IoT in Fintech – A Deep Dive into the Future of Banking

- TECHVIFY Team

- 0 Comments

The Banking, Financial Services, and Insurance (BFSI) industry has dramatically evolved from the days of the barter system to the current era of digital money. IoT in Fintech has revolutionized fund transfers, making it possible to conduct transactions without the need for physical cash. While cryptocurrency is gaining attention as a potential alternative to traditional fiat currency, its widespread adoption remains speculative.

The digital revolution in finance can be largely attributed to IoT. This modern technology accelerates operations, enhances service delivery, and improves customer experience within the financial sector.

According to Markets and Markets, the global market for IoT in fintech and banking services is expected to increase from $249.4 million in 2018 to $2,030 million by 2023, achieving an annual growth rate of 52.1% over this period.

In this article, we will explore how IoT in fintech is driving innovation at the intersection of finance and technology.

I. How is IoT impacting the fintech industry?

The use of IoT in finance has introduced concepts like the Bank of Things. IoT provides valuable data that helps banking and insurance institutions improve their services. Integrating IoT into financial services has many benefits. Let’s explore how IoT can transform the system.

Modernizing Bank Branches and ATMs

IoT can transform traditional banks, creating a more connected environment that prioritizes customer value. For example, customers’ account details could be delivered through an IoT-based app or device for real-time service upon entering a branch. Customers can also schedule cash withdrawals from nearby ATMs.

By analyzing data from IoT devices, banks can strategically place ATMs and branches to meet customer demand better.

Analyzing Spending Patterns

While many financial mobile applications inform users about their spending and suggest ways to save money, integrating IoT technology can enhance this process significantly. IoT can help users identify and understand their spending patterns more comprehensively and even assist them in changing these patterns if necessary. This capability goes beyond traditional payment statements, which merely list expenses without offering deeper insights.

Strengthening Fraud Detection

Integrating AI with IoT enhances the security of IoT devices and protects them from cyber threats. AI-powered IoT devices can detect unauthorized attempts to access data, promptly alerting financial institutions to take protective and proactive measures.

For instance, if a cybercriminal tries to make a payment using stolen credentials from an unfamiliar device or location, the system can immediately alert the institution to block the transaction.

Cashless Payments

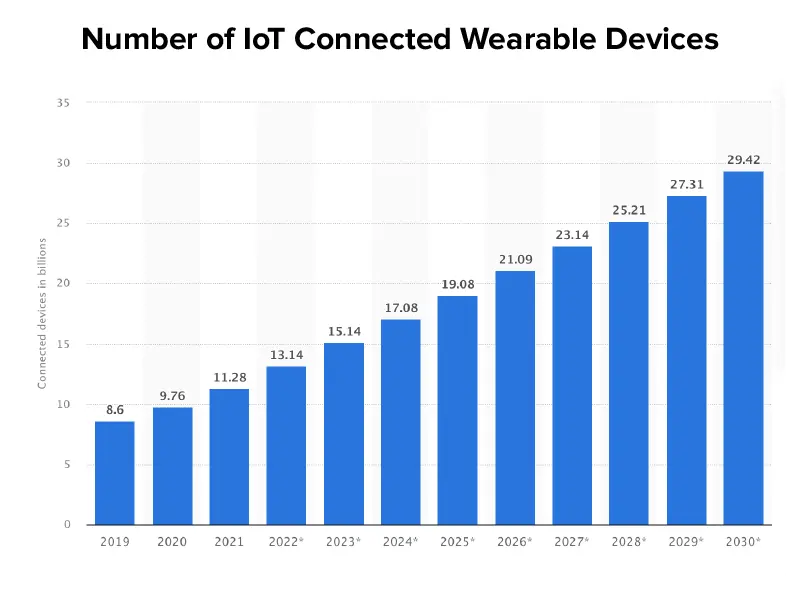

Cash transactions are becoming outdated, and even credit/debit cards are losing relevance. IoT wearable payment systems allow users to pay directly through wristbands, watches, smart clothing, jewelry, or other connected devices. These devices also let users check their credit history and account balances. According to Statista, the global number of IoT-connected devices is anticipated to grow from 8.6 billion in 2019 to 29.42 billion by 2030.

