How to Build a Loan App: A Beginner’s Guide to Fintech Success

- TECHVIFY Team

- 0 Comments

The financial market is where the big money flows, and thanks to digitalization, it’s evolving fast. Now, instead of going to a bank, people can get loans instantly by downloading a money lending app, signing up, and applying right from their phone.

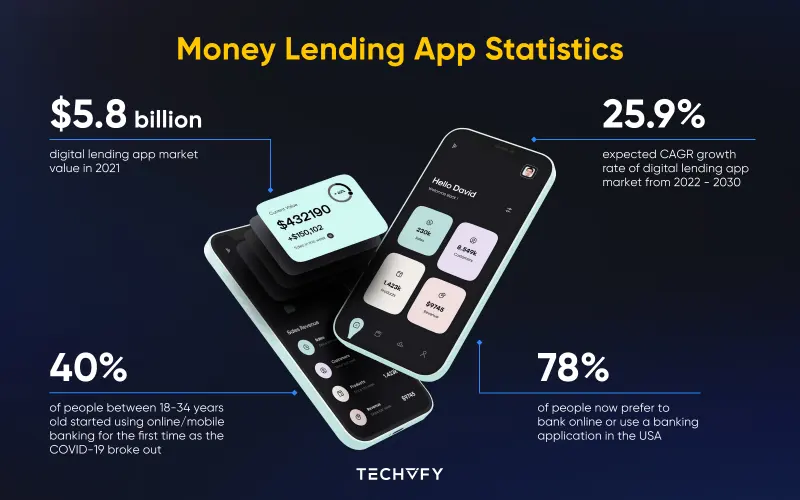

In recent years, the global lending market hit almost $6 billion and is expected to grow by 25% each year until 2030. But with all this growth comes the need for extra security and strict legal compliance to handle transactions and personal data safely.

If you’re still wondering how to build a loan app and how much it costs, this guide can help. It covers everything you need to know, from the development process to staying compliant with regulations.

I. A Snapshot of the Money Lending App Market

Before we dive into the numbers, it’s worth highlighting one key player in the push for financial digitalization: mobile banking. Even before the pandemic, mobile banking was gaining traction, but COVID-19 caused a significant jump in demand for remote financial services. A survey by Boston Consulting Group found that over 40% of people aged 18-34 began using online or mobile banking for the first time as the pandemic unfolded. In the U.S. alone, 78% of people now prefer to bank online or through a banking app.

Money lending app market

Loan services have followed a similar upward trend. The digital lending platform market, for instance, was valued at $5.8 billion in 2021, with expectations of a 25.9% annual growth rate between 2022 and 2030. What’s even more impressive is that some of the top lending companies have only risen to prominence in the past five years, mainly in North America and Europe. However, demand in the Asia-Pacific region is also on the rise, thanks to an increasing number of fintech startups.

Find out more insights about Banking, Financial Services, and Insurance industry:

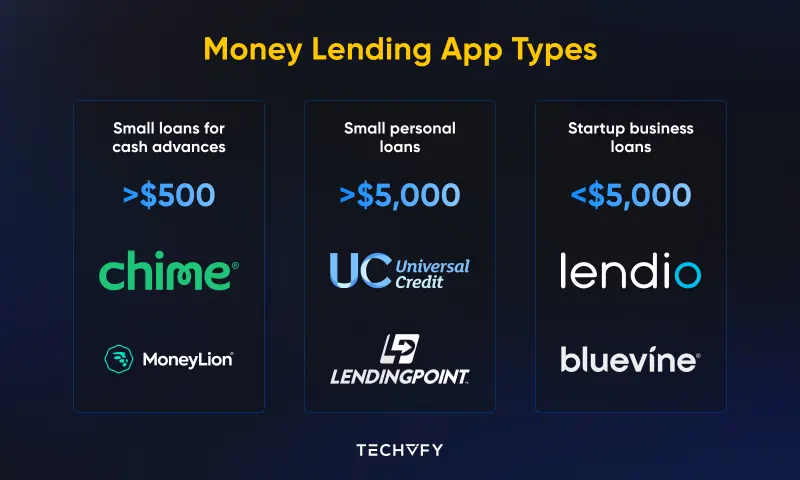

II. Types of Money Lending Apps and Examples

Now, let’s break down the main types of loan apps, based on the loan sizes they offer. Once you identify the type you need, estimating the cost and features of building a lending app becomes much easier.

