How to Create a Money Transfer App: Step-by-step Guide

- TECHVIFY Team

- 0 Comments

As our world changes, it’s time for new money transfer apps to take the stage. Old payment methods are outdated and lacking.

Mobile payments have become really popular, with over 2 billion users in 2022. This is expected to grow to 4.8 billion by 2025, showing a big global shift.

The global peer-to-peer payment market was worth $1.89 trillion in 2021. It’s set to reach about $9.87 trillion by 2030, according to Precedent Research. This market is growing at a rate of 20.16% each year from 2022 to 2030.

The demand for mobile payments is not just driven by convenience. In many areas, many people lack access to traditional banking.

With society heading towards a cashless future, the future for money transfer apps looks bright. In this article, we’ll go through the process of how to create a money transfer app in 2025.

I. Why Creating a Money Transfer App is a Smart Move

Growing Demand

Mobile payments are more popular than ever, and there are more than 2.5 billion active users. Fast peer-to-peer transfers offer a simple and social way to send and receive money instantly. Although money transfers dropped in 2022 due to the crisis from the Russian aggression in Ukraine, the high demand for quick digital payments, which grew during the pandemic, isn’t going away.

P2P payment market size 2022-2032 by Precedence research

Boosting Financial Inclusion

Demand isn’t the only factor that makes developing instant remittance apps appealing. For many unbanked individuals, these apps might be the only way to access financial services otherwise unavailable in certain regions. According to Statista, Morocco, Vietnam, Egypt, the Philippines, and Mexico have the largest unbanked populations.

The issue of limited financial inclusion affects many more countries, with about 1.7 billion people lacking access as of 2017, according to the World Bank. Therefore, peer-to-peer payment apps could see strong demand as long as people have access to smartphones and the Internet.

Find out more insights about Banking, Financial Services, and Insurance industry:

II. Advantages of Using a Money Transfer App

But why do consumers love money transfer apps so much? There are plenty of reasons, so let’s go through them one by one:

Lower Fees

Consumers are eager to exchange some traditional banking benefits for lower fees and a more user-friendly experience. Money transfer apps usually offer more competitive rates and sometimes even fee-free transactions for certain types of transfers or specific regions. This makes them an attractive option for users looking to save money on transaction costs without sacrificing convenience.

Always Accessible

Money transfer apps are available around the clock, allowing you to send or receive money at any hour, including weekends and holidays. This constant accessibility ensures that you have easy access to your finances whenever necessary, whether you need to send funds to a family member during an emergency or settle a bill that can’t wait. The flexibility offered by these apps is invaluable for managing unexpected expenses or time-sensitive transactions.

Fast Transaction Speed

These apps allow you to send and receive money swiftly and effortlessly, often with just a few taps on your smartphone. This efficiency removes the need to visit a physical bank branch or ATM, which can be time-consuming and inconvenient. By streamlining the transfer process, money transfer apps save you both time and effort, making financial transactions a hassle-free experience.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

Easy Record Keeping

Money transfer apps keep a detailed transaction history, simplifying the process of tracking your financial activities. This feature helps you stay organized, monitor your financial well-being, and ensure you’re achieving your financial objectives. By providing easy access to past transactions, these apps offer a convenient way to handle your finances and make smart choices about your spending.

Integration with Other Services

Many money transfer apps integrate with additional financial services, such as bill payments, mobile top-ups, online shopping, and various payment systems. This integration enhances the app’s functionality, allowing users to manage multiple financial tasks from a single platform. Such versatility is a significant advantage for users aiming to simplify their financial management and enhance digital payment use.

III. Types of Money Transfer Apps

There are 3 main types of money transfer apps:

Mobile OS Systems

You might not realize it, but widely used P2P services like Apple Pay and Android Pay are examples of mobile OS systems. Thanks to contactless payments for purchases wherever NFC technology is supported, this software has gained significant popularity. However, there’s a limitation—users of Android or Apple devices can only transfer money to others using the same system. Despite this, the convenience and ease of use have made these apps a staple for many smartphone users.

Independent Services

PayPal is a leading example of independent services. The app facilitates card payments using electronic wallets, enabling seamless P2P transactions. However, these services typically support only Visa and MasterCard card types, which might limit their accessibility for some users. Despite this limitation, independent services continue to thrive due to their widespread acceptance and robust features.