Enhancing Customer Support

With IoT technology, banks can significantly improve personalized customer services. For instance, fintech institutions use AI combined with IoT to offer immediate support. IoT devices like smartphones notify branch managers when customers arrive, enabling automatic assignment to service providers. This enhances customer experience and satisfaction.

Context-aware smart devices also enable financial institutions to optimize customer service. They can send personalized greetings and messages as customers arrive.

Leveraging Voice Technology

The adoption of voice technology has surged since its inception in the IT sector, and fintech companies have found innovative applications for it. For instance, in 2016, Capital One introduced features in Alexa that allowed users to manage sensitive financial data, such as checking credit/debit card balances, viewing pending transactions, and accessing loan information.

Enhancing Risk Assessment for Insurance and Loans

Traditionally, risk assessment in the insurance and loan sectors has been manual. However, the adoption of IoT in fintech has revolutionized this practice.

How does it work?

IoT sensors gather essential data about individuals, which insurance providers utilize to track and analyze habits and patterns related to health, driving, and more. This data allows insurers to identify candidates who qualify for insurance based on their behavior and history.

For example, vehicle insurers can offer customized protection packages by examining data such as average speed, driving behavior, and other relevant factors collected by IoT sensors in and around the vehicle.

Note: These sensors might increase the vehicle’s maintenance costs, which insurers might need to cover.

Find out more insights about Banking, Financial Services, and Insurance industry:

II. Best IoT in Fintech Examples You Have to Know

1. Smart ATMs: Diebold Nixdorf

Diebold Nixdorf is a prominent provider of ATMs and financial services technology. Their smart ATMs are equipped with IoT technology to enhance functionality and customer experience. These ATMs use sensors and connectivity to monitor various aspects of their operation in real-time, such as cash levels, transaction volumes, and machine health. The collected data is transmitted to a central system, enabling predictive maintenance and timely cash restocking, minimizing downtime, and improving service availability.

Features:

- Real-time Monitoring: Continuous tracking of cash levels, transaction volumes, and operational status.

- Predictive Maintenance: Automated alerts for potential issues before they cause downtime based on data analysis.

- Enhanced Security: Incorporation of biometric authentication methods (e.g., fingerprint or facial recognition).

- Integration with Banking Systems: Seamless integration with bank networks for real-time updates and service improvements.

Pros:

- Improved Operational Efficiency: Reduces the frequency of ATM downtime and ensures cash availability.

- Cost Savings: Lowers maintenance costs through predictive maintenance.

- Enhanced Security: Biometric authentication reduces fraud risk.

- Customer Satisfaction: Increased uptime and reliability enhance customer trust and satisfaction.

Cons:

- High Initial Investment: Significant costs associated with deploying IoT-enabled ATMs.

- Cybersecurity Risks: Increased connectivity can expose ATMs to cyber threats.

- Dependence on Connectivity: Requires stable internet connections for optimal functionality.

2. Wearable Payment Devices: Apple Watch

The Apple Watch is a leading example of wearable technology that integrates fintech capabilities, specifically through Apple Pay. This smartwatch allows users to make contactless payments at NFC-enabled terminals. Users can complete purchases without needing a physical wallet or phone by simply holding the Apple Watch near a payment terminal and confirming the transaction. The device also offers real-time transaction notifications, enhancing security and user awareness.

Features:

- Contactless Payments via NFC: Enables quick and seamless payments at compatible terminals.

- Integration with Apple Pay: Securely stores payment information and facilitates transactions.

- Real-time Transaction Notifications: Immediate alerts for every transaction, enhancing security.

- Health and Fitness Tracking: Additional features for health monitoring, adding value beyond payments.

Pros:

- Convenience: Simplifies the payment process, eliminating the need for cash or cards.

- Security: Uses tokenization to protect payment information, reducing fraud risk.

- Speed: Accelerates the checkout process with quick, contactless transactions.

- Versatility: Offers multiple functionalities, including fitness tracking and notifications.

