or simplified for customers?

- What is the financial literacy level of our target audience?

- What potential concerns or challenges might our users face?

Addressing these questions will provide a solid basis to design a chatbot that aligns with your business goals and genuinely improves the customer experience. Think of these insights as a blueprint for creating a chatbot that not only answers questions but also enhances your overall service delivery.

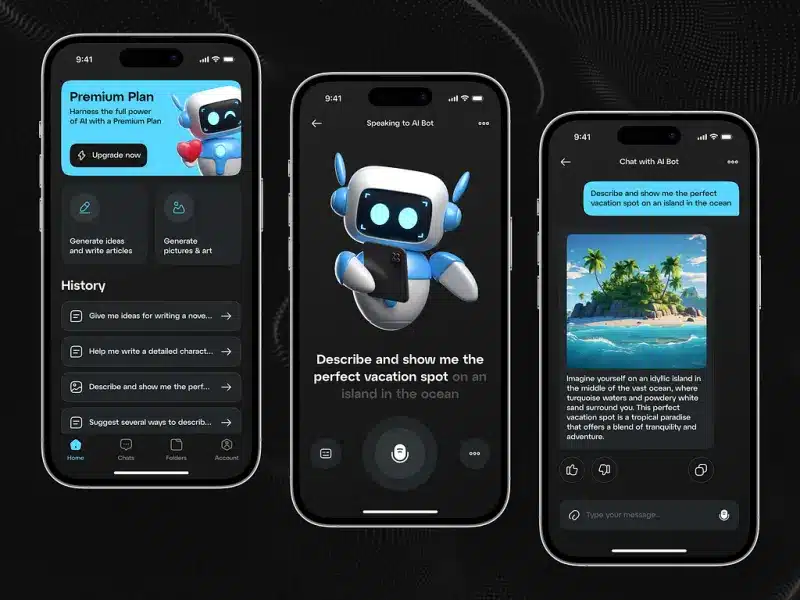

AI fintech chatbot

2. Choose the Right Platform

Once you’ve pinned down the goal of your chatbot, the next step is deciding where the chatbot will live. Do you want it to be part of your website, or would it be better as a standalone mobile app? Perhaps your target audience spends a lot of time on social media, so integrating your chatbot with platforms like Facebook Messenger, WhatsApp, Instagram, or Telegram might be a better strategy.

The key here is using what you know about your audience to make the right choice. For example, younger people are generally more comfortable using chatbots on social media, while older users might prefer simpler web-based or app-based solutions. Picking the platform that makes the most sense for your audience ensures that they’ll engage with your chatbot in a way that feels natural and intuitive.

3. Provide a Human-Like Experience

One of the most exciting things about modern AI chatbots is how seamlessly they can mimic human conversation. Today’s AI-powered bots use natural language processing to understand and respond to queries in a way that feels almost like talking to a real person. In fact, in some cases, they can even outperform human agents when it comes to speed and accuracy.

In the fintech industry, it’s especially important for chatbots to be not only friendly but also clear and concise. Users often come to chatbots with specific financial questions, and they expect accurate, easy-to-understand answers. Your chatbot should be designed to communicate in a way that leaves no room for confusion, ensuring that customers feel confident and satisfied after each interaction.

4. Test and Improve Your Chatbot

Just like any other product or service, your chatbot needs to be rigorously tested before it goes live. Testing is crucial to making sure that the chatbot performs well under a variety of scenarios, and it’s also an opportunity to refine how the bot handles more complex queries. During this phase, it’s important to assess the chatbot from the user’s perspective: Is it easy to use? Does it respond quickly and accurately? Does it handle unexpected or unusual questions smoothly?

As you test, you may uncover bugs or areas where the chatbot needs improvement. These can be fixed manually, but over time, leveraging machine learning can help your chatbot evolve on its own. Machine learning allows the bot to learn from mistakes and fine-tune responses based on past conversations, making it smarter and more effective with each interaction.