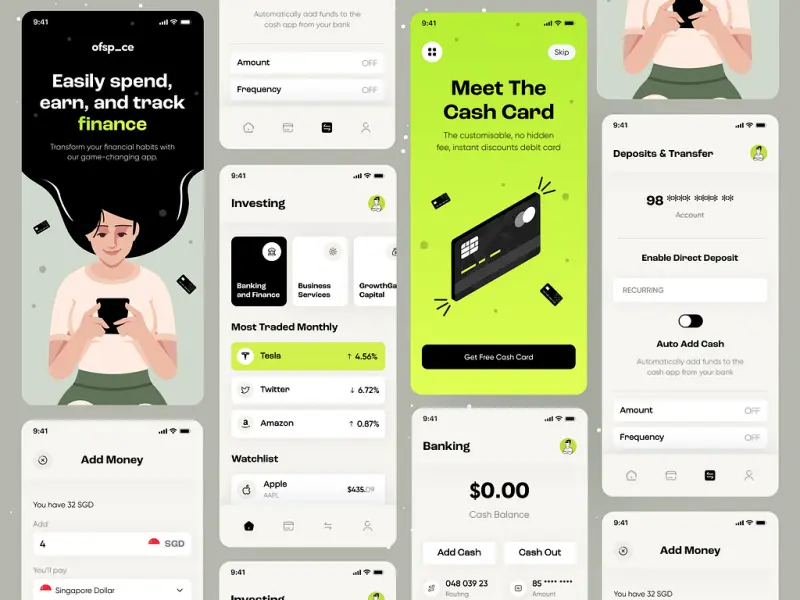

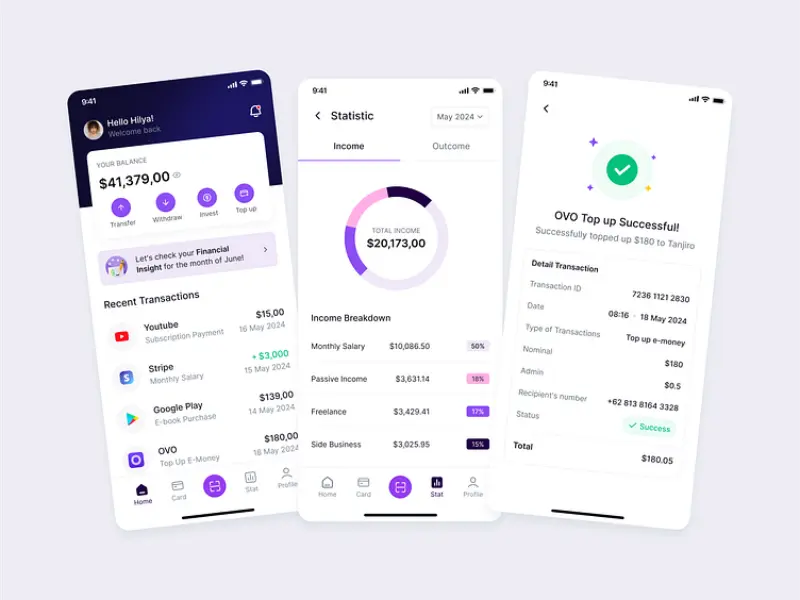

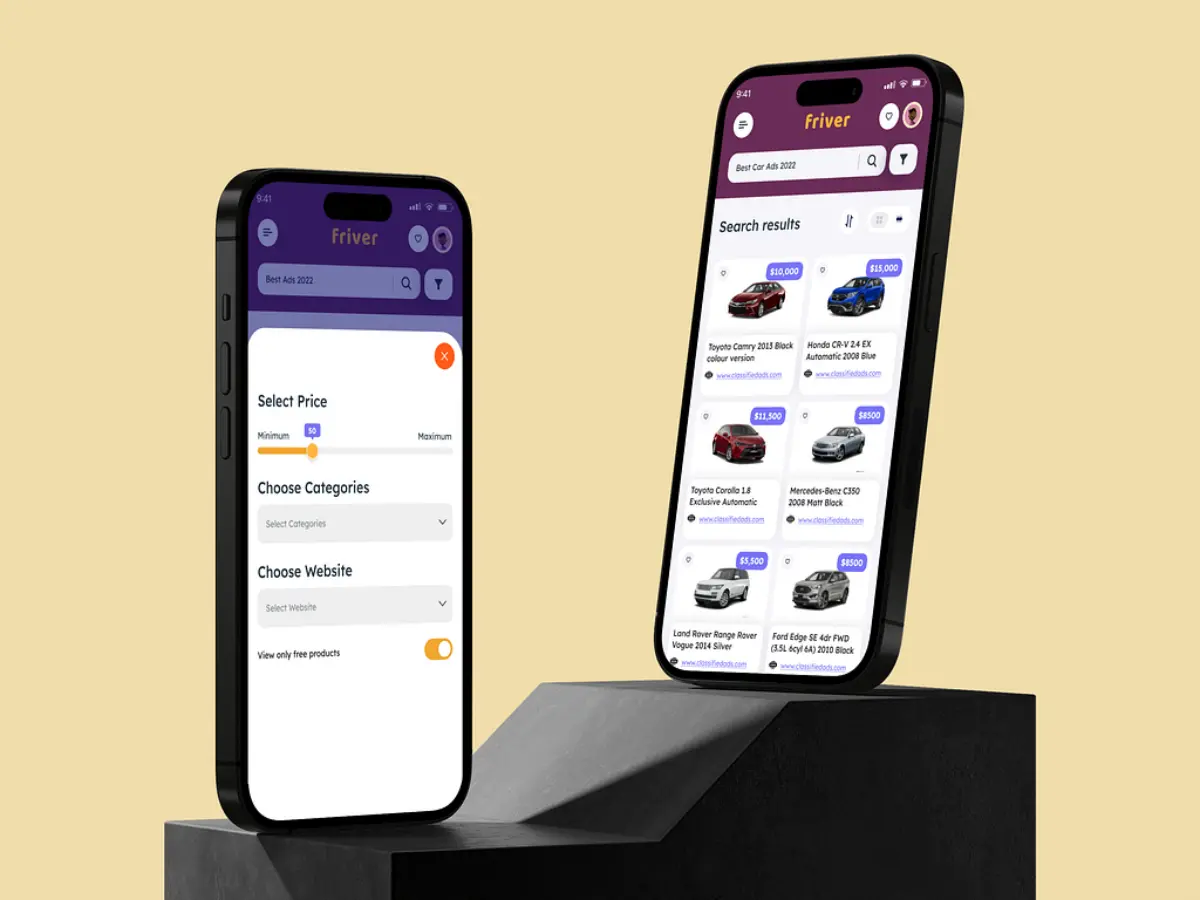

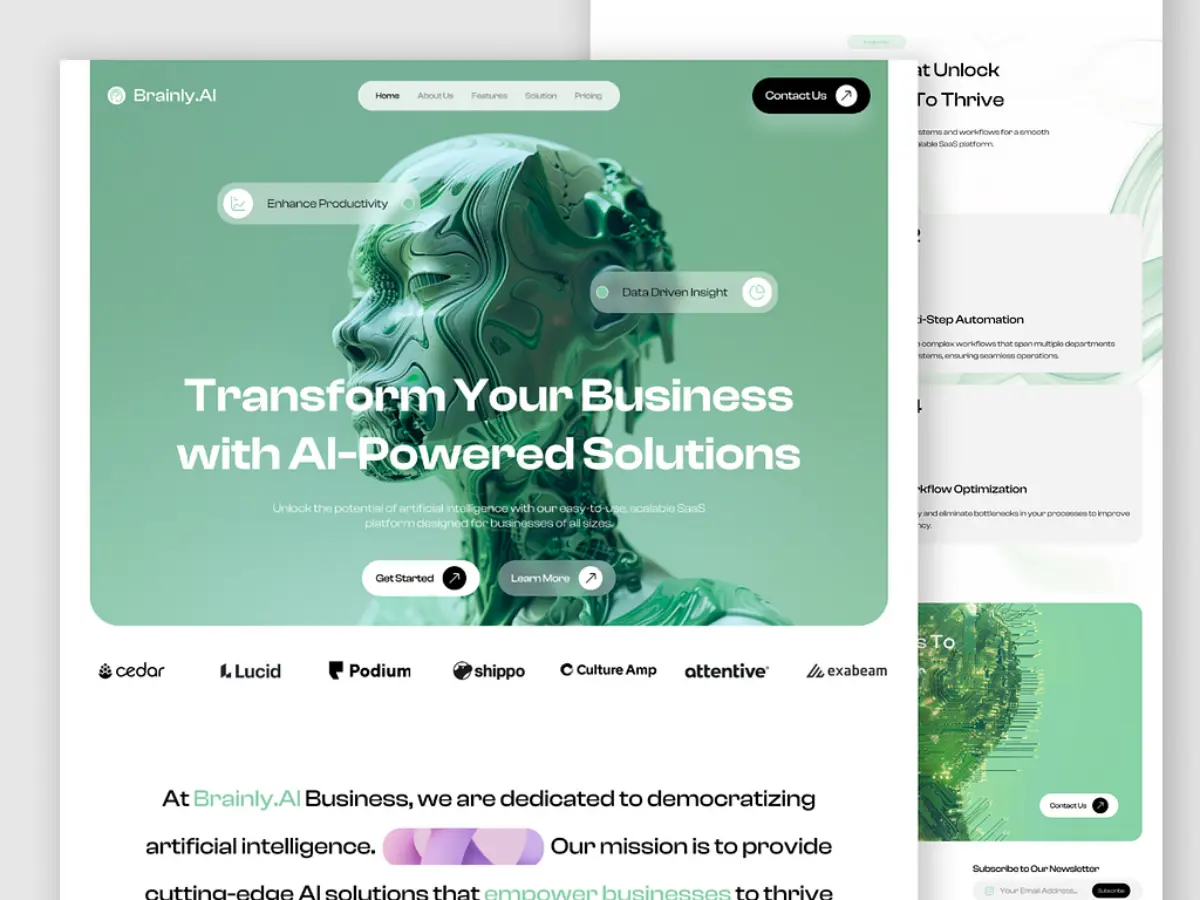

How to develop a money transfer app

Online Banking Services

Traditional banking is rapidly evolving, and no one understands this better than the banking sector. As they compete in the digital sphere, banks are embracing trends and offering P2P services. Examples of these bank-centric apps include Zelle and Dwolla. By adopting digital solutions, banks aim to retain their customer base and appeal to tech-savvy users who prefer online transactions over conventional banking methods.

IV. Must-Have Features of a Money Transfer App

A money transfer or P2P payment app allows users to make payments to others without using a bank or credit card. It also allows users to conduct banking transactions without cash methods and exchange currency. These apps offer a range of features beneficial for both businesses and consumers, making them an essential tool for modern financial management.

Wallets

An e-wallet provides users with a secure place to store funds and bank information within the app, allowing for seamless transactions. This feature is crucial for ensuring that users can manage their finances efficiently and confidently, knowing their data is protected.