Small Loans for Cash Advances

These loans are typically under $500 and are perfect for quick funding with minimal fees. They often come with features like automatic overdraft protection. Examples of these kinds of apps include Chime and MoneyLion.

Small Personal Loans

These loans usually range up to $5,000 and are ideal for those needing fast cash with low credit score requirements. A standout example is Universal Credit, which offers loans from $1,000 to $50,000, even for people with damaged credit. Another top platform is LendingPoint, which allows users to create an account quickly and receive loan approval, with funds often available the next day.

Startup Business Loans

Typically starting at $5,000 or more, these loans are designed for entrepreneurs looking to get their businesses off the ground. Apps like Lendio and Bluevine connect business owners with various lenders, offering lines of credit. It’s worth noting that some loan apps are restricted to certain regions, but Lendio is available worldwide, making it a win-win for both lenders and borrowers.

Money lending app types

III. How to Build A Loan App: Step-by-step Guide

Building a money lending app starts with a solid idea — maybe there’s a specific feature that will solve a problem for users and help you stand out from the competition. It will take 9 key steps to turn that idea into a reality:

Step 1: Conduct an Initial Study

Before jumping into building a money lending app, the first thing you need to do is some groundwork. This means researching the market, studying similar apps, and surveying your target audience to find out what they’d like to see in a loan app. It’s important to know what features and services users are looking for, so you can build something that meets their needs.

Key Stages of the Initial Study

-

Study the Market

To get a better sense of the market you’re entering, ask yourself the following questions:- What problem does your product or service solve?

- Who else is solving this problem?

- Are your competitors large or small companies?

- What do customers say about them?

-

Research Competitors

Once you have an idea of what the market looks like, it’s time to take a closer look at your competitors:- What types of users are they targeting?

- What are their strengths and weaknesses?

- Are they planning to release new features or products?

- What features do they offer that you find appealing?

-

Define Your Competitive Advantage

Now, focus on your own product and compare it with what’s already out there:- What will you offer that others don’t?

- Is your pricing competitive and fair?

- Why are you building this loan app?

- What do you do best?

By the end of your initial study, you should have a clearer idea of how to create your loan app, including its main goals, user characteristics, and a list of essential features. With this, your development team will have a solid foundation to build on and can create an app that fits your vision perfectly.

Step 2: Get the Legal Side Right

Next, you’ll need to make sure the app complies with all legal requirements. This means understanding consumer protection laws, usury limits, and securing the proper lending licenses. It’s also a good idea to work with a team of financial and legal experts to help you draft loan agreements, if necessary.

One of the biggest challenges here is finding the right balance between making your app easy for users and staying compliant with regulations like Know Your Customer (KYC) and anti-money laundering (AML) laws. While you want to make it easy for users to sign up and get loans, you also need to ensure that your app follows these rules to prevent fraud and other illegal activities.

Collaborating with legal experts is crucial for making sure your app complies with all local, national, and international laws. Fintech regulations change all the time, and even the best experts can find it hard to keep up. To avoid risks and ensure your app operates ethically and legally, having a good lawyer on your team is a must.

Step 3: Choose a Platform

Once you’ve got the legal side sorted, it’s time to figure out which platforms your app will support. This depends on who your users are. For example, many peer-to-peer lending apps offer a mobile app for investors and a web version for borrowers. If your target audience includes a wide range of users, you might want to create a cross-platform app that works on both Android and iOS.

Using frameworks like React Native can help you speed up the development process, allowing you to create a cross-platform app in as little as 5 months.

Step 4: Find a Development Team

Now it’s time to find the right team to bring your app to life. There are three main options for this:

- In-house team: You can hire developers as part of your own company. This gives you the most control over the project but can be expensive.

- Freelancers: This is a more flexible option and can be cheaper than hiring in-house staff, but it comes with fewer guarantees.

