How to Start a Neobank in 8 Steps: A Quick Guide

- TECHVIFY Team

- 0 Comments

The surge in fintech funding has unlocked a new era for neobanks—digital-only financial companies revolutionizing traditional banking with innovation and agility. Unlike their brick-and-mortar counterparts, which often charge higher fees and struggle with customer engagement, neobanks offer cost-effective, tech-driven solutions that redefine convenience.

If you’re wondering how to start a neobank that stands out, or even how to create a neobank from scratch, you’re in the right place. Let’s explore why starting a neobank is a smart move, what features you need to thrive in this competitive space, and how to ensure your venture succeeds.

I. Why Start a Neobank Now? Market Overview

The numbers speak for themselves—neobanks are not just a trend; they’re the future. By 2025, over 80 million Americans are projected to use neobanks, while the European market is expected to grow by an impressive 53% from 2022 to 2025. Their appeal lies in offering seamless, cost-effective services without withdrawal fees or monthly charges.

Neobanks excel at serving tech-savvy users who value agility, innovation, and superior customer experiences. Established players like Chime and N26 have paved the way, but emerging neobanks are rapidly carving out niches, catering to specialized demographics such as freelancers, immigrants, and small businesses.

If you’ve identified a unique market need, the time to act is now. Starting smart with thorough research and audience discovery ensures you can build a neobank on a strong foundation.

Build a neobank

II. What to Pay Attention Before Building a Neobank

Learning how to start a neobank involves more than innovative features—it requires navigating stringent regulations and technological challenges. Here are the key considerations for how to start a neobank successfully:

1. Regulatory Compliance

Neobanks must adhere to financial industry standards, including:

- Anti-Money Laundering (AML): Ensures your platform isn’t used for illicit activities.

- Know Your Customer (KYC): Verifies user identities to maintain transparency.

- GDPR Compliance: Protects user data and privacy in the European market.

- PCI DSS: Ensures secure handling of card payment information.

Additionally, while a banking license isn’t mandatory, it’s a valuable asset that enhances trust and credibility, allowing you to attract deposits and process payments.

2. Robust Security

Neobanks handle sensitive financial data, making security a top priority. Your app must be resilient against fraud, capable of high-load operations, and designed to safeguard user information.

3. Technical Infrastructure

A scalable, interoperable tech stack is crucial when considering how to build a neobank that can grow with user demands. For example:

- Use React Native for cross-platform app development, enabling you to launch on iOS and Android simultaneously.

- Implement high-performance frameworks to handle real-time transactions and ensure seamless user experiences.

III. How to Start a Neobank from Scratch: 8 Steps and Expert Tips from TECHVIFY

Here are 8 steps to guide you through how to start a neobank from scratch.

How to start a neobank

1. Choose Your Tech Stack Early

A well-thought-out tech stack prevents unnecessary rework and ensures efficient use of resources. Flexibility and scalability are key, especially as the financial industry evolves. Early decisions on tech choices enable smoother updates and a seamless user experience.

TECHVIFY Tip

Start defining your tech stack during the MVP phase to avoid managing multiple codebases. Review BaaS providers for quality, security, and adaptability, as their SDKs and APIs can significantly streamline development.

2. Evaluate BaaS Providers

Banking-as-a-Service platforms simplify essential functions like payments, compliance, and security—key aspects of how to create a neobank. Their APIs enable customized financial products, saving time and resources.

TECHVIFY Tip

Focus on clear app feature definitions when selecting a BaaS provider. Assess SDKs, APIs, and security measures, and request live demos to ensure suitability. Opt for providers offering flexibility and robust customization options to avoid future roadblocks.

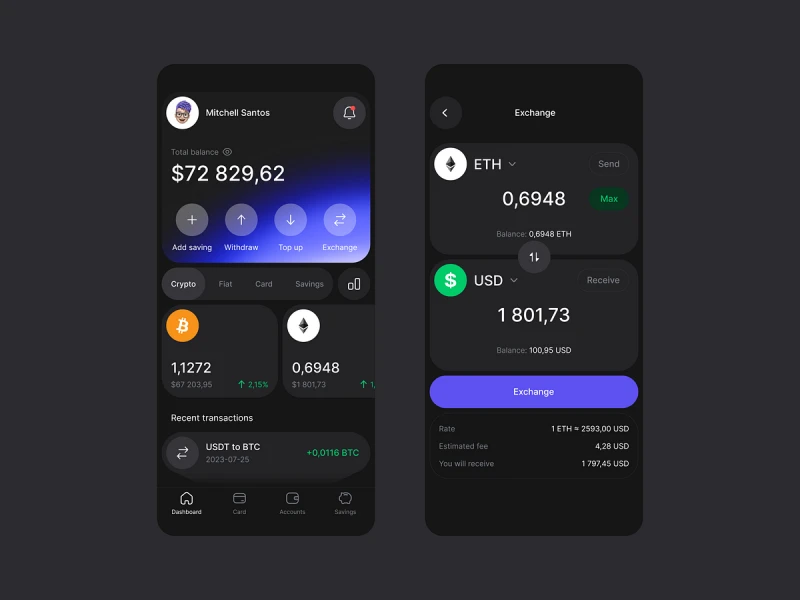

3. Develop a Customer-Centric Mobile App

A seamless mobile app experience is critical, as customers expect end-to-end banking services at their fingertips. Essential features include account management, budgeting tools, real-time notifications, and chat support.