Bill Payments

An essential feature of a customer-centric money transfer app is the ability to handle phone top-ups, utility bill payments, and more with just a few taps. Adding invoice scanning can make your app even more appealing to users, offering an advantage and establishing a strong base for future expansion.

Expense Tracking

This feature adds significant value by helping users manage their finances more effectively. By visualizing and grouping transactions by volume, status, location, etc., users can gain insights into their spending habits and optimize their financial strategies. Improved user experience and financial transparency are key benefits of this feature.

Create a money transfer app

International Remittance

Remove boundaries for your users by allowing them to transfer money abroad or receive international transfers in minutes, without delays and high fees. This feature is especially valuable for users with family or business connections overseas, providing a reliable and cost-effective solution for international transactions.

Currency Exchange

Enable users to send, receive, and exchange different currencies between their accounts. This versatility is crucial for users who conduct transactions across borders, offering them the flexibility to manage multiple currencies within a single platform.

Online ID Checks

Online ID checks protect both the sender and receiver from fraud, ensuring secure and trustworthy transactions. They offer convenience by eliminating the need for in-person meetings or exchanging phone numbers, making them a vital feature for maintaining user security and peace of mind.

Multilingual Interface

While a single language interface might be sufficient initially, incorporating multiple languages can expedite product growth and expand your reach worldwide. This feature is essential for startups aiming to capture a diverse user base and enhance global accessibility.

Customer Support

A robust support system typically includes live chat, email, or phone support, with online chats often providing the quickest assistance. Ensuring fast and effective customer support is crucial for maintaining user satisfaction and fostering trust in your app’s reliability.

V. Steps on How to Create a Money Transfer App

When you decide to create your own custom money transfer app, starting with a Minimum Viable Product (MVP) is advisable. An MVP is a basic version of the product featuring only essential functions. It’s an excellent choice for entrepreneurs aiming to test their ideas in the market with minimal budget constraints.