- Outsourcing company: This is often the most cost-effective option, as outsourcing companies usually offer more guarantees and expertise than freelancers, while costing less than building an in-house team.

Choosing an outsourcing company is often the best way to go, especially if you’re looking to develop a Minimum Viable Product (MVP) first. This approach gives you the best chance of success, as you’ll have a team of experts working to bring your app to market quickly and efficiently.

When selecting a development team, make sure to check their experience in your niche and look at reviews from previous clients. But don’t just trust a 5-star rating on Clutch or Trustpilot. Ask if you can contact their previous clients directly to get a better understanding of their experience.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

Step 5: Develop an MVP (Minimum Viable Product)

An MVP is the first version of your product. It’s fully functional but includes only the most essential features. The main goal of an MVP is to test whether your idea works in the real world and gather feedback from early users.

Here’s why an MVP is a smart move:

-

Test your idea: No matter how great your idea seems on paper, you won’t know if people will actually use it until it’s out in the real world. An MVP lets you test the waters with minimal investment.

-

A chance to pivot: Sometimes, even when there’s interest in your app, the solution you’ve designed doesn’t quite hit the mark. An MVP gives you the opportunity to pivot and adjust your app based on real user feedback, all without over-investing in the initial version.

-

Early returns: If your MVP is successful, you can start generating revenue early on. This allows you to reinvest that money into further development, making your app even better. The more your app improves, the more users you’ll attract, and the more profit you’ll generate.

Developing an MVP is fast and cost-efficient. Most MVPs can be launched within 3-4 months. For a money lending app, creating an MVP is a great way to test the market and validate your idea before committing to a full-scale product launch.

Step 6: Prioritize Features

Once your MVP is ready, the next step is to work with your development team to prioritize the features you want to include in the final version of the app. This will depend on your overall goals, the needs of your target users, and your budget.

A good way to do this is by using the MoSCoW prioritization technique. This breaks down features into four categories:

-

Must-Have (M): These are the essential features that your app can’t function without. For a loan app, this might include user registration, loan applications, and a loan approval process.

-

Should-Have (S): These features aren’t essential, but they make the app easier to use and improve the overall user experience. Examples include account dashboards and secure document uploads.

-

Could-Have (C): These are nice-to-have features that add extra value but aren’t critical. Things like loan calculators or budgeting tools fall into this category.

-

Won’t-Have (W): These are features that are nice but can be added later. Advanced analytics or integration with third-party services might fit into this category.

Here’s an example of how feature prioritization might look for a money lending app:

| Category | Features |

|---|---|

| Must-Have (M) | User registration, loan application process, KYC/AML verification, repayment notifications |

| Should-Have (S) | Account dashboard, secure document upload, customer support chat |

| Could-Have (C) | Loan calculator, budgeting tools, rewards program |

| Won’t-Have (W) | Advanced data analytics, integration with investment platforms |

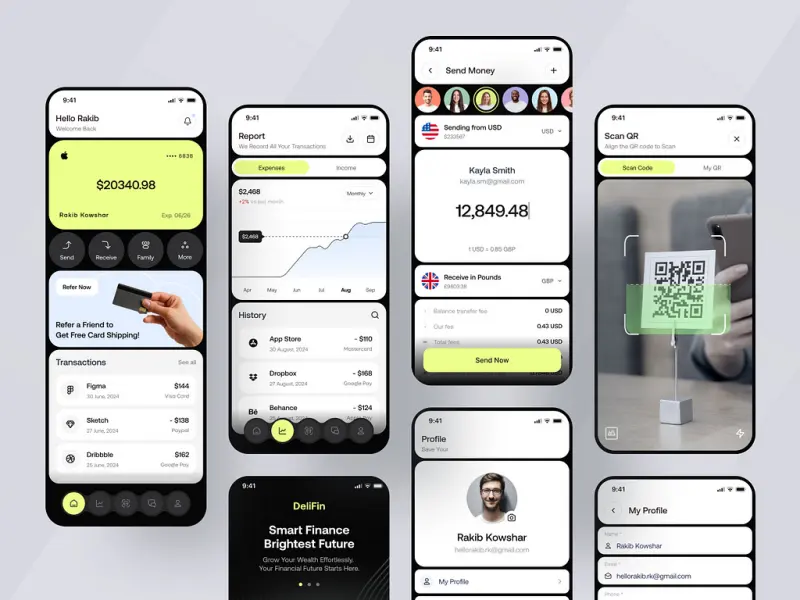

Step 7: Create UI/UX Design

A simple, stylish design will help your app stand out and make it easy for users to navigate. Pay special attention to the UI/UX design (user interface and user experience), as this will determine how intuitive and user-friendly your app is.

