IoT in Banking: Unlocking New Opportunities for Digital Transformation

- TECHVIFY Team

- 0 Comments

The banking industry is always on the lookout for innovative ways to expand and evolve. There are several critical trends poised to reshape the sector in the years ahead, and one of the most impactful is the Internet of Things (IoT). No longer just a futuristic concept, IoT is now at the core of the financial industry’s shift toward comprehensive digital transformation.

The market for IoT in banking and financial services is projected to grow by 50.10% between 2023 and 2030. In today’s world, staying technologically relevant is essential for banks to thrive. Without embracing these innovations, financial institutions may struggle to keep up with market demands. Let’s explore the distinct advantages and real-life applications of IoT in financial services.

I. Revisit The Definition of IoT in Banking

IoT in the banking sector refers to an interconnected network of smart devices that collect and transmit data to enhance banking services. These devices—such as smartphones, digital doorbells, and fitness trackers—are often in close proximity to consumers, giving IoT an unparalleled ability to capture human activity in real-time. The data collected is highly contextual, offering banks a clearer picture of customer behavior.

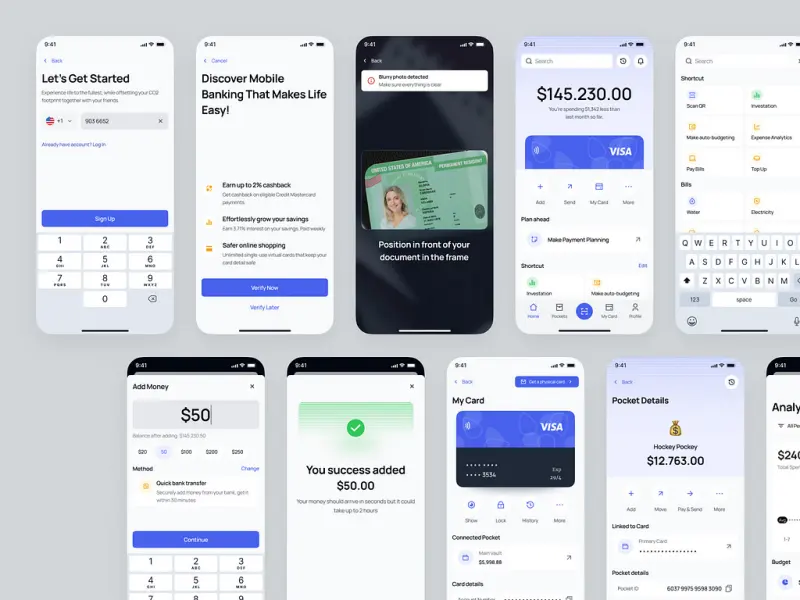

Internet of things in banking industry

For example, consider a fitness tracker. The device monitors your physical condition—tracking metrics like heart rate, blood pressure, and body temperature. As you engage in physical activity, the sensor converts your movements into digital data, which can then guide you toward improving your fitness routine. Similarly, IoT devices can track customer behavior in the banking world, allowing institutions to refine and enhance their services. IoT creates a bridge between banks and their customers by offering real-time, data-driven insights.

Find out more insights about the Banking, Financial Services, and Insurance industry:

II. Benefits of IoT in Banking

Transforming Branch Banking

Bank branches are traditionally where customers go for face-to-face assistance, but with the rise of digital and mobile banking, in-person transactions have steadily declined. That said, physical branches are far from becoming obsolete. In fact, the introduction of smart branches has significantly boosted the convenience of banking services.

Smart branches are equipped with IoT-enabled systems that can handle customer requests without the need for staff. Typically located in remote or less profitable areas, these branches are connected to a centralized hub that manages customer interactions through virtual assistants. With advanced biometric technology, customers can access their accounts with just a fingerprint and perform transactions remotely. They can also speak to a bank representative via video conferencing if necessary. The integration of IoT into branch banking makes it possible for customers to receive seamless, efficient service, even in hard-to-reach areas.

Elevating the Customer Experience

The banking industry is increasingly focused on enhancing the customer experience, especially in the digital realm. Younger demographics, including Millennials and Gen Z, expect modern, convenient banking services, and they are quick to switch providers if their expectations aren’t met.