5. Prioritize Security

Security is a top priority when building a fintech chatbot. Financial data is highly sensitive, and any system that handles such data must be designed with robust security measures. The best chatbots for banking are those that leave no gaps for malicious users to exploit. This means implementing multiple layers of protection, from advanced authentication methods to bank-level encryption.

In addition to encryption and authentication, consider adding features like multi-factor authentication (MFA) to further safeguard user data. Your chatbot should be designed to protect users at every stage, ensuring that their personal information and financial transactions remain secure.

6. Gather User Feedback and Continuously Improve

Once your chatbot is live, your work isn’t done. Gathering user feedback is essential to understanding how well the chatbot is performing in real-world conditions. Encourage users to rate their experience with the bot, either within the chat itself or through follow-up emails or surveys. This input will be essential for pinpointing areas where the chatbot can be improved.

Don’t be afraid of negative feedback—look at it as a golden opportunity to make your chatbot even better. By paying attention to your users and consistently improving the bot’s performance, you can ensure that it remains a valuable tool that provides a top-tier user experience.

IV. Chatbot Use Cases for the Fintech Industry

Fintech chatbots can perform a wide variety of tasks across customer service, security, and even marketing. They provide an efficient method to optimize processes and enhance customer engagement, and enhance security measures. Below are some common use cases for chatbots within the fintech landscape, along with examples that illustrate how they’re being used in banking and other financial sectors.

Chatbots in fintech

24/7 Customer Support

In the financial world, the phrase “time is money” takes on a literal meaning. Customers expect fast, around-the-clock service, and many turn to chatbots specifically for their ability to provide immediate assistance without the need for human intervention. This 24/7 availability is one of the primary reasons why chatbots have become so popular in banking.

By offering non-stop support, AI-driven chatbots not only save financial institutions money but also reduce the strain on human employees. This helps maintain a healthier work-life balance for staff while still ensuring customers receive the support they need.

Example:

TD Clari is a well-known example of a financial chatbot that provides round-the-clock assistance. It handles common queries with ease, making it an excellent example of a smart financial assistant that is always available, without any pauses or days off.