-

Define your target audience: Start by identifying who your typical users will be. Some designers create a user persona — a semi-fictional character that represents your ideal user. This helps guide the design process. Surveying potential or current users can also give you valuable insights into their preferences.

-

Map out the user journey: Think about how users will move through your app. Identify different scenarios they might encounter, and highlight their goals, expectations, and potential pain points.

-

Design the interface: Use the data you’ve gathered to brainstorm ways to make the design elements as user-friendly as possible. Start with wireframes to plan out the screen layout, and then move on to creating mockups and a UI-kit that includes branded design elements.

Step 8: Develop a Full App

Creating a money lending app involves two main components: frontend and backend development. To make it easier to understand, think of it like building a car.

-

Frontend development is like the exterior of the car — it’s what the user sees and interacts with. Think of it as the wheels, the leather seats, or the dashboard you notice when you first sit down. In a loan app, the frontend includes things like coding the user interface (UI), designing the user experience (UX), and creating the layout and interactivity that users engage with.

-

Backend development, on the other hand, is like the engine and all the other parts that keep the car running smoothly but are hidden from view. It’s responsible for everything happening behind the scenes, like processing transactions and securely storing user data. Backend development involves building the infrastructure that powers the app, setting up the security protocols, and writing the code for server integration, which manages user data, authorization, and other core functions.

At this stage, you’re taking the MVP you built earlier and enriching it with more features and functionality to create a polished, full-scale version of the app. This is where everything comes together, and both the frontend and backend work in sync to deliver a seamless experience for your users.

Step 9: Test and Launch

Before you release your app, it’s crucial to thoroughly test it for any bugs or issues. This prevents problems that could negatively impact the user experience. Testing follows a structured process with four stages: Plan, Do, Check, and Act.

-

Plan: Start by identifying the requirements and outlining test case scenarios. Plan out what needs to be tested, whether it’s the server, network, or devices.

-

Do: Run the test cases. Testers will evaluate the app on different devices and network environments to ensure it works as expected.

-

Check: Fix any bugs or issues discovered during testing. Then, recheck the app to make sure everything has been resolved. This is also when regression testing is performed — a process that ensures new changes haven’t broken any previously working features.

-

Act: Close the cycle by evaluating the overall performance based on the testing results. If everything looks good, the app is ready for launch.

However, launching the app isn’t the finish line — it’s just the beginning. After the app is live, the next stage involves gathering feedback from real users and using it to make improvements. This feedback helps you spot areas for growth and guides you into the second cycle of development, where you can add new features, improve the user experience, and update design elements.

By continuously listening to user feedback and making data-driven decisions, you can keep enhancing your money lending app and stay competitive in the market.

Let’s talk

A consultation with the Client Relationship Manager, who represents TECHVIFY, without any commitment from your side, will give you:

- Structured and clear vision of your future application

- Information about how our software development company guarantees 100% on-time and on-budget delivery

- Recommendations for choosing the tech stack

- Advice on further steps

- Business-side recommendations

- Rough project estimation on software development

TECHVIFY is right where you need. Contact us now for further consultation:

IV. How Long Does It Take for Money Lending App Development?

The timeline for developing a money lending app depends on the scope of the project, the features you plan to include, and the complexity of the app. Based on typical development cycles, here’s an estimated breakdown of man-hours required to develop a money lending app for both iOS and Android platforms:

| Money Lending App Development Process | Estimated Man Hours (iOS) | Estimated Man Hours (Android) |

|---|---|---|

| Wireframing | 40 hours | 40 hours |

| Design | 45 hours | 45 hours |

| SRS (Software Requirements Specification) | 35 hours | 35 hours |

| Test Case Creation | 30 hours | 30 hours |

| App Development | 220 hours | 220 hours |

| Backend Development | 160 hours | 160 hours |

| App Testing | 40 hours | 40 hours |

| Total | 570 hours | 570 hours |

In total, you’re looking at 570 hours for each platform. If you’re developing the app for both iOS and Android, the total number of hours would double, unless you use cross-platform frameworks like React Native or Flutter to build the app simultaneously for both platforms.