Cons:

- Battery Life: Frequent usage of payment features can drain the battery quickly.

- Loss or Theft Risk: Wearable devices are easier to misplace compared to phones or wallets.

- Compatibility Issues: Not all payment terminals support NFC or Apple Pay.

3. Connected Insurance: Progressive Snapshot

Progressive’s Snapshot program leverages telematics technology to offer usage-based insurance. Drivers install a small device in their vehicles or use a mobile app that tracks driving behavior, including speed, braking patterns, and mileage. Progressive receives this data, allowing the company to customize insurance premiums based on actual driving habits. Safe drivers can earn significant discounts on their insurance premiums, while the company benefits from more accurate risk assessments.

Features:

- Real-time Data Collection: Monitors driving behavior continuously.

- Personalized Premiums: Adjusts insurance rates based on individual driving habits.

- Mobile App Integration: Allows users to track their driving scores and review trips.

- Incentives for Safe Driving: Rewards cautious drivers with discounts.

Pros:

- Fairer Premiums: Rates reflect actual driving behavior, promoting fairness.

- Safety Incentives: Encourages safer driving habits through financial rewards.

- Accurate Risk Assessment: Provides insurers with detailed data to evaluate risk better.

- User Engagement: Drivers can monitor and improve their driving habits.

Cons:

- Privacy Concerns: Continuous tracking can raise issues regarding data privacy.

- High Cost: Initial setup and device costs can be significant.

- Data Interpretation: Potential inaccuracies or misinterpretations of driving data.

4. Smart POS Systems: Square

Square offers advanced Point-of-Sale (POS) systems that utilize IoT technology to provide comprehensive solutions for businesses. These systems are not just for processing payments but also offer features like real-time inventory management, customer analytics, and seamless integration with other business tools. By connecting various components of a retail operation, Square’s smart POS systems help businesses optimize their sales processes and improve customer service.

Features:

- Real-time Inventory Tracking: Automatically updates inventory levels with each transaction.

- CRM Integration: Collects and analyzes customer data to enhance marketing efforts and customer relationship management.

- Multiple Payment Methods: Supports numerous payment methods, including credit and debit cards, contactless payments, and mobile wallets.

- Cloud-based Data Storage: Securely stores transaction and inventory data in the cloud, accessible from anywhere.

- Analytics and Reporting: Provides detailed sales reports and business analytics to help with decision-making.

Pros:

- Enhanced Customer Experience: Faster and more efficient transactions improve customer satisfaction.

- Improved Inventory Management: Real-time tracking helps avoid stockouts and overstock situations.

- Valuable Insights: Detailed analytics support better business decisions and targeted marketing.

- Scalability: Appropriate for enterprises of all sizes, ranging from small shops to large retail chains.

Cons:

- Dependence on Internet Connectivity: Requires a stable internet connection for optimal performance.

- Security Vulnerabilities: Increased risk of cyberattacks due to cloud connectivity.

- Higher Upfront Costs: More expensive than traditional POS systems.

- Learning Curve: May require training for staff to utilize all features fully.

5. Smart Home Banking: Bank of America’s Erica

Bank of America’s Erica is a virtual financial assistant that integrates with smart home devices like Amazon Echo and Google Home, providing a hands-free banking experience. Users can perform various banking tasks through voice commands, such as checking account balances, paying bills, transferring money, and receiving financial advice. Erica leverages artificial intelligence (AI) to offer personalized insights and proactive alerts, enhancing the overall customer experience.

Features:

- Voice-activated Banking Services: Perform banking tasks using simple voice commands.

- Real-time Account Balance Inquiries: Quickly check account balances and recent transactions.

- Payment Processing and Bill Payments: Pay bills and transfer money without needing to access a computer or smartphone.

- Financial Advice and Alerts: Receive personalized financial insights, spending alerts, and reminders.

Pros:

- Convenience: Hands-free banking allows users to multitask and access services effortlessly.

- Accessibility: Beneficial for visually impaired users or those with limited mobility.

- Personalized Assistance: AI-driven insights and alerts help users manage their finances better.