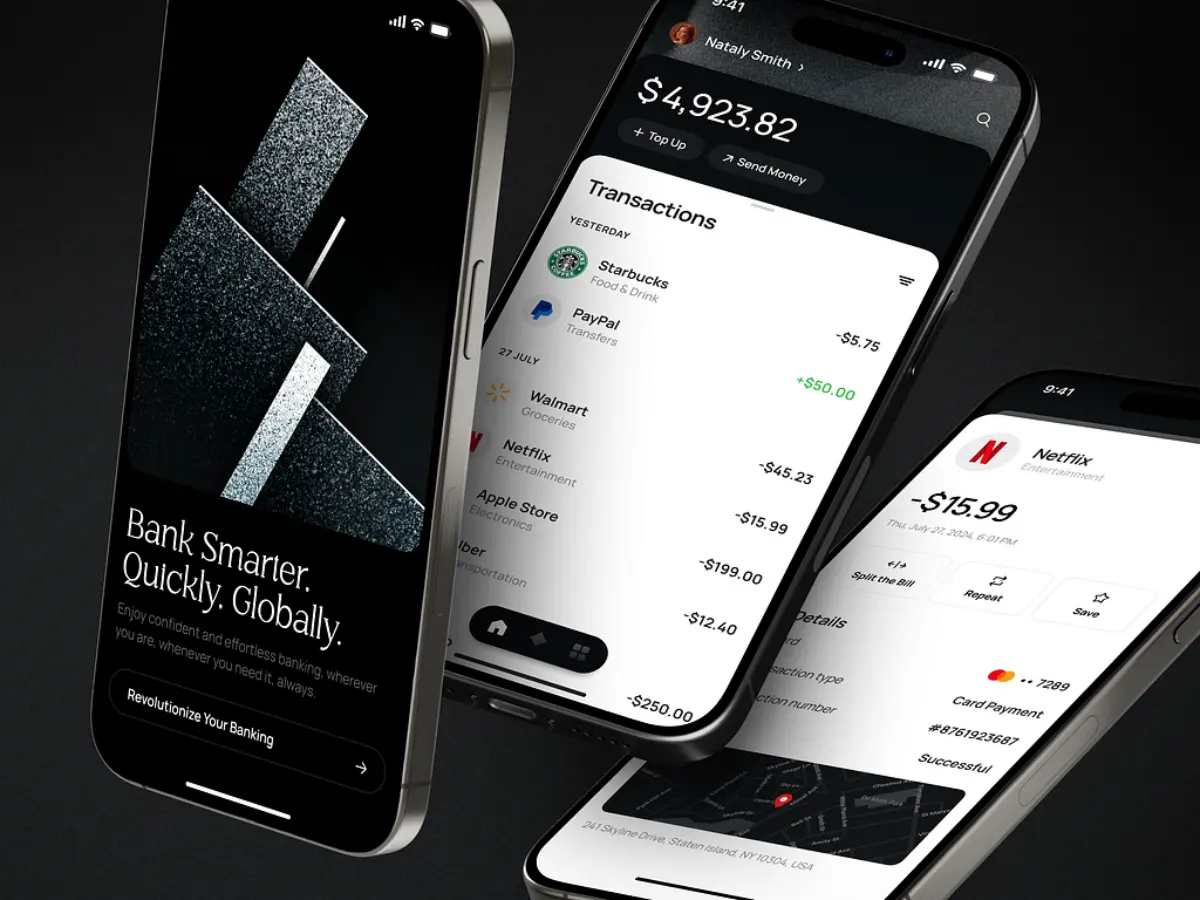

Digital Payments

One of the core functions of many fintech chatbots is to simplify the process of making payments or completing transfers. Financial transactions can be stressful, especially if the platform isn’t user-friendly. Chatbots can guide customers through the process, ensuring that everything is done correctly and efficiently.

By integrating with payment systems like PayPal or other online banking platforms, chatbots can make digital payments a smooth and hassle-free experience.

Example:

Hang Seng Bank in Hong Kong utilizes a chatbot called Haro to offer 24/7 payment services. Whether it’s currency exchange or money transfers, Haro ensures that transactions are handled quickly and smoothly.

Finance Management

Managing personal finances can be tricky, especially without the right tools. Fintech chatbots provide users with a way to track spending, monitor income, and manage budgets. These chatbots can send reminders for bill payments, track monthly spending, and even provide insights into where a user’s money is going.

Example:

Erica, the AI-powered chatbot from Bank of America, helps users manage their finances by offering a variety of services. It can show account balances, track transaction history, set up bill payment reminders, and alert users to potential issues like duplicate charges.

Let’s talk

A consultation with the Client Relationship Manager, who represents TECHVIFY, without any commitment from your side, will give you:

- Structured and clear vision of your future application

- Information about how our software development company guarantees 100% on-time and on-budget delivery

- Recommendations for choosing the tech stack

- Advice on further steps

- Business-side recommendations

- Rough project estimation on software development

TECHVIFY is right where you need. Contact us now for further consultation:

Investments

Chatbots can also be a valuable tool for investors, whether they’re seasoned professionals or newcomers to the financial world. Investment-focused chatbots can offer advice on building portfolios, suggest investment strategies, and even help users monitor the performance of their investments.

Example:

MyEva is a chatbot designed to help users achieve financial well-being. It not only assists with budgeting and saving but also provides investment advice, making it a valuable tool for both beginners and experienced investors.

Automated Fraud Detection

Financial institutions are highly concerned about fraud, and it’s becoming increasingly difficult to manually monitor transactions for suspicious activity. Chatbots can help solve this problem by automatically identifying and flagging fraudulent activity in real time.