V. Money Lending App Development: Challenges to Consider

Developing a money lending app isn’t just about coding and design. There are several industry-specific challenges that you need to keep in mind, both from a technical and regulatory standpoint. Below are some of the main challenges you may face:

1. The Complexity of the Industry

The financial and lending industry is inherently complex. To understand this, you can look at mobile banking and the numerous challenges it faces. For example:

- Security issues: In traditional banking, security is a huge concern, but on a digital platform, it becomes even more critical. You’ll need to implement strong encryption, secure authentication methods (like two-factor authentication), and fraud detection measures.

- Third-party integrations: Many lending apps rely on third-party services like payment gateways, credit bureaus, or customer verification services. Each of these integrations adds complexity to both the front and backend development.

In short, handling sensitive customer data and ensuring secure transactions will require a more delicate and thoughtful approach than in most other industries.

Create a loan app

2. Diversity of Legal Regulations

One of the biggest challenges in developing a lending app is navigating the legal regulations that vary by region. Every country, and sometimes even states or provinces within a country, have different rules governing financial services. For example, in the U.S., states have their own lending laws and privacy regulations, like the California Consumer Privacy Act (CCPA), which imposes strict guidelines on how businesses handle personal data.

To avoid legal issues, you’ll need to:

- Ensure your app meets the local laws of every region where it will operate.

- Work with legal experts who specialize in fintech regulations and stay up-to-date on evolving laws like General Data Protection Regulation (GDPR) in Europe or Anti-Money Laundering (AML) requirements.

Failing to comply with these regulations can result in hefty fines or even the shutdown of your app in certain regions.

3. The Need for a Financial Specialist (In-House or Outsourced)

Developing a lending app isn’t just about the tech — you’ll also need financial expertise. Having a financial advisor on your team can help with several critical tasks:

- Structuring loan products: You’ll need help designing loan products that are competitive yet profitable.

- Complying with financial regulations: A financial expert can help navigate complex regulations and compliance issues, reducing the risk of legal trouble.

- Creating financial strategies: Whether you’re seeking investors or trying to grow your user base, a financial advisor can help you craft strategies that make sense for your business.

Finding the right financial expert can be tricky. You’ll want someone who genuinely understands the fintech space and is interested in helping develop your app. This could be an in-house hire or an outsourced consultant, depending on your needs and budget.

4. Finding a Bank Partner

To operate a lending app, you’ll need access to capital. Partnering with a bank or investor is a common way to fund your lending operations, but it’s not as simple as just securing funding.

-

Partnering with a bank: Banks often have strict regulations and procedures that you’ll need to follow. This can include meeting their compliance standards, undergoing regular audits, and adhering to specific financial protocols. While partnering with a bank can provide stability and access to funds, it also introduces more bureaucracy.

-

Partnering with investors: Working with investors can be more flexible, but it often comes with strings attached. Investors may want a stake in your company, which could lead to a loss of control over key business decisions. However, investors typically don’t impose the same level of regulatory oversight as banks.

In either case, securing funding is crucial to getting your app off the ground. Be prepared for a lengthy process of negotiation, legal adjustments, and financial planning.

Conclusion

Building a money lending app is an exciting opportunity to tap into a rapidly growing market. But it’s essential to get it right — from developing secure, user-friendly features to navigating complex legal regulations. With the market expected to grow by 25% annually, now is the perfect time to invest in a well-designed lending app that meets both user needs and compliance standards.

Ready to bring your money lending app idea to life? TECHVIFY can help. Whether you need expert advice or a full development team, we’re here to guide you through every step — from concept to launch. Get in touch with us today for a free consultation and see how we can turn your vision into a reality. Let’s build something great together!

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666