IoT plays a vital role in meeting these expectations, enabling banks to offer services that are accessible anytime and anywhere. Whether it’s through online banking apps or smart branches, customers can enjoy a hassle-free experience without long queues or excessive paperwork. Moreover, IoT allows banks to gather data on customer behavior, such as how often they use ATMs, visit branches, or interact with digital services. This data can then be used to create personalized offers and services, ultimately boosting customer satisfaction and loyalty.

Enhancing Security and Fraud Prevention

Security is an ongoing concern for banks, and IoT provides advanced tools to protect both physical and digital assets. By leveraging IoT-enabled devices such as surveillance cameras, biometric scanners, and smart alarm systems, banks can create a highly secure environment that operates around the clock.

The interconnected nature of IoT devices allows for remote monitoring and quick responses in case of security breaches. Should an incident occur, security teams can immediately lock down the affected branch or take other preventive measures to stop fraud before it escalates. Additionally, IoT can assist with asset management, allowing banks to track and evaluate their equipment and other resources in real time. This real-time data enhances risk management and helps banks make more informed decisions.

Example of IoT in banking

Streamlining Business Processes Through Automation

Automation is one of the most transformative benefits IoT brings to the banking industry. By using IoT-powered software, banks can automate repetitive tasks like data entry, payment processing, and account management, allowing employees to concentrate on higher-value tasks.

The advantages of automation are clear:

- Increased Efficiency: More tasks can be completed in less time, improving overall productivity.

- Enhanced Customer Support: Automated systems can provide 24/7 assistance, ensuring customers get the help they need, whenever they need it.

- Improved Compliance: Automated tools can deliver accurate and timely data, helping banks stay compliant with regulatory requirements.

IoT also enables the automation of more complex operations, such as loan processing or the transfer of ownership for assets. With IoT, loans can be approved almost instantly, and collateral can be monitored remotely, reducing the need for physical inspections.

Real-Time Monitoring and Insights

One of the greatest advantages of IoT is its capability to gather and process data instantly. Whether it’s tracking customer wait times in a branch or sending real-time account balance alerts, IoT ensures banks stay connected to their customers’ needs 24/7.

Another powerful application of real-time data is fraud detection. IoT-enabled systems can analyze transaction details before they are processed, identifying any potential discrepancies. If a transaction appears suspicious, it can be flagged for further investigation, reducing the risk of fraud and ensuring a higher level of service accuracy.

Advanced Analytics for Deeper Customer Understanding

IoT devices generate a wealth of data, and banks are increasingly using this information to gain deeper insights into customer behavior. By analyzing data from smartphones, apps, and other digital platforms, banks can build comprehensive customer profiles that consider everything from spending habits to personal preferences.

These insights allow banks to offer highly personalized services and products, from tailored financial advice to customized budget plans. By leveraging IoT analytics, banks can better keep current clients and bring in new ones by delivering solutions that precisely meet their needs.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