Example:

Eno, the Capital One chatbot, was designed with fraud prevention in mind. It keeps an eye on transactions for any unusual behavior and notifies users when something seems off. Additionally, Eno can generate virtual card codes for online purchases, offering additional security against fraud.

Marketing and Promotions

In addition to customer service and security, fintech chatbots can also play a role in marketing. By analyzing customer behavior and transaction history, chatbots can promote personalized offers and recommendations, boosting engagement and generating additional revenue for the company.

Example:

Ally, a digital finance service, uses its chatbot not only to handle basic financial tasks but also to offer personalized tips and advice. By analyzing a user’s transactions, the chatbot can offer personalized suggestions that match the customer’s financial behavior.

Insurance & Loans

Fintech chatbots can help streamline traditionally slow processes like insurance claims and loan applications. By automating much of the paperwork and verification steps, chatbots can significantly speed up these processes while maintaining the same level of security.

Example:

Lemonade, an insurance company, uses a chatbot to handle insurance claims. The chatbot prompts users with several questions and processes claims in a matter of seconds, making it a prime example of how AI can simplify complex financial processes.

V. Prediction of Future Trends of Chatbots in Fintech

In the early days, chatbots were seen as simple customer support tools, but their capabilities have since evolved dramatically. Today, chatbots are sophisticated enough to handle complex financial tasks, rivaling the functionality of full-fledged websites and advanced applications. They are crucial in improving the user experience, optimizing operations, and encouraging clients to adopt fintech services. As technology progresses, a few important trends are shaping the future of fintech chatbots, transforming them into indispensable tools for financial institutions.

AI chatbot fintech

1. AI-Powered Personalization

One of the biggest shifts in the fintech industry is the focus on AI-driven personalization. Customers no longer want to be treated as just numbers; they expect tailored experiences that cater to their unique financial needs. Fintech chatbots are increasingly leveraging artificial intelligence to provide personalized services.

By analyzing user behavior, sentiment, and transaction history, AI-powered chatbots can predict future customer actions and proactively suggest financial products or services. For example, if a customer frequently makes international transactions, the chatbot might recommend foreign currency accounts or transfer services. Such personalization not only boosts customer satisfaction but also deepens the bond between the customer and the financial institution, leading to increased loyalty and profitability.

Key Benefits:

- Predictive analytics to offer relevant financial products.

- Enhanced customer satisfaction through personalized recommendations.

- Improved financial outcomes for institutions through cross-selling and upselling.

2. Voice-Activated Assistants

Voice technology is rapidly becoming a mainstream feature in the fintech space. As more consumers become comfortable using voice commands, the demand for voice-activated assistants in banking is set to surge. In fact, 69% of consumers have already expressed interest in using voice authentication for banking transactions.

Voice-activated chatbots offer hands-free, conversational banking experiences that are convenient and efficient, allowing users to perform tasks like checking balances, transferring money, or paying bills with simple voice commands. This technology is powered by advanced Natural Language Processing (NLP), which continually improves understanding of complex financial queries.

Key Benefits:

- Hands-free banking for convenience and speed.

- Increased customer engagement.

- Reliable information processing through advanced NLP.

3. Multilingual Support

As fintech companies expand globally, the demand for multilingual chatbots is growing rapidly. To better serve international clients, financial institutions must offer chatbot support in multiple languages. This trend is driving the growth of the Language Translation NLP market, which is expected to reach $5.92 billion by 2024.

Offering multilingual support helps financial institutions break down language barriers, making fintech services accessible to a broader audience. This trend is particularly important for underserved or unserved populations who speak only one language, opening new revenue streams for financial institutions.

Key Benefits:

- Expanded global reach and customer base.

- Improved customer experience for non-native speakers.

- Greater inclusivity and accessibility for underserved markets.

4. Integration with Social Media Platforms

As people become more dependent on social media for everyday communication, fintech chatbots are evolving to integrate with multiple social media platforms. The average person uses about six social media platforms daily, making it essential for fintech companies to meet customers where they are. While earlier chatbots were primarily integrated with platforms like WhatsApp, the future will see chatbots operating across a broader range of social channels.