- Quick Access: Fast and straightforward access to essential banking services.

Cons:

- Privacy Concerns: Voice data is recorded and stored, raising privacy issues.

- Limited Functionality: Not all banking services are available through voice commands.

- Security Risks: Potential for unauthorized access if voice recognition security is not robust.

- Dependence on Smart Devices: Requires ownership of compatible smart home devices.

Looking to Outsource Development?

Contact TECHVIFY, Vietnam’s Leading Offshore Software Development & Outsourcing Company, for a consultation and development services.

III. Future of IoT in Financial Services

The outlook for IoT in the BFSI (Banking, Financial Services, and Insurance) sector is exceptionally promising. While IoT has already made significant strides in enhancing efficiency within the finance industry, there is much room for further exploration. Advancements in IoT can lead to the development of robust, interconnected systems that provide enhanced security against information breaches and fraud, addressing various challenges that FinTech companies encounter.

The immense data generated by current and upcoming IoT solutions will be pivotal for the future of the banking industry. Distributed stream computing platforms, which enable real-time analytics and pattern recognition, are set to play a crucial role in this evolution.

According to Markets and Markets, the IoT market in the financial and banking industry is expected to expand by $566.4 billion by 2027.

In essence, IoT will remain a key driver in the advancement of online banking. By 2023-2024, we anticipate a greater adoption of IoT, AI, Blockchain, and other technologies in financial transactions.

As a result, consumers will benefit from more sophisticated and tailored services that cater to their individual needs. The ongoing technological innovations in IoT and fintech will continue to shape the finance industry, necessitating that banking and financial institutions stay proactive to remain competitive.

Learn More On:

IV. Can You Outsource IoT App Development in the Fintech Industry?

The fintech industry is rapidly evolving, driven by advancements in technology and changing consumer expectations. However, developing these sophisticated solutions requires specialized expertise and resources. This is where outsourcing IoT app development becomes a strategic choice for many fintech companies.

Outsourcing offers access to a worldwide talent pool with specialized skills in IoT fintech. Developers with expertise in IoT protocols, security, and data analytics can ensure high-quality and secure applications.

It reduces the need for significant upfront investments in infrastructure and hiring, allowing fintech companies to focus on core business activities while leveraging outsourced resources for development. Experienced outsourcing partners can expedite development, helping companies launch their IoT solutions faster.

Techvify is a renowned outsourcing company specializing in IoT app development for the fintech industry. With a strong focus on innovation and quality, Techvify has established itself as a trusted partner for fintech companies looking to leverage IoT technology.

Key Offerings:

-

Expertise in Internet of Things Fintech:

- Techvify’s team comprises seasoned professionals with deep knowledge of IoT protocols, security standards, and fintech applications.

- Established a history of creating secure, scalable, and high-performance IoT solutions tailored to financial services.

-

Comprehensive Development Services:

- End-to-end IoT app development, including consulting, design, development, testing, and maintenance.

- Custom solutions for various fintech needs include payment processing, fraud detection, customer engagement, and regulatory compliance.

-

Agile Methodologies:

- Agile development practices ensure iterative progress, continuous feedback, and rapid delivery of functional prototypes.

- Emphasis on collaboration and transparency throughout the development lifecycle.

-

State-of-the-art Technology Stack:

- Utilizes the latest IoT platforms, frameworks, and tools to build robust and innovative applications.

- Focus on integrating advanced analytics, machine learning, and AI to enhance IoT functionalities.

-

Client-Centric Approach:

- Dedicated project managers and client support teams ensure seamless communication and project alignment.

- Dedication to understanding client requirements and delivering solutions that drive business value.

Conclusion

The global market for IoT in fintech is booming. It offers benefits such as cashless payments, improved customer support, and real-time data analysis. Successful applications include smart POS systems and home banking solutions.

Outsourcing IoT app development is a strategic move for many companies. As a leading company specializing in this area, TECHVIFY provides comprehensive services, deep expertise, and a client-focused approach. Contact TECHVIFY today to unlock innovation, boost efficiency, and stay ahead of the competition.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666