TECHVIFY Tip

Quick prototyping helps fine-tune UI/UX for your target audience. Build core frameworks from scratch for added security, or, if using third-party libraries, ensure they meet industry standards and are sourced from reputable vendors.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

4. Prioritize Compliance and Security

Compliance and security are fundamental, particularly when handling sensitive financial data. While many neobanks partner with regulated institutions, obtaining your own banking license can enhance credibility.

TECHVIFY Tip

Whether working with a partner or pursuing full licensing, build compliance into your app through features like identity verification and fraud detection. Partner with tech experts experienced in navigating regulatory certifications to streamline the process.

5. Build a Robust Infrastructure

A hybrid cloud infrastructure is ideal for neobanks, offering agility, security, and scalability—foundational elements for how to build a neobank. This setup uses public clouds for integration and private clouds for service development.

TECHVIFY Tip

Choose a backend tech stack that aligns with your project’s size, complexity, and goals. Document internal procedures and SLAs early to ensure smooth scaling once the neobank goes live.

6. Think Customer-Centricity in Strategy

Customer-centricity isn’t a one-time step—it’s a continuous effort woven into every aspect of your strategy. In a competitive and innovation-driven neobanking market, aligning with customer needs is key to sustainable growth. When done right, this approach not only satisfies customers but also accelerates returns for investors by offering resilient, innovation-proof features.

TECHVIFY Tip

Focus on four core customer needs:

- Payments – Enable seamless transactions between individuals or businesses.

- Credit – Provide flexible options for borrowing funds.

- Investment – Offer tools to help users grow their wealth.

- Financial Insights – Leverage data to deliver actionable advice for optimal money management.

By centering your product on the first three needs and using them as a foundation for insights, you’ll create a truly customer-first neobank. Research also shows that customer-centric companies outperform their competitors by 60% in profitability.

7. Make Your Design an Extension of Your Product

An app’s design should encourage users to engage confidently, not shy away. While there’s no single formula for flawless app design, simplicity and user-friendliness are critical. Every element, from fonts to colors, should reinforce trust and ease of use.

TECHVIFY Tip

Embrace minimalism and focus on personalization to elevate customer loyalty. Use analytics, such as transaction history or location, to tailor user experiences. Also, prioritize convenience by offering biometric authentication and digital signatures instead of traditional methods. A fast, secure onboarding process sets the tone for an excellent user journey.

8. Test and Deploy Your Neobank

Before launch, rigorous testing ensures your platform’s stability, security, and usability. Combine automated and manual tests to address potential bugs and verify performance across devices and operating systems.

TECHVIFY Tip

Conduct comprehensive security testing to guard against vulnerabilities and breaches when planning how to start a neobank. Plan a staged deployment starting with beta testing, where limited users can provide feedback. Address any issues before proceeding with the full launch and maintain post-deployment monitoring to refine the experience continuously.

IV. Must-Have Features in A Neobank

Neobanks today cater to both specialized target audiences and the broader market, offering a mix of essential features and innovative solutions. If you’re interested in how to start your own neobank, it’s important to consider both the core functions required for a solid banking application and the optional features that can set your platform apart.

Features needed to build a neobank

Must-Have Features for Neobanks

To stay competitive in the fintech space, understanding how to create a neobank with core features is essential to meeting user expectations. Here’s a breakdown of the must-have features for neobanks:

- Sign Up/Sign In: A simple, quick registration process that allows users to easily create and access their accounts.

- Biometrics: Secure and convenient biometric authentication for faster and safer access.

- KYC (Know Your Customer): Ensuring compliance by verifying user identities through KYC processes.

- Home Page: An intuitive and user-friendly home screen that allows easy access to essential features.

- Checking (Spending) Account: A core account for everyday transactions.

- Saving Account: An account designed for saving money with better interest rates or other benefits.

- Debit Card: A linked card for instant payments and withdrawals.

- Block/Unblock Card: The ability to instantly block or unblock the debit card for security purposes.

- Change PIN: A feature that allows users to change their PIN for added security.

- Report Card Lost: An easy way to report a lost or stolen card and get it replaced.

- Support: 24/7 customer support for troubleshooting and guidance.