This trend will enhance customer support by providing seamless, around-the-clock assistance on platforms users are already familiar with. It also boosts brand presence and accessibility, making it easier for customers to interact with their financial institution in real-time.

Key Benefits:

- Increased customer engagement through multiple touchpoints.

- Expanded brand presence and accessibility.

- Seamless 24/7 customer support on familiar platforms.

5. Enhanced Security Features

As cyber threats become more sophisticated, fintech chatbots must prioritize enhanced security features to protect user data and financial transactions. In the future, financial institutions will increasingly invest in chatbots with robust security measures such as multi-factor authentication (MFA), biometric identification, and tokenization.

Additionally, chatbots will adopt features like session timeouts and automatic logouts to prevent unauthorized access, ensuring that sensitive financial data remains secure even during idle periods. These advanced security protocols will help mitigate risks, making chatbots a trusted interface for handling sensitive financial tasks.

Key Benefits:

- Increased security through MFA, biometrics, and tokenization.

- Prevention of unauthorized access with session timeouts and logouts.

- Improved trust and reliability for sensitive financial transactions.

6. Conversational Banking Experiences

Fintech chatbots are moving beyond transactional interactions to offer comprehensive conversational banking experiences. Instead of merely responding to basic queries, advanced chatbots engage users in meaningful, human-like conversations that provide real-time financial advice and personalized insights.

These chatbots can guide customers through complex financial decisions, such as choosing the best savings account or investment strategy, making them invaluable tools for both everyday banking and long-term financial planning.

Key Benefits:

- Engaging, human-like conversations that improve user experience.

- Real-time financial advice and guidance.

- Personalized insights for better financial decision-making.

7. Robo-Advisory Services

The emergence of robo-advisors is revolutionizing the way people manage their finances. Unlike the early prototypes like Betterment, modern robo-advisors use sophisticated algorithms and passive indexing strategies to guide users in managing their investments. Although robo-advisors are not yet capable of fully replacing human financial advisors, their capabilities continue to improve.

For instance, BloombergGPT, a large language model trained on massive amounts of financial data, is pushing the boundaries of robo-advisory services. In the future, fintech chatbots will likely incorporate similar AI-driven tools to offer advanced financial planning and investment advice, helping users achieve better financial outcomes with minimal risk.

Key Benefits:

- Improved financial planning and investment management.

- Reduced risk of financial loss through sophisticated algorithms.

- Enhanced user trust in AI-driven financial tools.

8. Emotional Intelligence and Empathy

OOne of the most thrilling advancements in chatbot tech is the emergence of emotionally intelligent chatbots. In the past, chatbots responded to queries based on keywords, but today’s AI-powered bots can understand and respond to human emotions. By analyzing the emotional tone of a conversation, these chatbots can adjust their responses to provide more empathetic and supportive interactions.

For example, if a user expresses frustration or confusion, the chatbot can offer reassurance and guide them through the issue in a calm and empathetic manner. This emotional intelligence fosters stronger relationships between users and financial institutions, increasing customer loyalty and satisfaction.

Key Benefits:

- Enhanced user experience through empathetic interactions.

- Stronger customer relationships and increased brand loyalty.

- Better understanding of user needs for personalized results.

Conclusion

AI-powered chatbots are no longer just a nice-to-have feature—they’re quickly becoming essential to delivering the smooth digital experiences customers now expect. From enhancing customer support to making operations more efficient, chatbots offer fintech companies a wide range of benefits that can keep them ahead of the curve in an ever-evolving industry.

As fintech continues to grow at an unprecedented pace, staying competitive means embracing the tools that make a difference. Chatbots are helping companies meet customer expectations and setting the stage for the future of financial services.

Why wait? Let’s build your fintech’s future today. Reach out to TECHVIFY for a free consultation and see how our custom AI-powered chatbots can take your business to the next level. Get started now—your customers are ready for the change!

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666