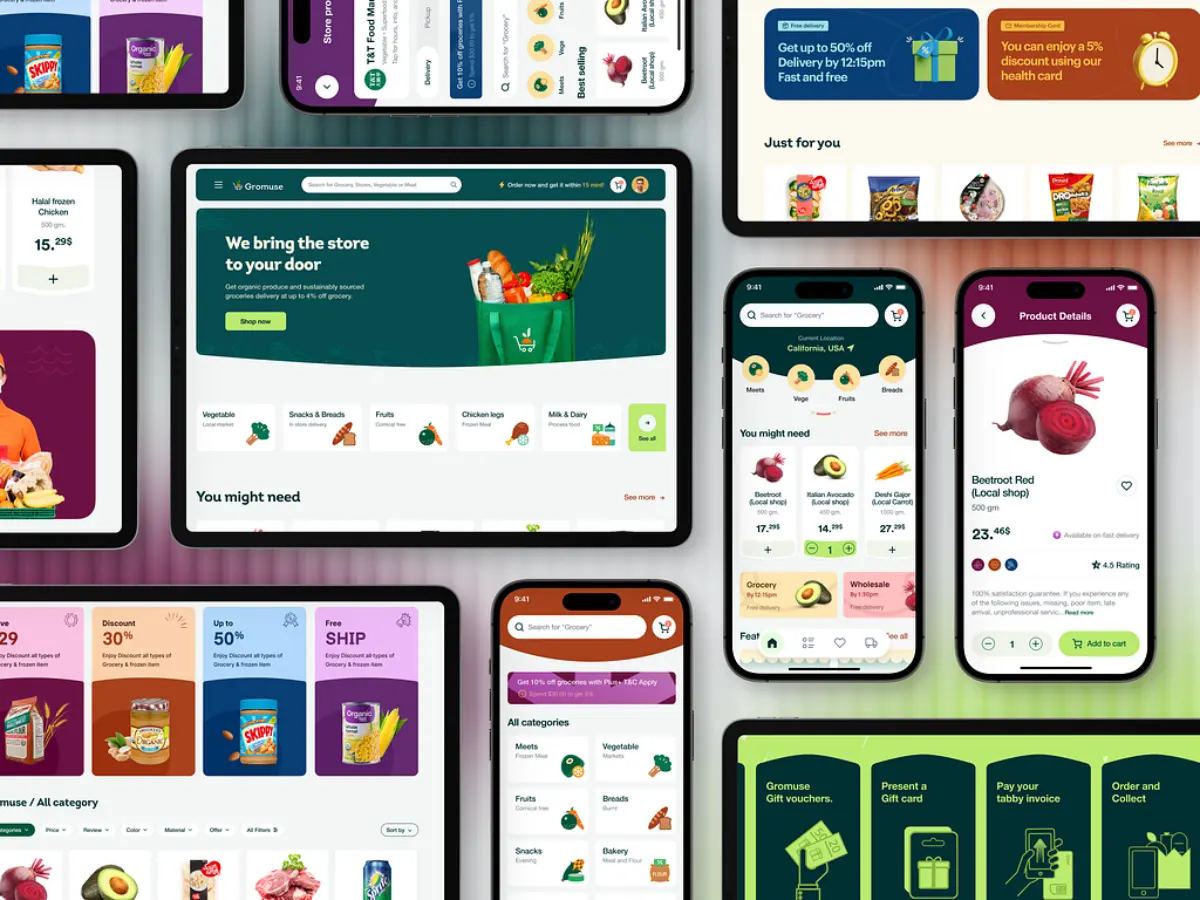

III. Discover the Modern IoT in Banking Use Cases

New Experience with The Smart Branch

A Smart Branch integrates digital tools into physical locations to create a more personalized banking environment. IoT, artificial intelligence, and data analytics enhance the customer experience by improving service efficiency and branch layout.

One major issue at traditional branches is the teller counter, where long lines form, creating congestion. IoT technology can analyze customer walk paths and suggest better layouts to reduce bottlenecks. Self-service kiosks and smart ATMs further reduce the need for human tellers, cutting down wait times. Interactive displays can guide customers based on their needs, while smart branches become “experience hubs,” blending design and technology for a smoother banking visit. Some banks are even experimenting with adding coffee shops to their branches for an added customer touch.

Real-Time Risk Assessment with Smart Insurance

Traditionally, auto insurance relied on static factors like age and driving record. IoT changes this by offering real-time data, such as driving habits, allowing insurers to create more accurate risk profiles. Sensors can track speed, braking patterns, and vehicle conditions, improving offerings for low-risk drivers.

This approach extends to other insurance types, like home and health. Data from smart devices like thermostats or wearables can help insurers adjust premiums based on real-time behavior. The use of IoT in insurance makes risk assessment more dynamic and tailored to individual clients.

Connected Customer Service: Enhancing Engagement

IoT is revolutionizing customer service by enabling banks to interact with clients through multiple digital channels. Personalized alerts, financial advice via apps, and automated voice assistants enhance customer satisfaction. Chatbots with natural language processing (NLP) handle routine queries, allowing human reps to focus on complex cases, which speeds up issue resolution.

Seamless, IoT-powered communication ensures customers receive efficient support without leaving their homes, improving both service quality and response times.

Blockchain-Based Smart Contracts: Secure and Automated Transactions

IoT integrates well with smart contracts—self-executing agreements stored on a blockchain. Blockchain ensures secure, transparent transactions, as all actions are recorded publicly and immutably.

IoT devices can trigger smart contracts based on real-world conditions. For instance, a weather sensor could activate an insurance contract if snowfall is detected, or smart locks could grant access to a property based on a rental agreement. The combination of IoT and blockchain offers enhanced security and speed, particularly for international transactions.

IoT in banking

Biometric Authentication: Strengthening Security

Biometric authentication is increasingly used to reduce fraud and enhance banking security. IoT devices collect and analyze biometric data—such as fingerprints, facial recognition, or voice ID—to verify users. This sophisticated authentication technique provides an additional security layer, reducing the risk of unauthorized access to accounts.