Features That Help Your Neobanks Stand Out

While the basic features are necessary, some unique features can help differentiate your neobank and attract more customers.

- Cross-Border Payments, Including Crypto: Enable international payments, including cryptocurrency transfers, to tap into a global market. This not only boosts growth for businesses but also provides users with more flexibility and access to international markets.

- Budgeting Assistance: Help users manage their finances by offering personalized budgeting tools and tips. This promotes financial literacy and adds more value to the user experience.

- Payments Through QR Codes: As QR code payments continue to rise, offering this feature allows businesses to reach customers in new ways while making payments more accessible and user-friendly for customers.

- Micro-Investment: Cater to younger generations, like Gen Z, by offering micro-investment options. This enables users to invest small amounts of money, making it easier to get started with investing without a large upfront commitment.

- Impact Score: Appeal to environmentally conscious users by offering features that track their financial impact on the planet. For example, tracking users’ climate impact based on their expenses and investments can differentiate your neobank in the sustainability space.

V. Challenges You May Face When Building Your Neobank

Before diving into creating your own neobank, there are several crucial factors to consider. Let’s take a look at a few challenges and how to solve them to ensure you’re setting yourself up for success.

1. Overcoming Regulatory Challenges

Navigating the complex world of regulations is one of the most significant hurdles when learning how to start a neobank. Before launching, obtaining the right licenses is essential, but the process can be both time-consuming and intricate. Each jurisdiction has its own set of requirements, and adhering to them is critical for legal operation. Laws like the Truth in Lending Act (TILA) in the U.S. mandate transparency in service offerings, ensuring consumer protection.

Solution:

- Work with legal professionals who specialize in financial regulations to streamline the process.

- Embed compliance features like identity verification and anti-money laundering (AML) mechanisms from the outset to ensure long-term adherence.

2. Building a Strong Technological Backbone

A robust technological infrastructure is vital for the success of a neobank. The foundation must support seamless transactions, data management, and secure connections to payment gateways. Effective API integration is key to linking various services, from fraud detection to financial operations. As the neobank scales, the system architecture must be flexible enough to handle growing user demands.

Solution:

- Adopt modular architecture, such as microservices, which enables scalability and easy integration of new features.

- Prioritize security through encryption, multi-factor authentication, and other safeguards to protect user data.

3. Safeguarding Data Security and Privacy

Data security is a top priority for neobanks, given the sensitive information they handle. With cyberattacks on the rise, it’s crucial to implement measures that protect customer data from breaches, which can lead to financial losses and damage to the brand’s reputation. Compliance with regulations like GDPR in Europe ensures the secure handling of personal data and mitigates risks.

Solution:

- Set up a Security Operations Center (SOC) to monitor systems, detect vulnerabilities, and respond quickly to incidents.

- Conduct regular security audits to identify weaknesses and ensure compliance with industry standards.

4. Crafting an Exceptional Customer Experience

In the competitive world of neobanking, offering an outstanding customer experience can set a brand apart. Customers expect a seamless, user-friendly interface, fast transactions, and responsive customer service. A well-designed app can significantly boost satisfaction, while personalized services, based on data insights, foster long-term loyalty.

Solution:

- Invest in user-centered design to create intuitive and efficient interfaces.

- Offer multi-channel customer support and leverage data analytics for tailored services that improve engagement and satisfaction.

5. Securing Sufficient Funding

One of the greatest challenges for neobanks is securing the financial resources necessary for growth. Building a strong platform, meeting regulatory requirements, and executing effective marketing campaigns all require substantial capital. Many neobanks turn to venture capital for early-stage funding, but to attract investors, a compelling business model and clear growth strategy are vital.

Solution:

- Develop a comprehensive business plan that highlights the neobank’s unique value proposition, target market, and revenue strategy.

- Explore diverse funding options, including crowdfunding or strategic partnerships with established financial institutions, to ensure long-term sustainability.

Conclusion

The neobank landscape is evolving rapidly, offering an exciting opportunity for entrepreneurs to disrupt the traditional banking industry with tech-driven solutions that meet modern consumer needs. With the right approach—combining the must-have features, standout differentiators, and a customer-centric strategy—your neobank can not only compete but thrive in this dynamic market. However, successful implementation requires a solid tech stack, regulatory compliance, robust security, and a commitment to continuous innovation.

At TECHVIFY, we specialize in delivering tailored consultation and development services to help you create a secure, user-friendly, and future-ready platform. Let us help you transform your vision into reality. Contact us today for a free consultation and explore how our expertise can support your neobank journey. Your success is just a conversation away!

TECHVIFY – Global AI & Software Solutions Company

For MVPs and Market Leaders: TECHVIFY prioritizes results, not just deliverables. Reduce time to market & see ROI early with high-performing Teams & Software Solutions.

- Email: [email protected]

- Phone: (+84)24.77762.666