Follow these steps to create a money transfer app:

Step 1: Formulate Your Idea and Conduct Market Research

The initial step in creating a successful money transfer app is to have a clear idea and define your main goals. Conduct market research to understand your target audience’s needs and preferences. Analyze your competitors to find gaps that your app can address.

Step 2: Identify Core MVP Functions

Select the core functions once you have a clear idea of your app’s purpose. Consider features like account management, basic money transactions, and transfer tracking. This will help you build a roadmap for the development process.

Step 3: Design the App

Design plays a crucial role in user experience and engagement. Collaborate with professional UI/UX designers to create a visually appealing and user-friendly interface. Designers will start with a mind map and wireframes to ensure the design meets your requirements, then turn these into live clickable prototypes.

Develop a money transfer app

Step 4: Develop Your App

This stage involves the actual software development, comprising the backend and frontend. The backend manages data, handles transactions, and ensures security, while the frontend focuses on the user interface. Developers turn design prototypes into a functional app with user-friendly navigation.

During this phase, you’ll encounter the capabilities and limitations of your chosen tech stack. It’s not just about enhancing quality but also reducing costs. For instance, using React Native allows developers to create apps for iOS and Android simultaneously, saving time and resources while focusing on business needs.

Step 5: Ensure Security

Security is crucial when handling financial transactions. Encryption protects data transmission between the app and server. Multi-factor authentication is incorporated, and user access is managed carefully. Access is restricted based on roles to prevent unauthorized access to sensitive functions. Compliance with regulations like AML and KYC is also crucial.

Assess your app’s security and potential vulnerabilities regularly. A clear incident response plan will prepare you to protect users’ money effectively.

Step 6: Integrate Third-Party APIs

External services can enhance your app’s functionality. Beyond simple money transfers, users can perform tasks like currency exchange and bill payments. APIs act as bridges between the app and external services, enabling structured data and instruction exchanges.

Consider APIs for:

- Utility and payments

- KYC/eKYC process automation

- International transfers

- Currency exchange

- Card payments

Integrating these APIs can give your app a competitive edge and lay a solid foundation for future growth. As the app becomes more popular, APIs enable scalability without compromising performance, efficiently handling increased transactions and interactions.

Step 7: Conduct Thorough Testing

Set aside time for comprehensive testing to ensure smooth functionality without bugs. Test compatibility across different devices and operating systems. This is crucial for a money transfer app, as users are concerned about security, and even minor issues could impact the app’s reputation.

Step 8: Release Your MVP

Once testing is complete and the app is ready, release it to the market. Publish it on platforms like the App Store and Google Play, and promote it through social media and other marketing channels.

Step 9: Manage Post-Release Support

The launch is not the final step. Continue to address issues, fix bugs, and add new features as needed. Listen to user feedback and keep updating and improving the app.

You now have a comprehensive guide to creating a money transfer app and understanding the nuances involved. Let’s explore the app’s main benefits for users.

VI. Latest Trends in Money Transfer App Development

If you’re thinking about creating your own money transfer app, it’s important to know the key trends in the fintech world. This will help you suggest cool features to your development team.

Going Contactless

Contactless payments are now part of everyday life, thanks to Near-Field Communication (NFC) technology speeding up transactions. Just tap your phone on the terminal, and you’re done. Plus, it keeps your PIN safe from prying eyes.

Making Payments Through Messaging Apps

Sending and receiving money while chatting with friends and family has become super convenient. Usually, we had to switch apps to split bills or pitch in for gifts. Now, messaging apps are starting to add money transfer options. For example, people in China use WeChat for banking, and Facebook Pay is available in some countries outside the US.

Using Mobile Wallets

Digital wallets let you make quick and secure payments with a simple tap. They also make managing money easier by showing transaction histories, categorizing expenses, and providing useful stats.

Paying with Smart Speakers

Smart speakers are becoming a handy way to handle finances. You don’t have to pick up your phone or open your laptop—simply ask your speaker to move money, settle bills, or check your account balance.

Conclusion

Money transfer apps are transforming how we handle finances. With growing demand and the push for financial inclusion, these apps are more important than ever. The opportunity for growth in this area is huge, making it a smart move for businesses looking to innovate.

If you’re thinking about creating one and still not sure how to create a money transfer app, TECHVIFY is ready to help. Our team will guide you through each step, ensuring your app is secure, easy to use, and packed with the latest features.

Get in touch with TECHVIFY today to bring your idea to life and lead the way in the fintech world. Let us provide you with the best development services.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666