Wearable Devices: The Future of Convenient Banking

Wearable devices, like smartwatches, are transforming how customers interact with banks. With biometric authentication, payments can be made securely using a fingerprint or voice command, eliminating the need to expose sensitive account details.

IoT also enables real-time alerts for spending limits and provides personalized financial advice. Wearables remove the barriers of in-person transactions, allowing customers to engage with their bank from virtually anywhere.

IV. Challenges of Implementing IoT in Banking

According to research from Academia.edu, a major open repository of academic articles, banks face several hurdles when implementing IoT technologies. These include security concerns, regulatory issues, and the need for significant investment in both technology and staff training.

Security and Privacy Concerns

Introducing IoT into banking infrastructure brings complex security challenges. IoT devices often become prime targets for cybercriminals due to their connectivity and the sensitive data they handle. In 2017, the Mirai botnet attack exposed the vulnerabilities of IoT devices, highlighting potential risks for sectors like banking if similar devices are compromised.

Banks need to adopt robust security protocols to guard against these threats. Developers must adhere to best practices in IoT design to ensure that customer information remains secure and trust is maintained.

Data Management and Analysis

IoT devices produce vast amounts of data, which present challenges in terms of processing, storage, and analysis. Banks must have the right tools to manage this influx of information effectively.

For example, JPMorgan Chase’s COiN platform uses AI to analyze data from contracts efficiently. While this system shows how banks can leverage technology for data management, extending these capabilities across the broader IoT landscape requires even more sophisticated analytics tools and expertise, presenting a significant challenge for many institutions.

Integration with Existing Systems

Many banks still rely on legacy systems that were never designed to interface with IoT technologies. Integrating IoT solutions into these older infrastructures can be both costly and technically challenging. A similar challenge was seen when banks first attempted to incorporate mobile banking—often considered a precursor to more complex IoT integrations. The process requires substantial changes to existing IT infrastructure, which can be a major barrier to adoption.

IoT in banking industry

Regulatory Compliance

Banks operate under strict regulatory oversight, particularly concerning data protection and privacy. IoT implementations must comply with regulations such as Europe’s General Data Protection Regulation (GDPR), which imposes stringent rules on data handling and privacy. As IoT devices multiply, so do the points of data collection, making compliance more complicated. Banks must ensure that every IoT application adheres to legal standards, which can be a costly and time-consuming process.

V. The Future of IoT in Banking

Despite these challenges, IoT is set to play a pivotal role in the future of banking. Several trends will likely shape the trajectory of IoT in the sector:

Expansion

We can expect the widespread adoption of IoT-enabled devices. Connected cars, advanced smartphones, and wearables will become even more integral to daily life, providing expanded opportunities for IoT-driven banking services. This could lead to the growth of usage-based insurance plans or personalized investment solutions, tailored to individual behavior and needs.

Integration with Other Technologies

IoT will increasingly combine with other emerging technologies like artificial intelligence (AI) and machine learning (ML). These technologies can optimize the data gathered by IoT devices, creating more intelligent and responsive banking systems. Blockchain technology will continue to play a significant role in supporting decentralized autonomous organizations (DAOs) and peer-to-peer lending. Additionally, edge computing could further enhance the speed and security of IoT-driven banking services.

Collaboration Across Industries

The rise of IoT will foster more collaboration within the financial ecosystem. The Smart Finance sector will likely partner with industries like Insurtech and Fintech, as they are already inclined toward technology integration. Fraud detection firms and cybersecurity companies will work closely with banks to address security vulnerabilities. Governments will also play an active role by imposing stricter compliance standards, ensuring that banks use IoT devices ethically and securely.

Conclusion

The banking industry is at a tipping point where embracing IoT will no longer be optional but essential for staying competitive. From transforming branch banking to enhancing security and streamlining business processes, IoT offers numerous opportunities for banks to improve customer service and operational efficiency.

The time to invest in IoT is now, and financial institutions that seize this opportunity will be well-positioned to lead the industry forward.

Ready to take your banking services to the next level? Contact TECHVIFY today for a free consultation on how we can help you implement cutting-edge IoT solutions tailored to your specific needs.

TECHVIFY – Global AI & Software Solutions Company

For MVPs and Market Leaders: TECHVIFY prioritizes results, not just deliverables. Reduce time to market & see ROI early with high-performing Teams & Software Solutions.

- Email: [email protected]

- Phone: (+84)24.77762.666