Mobile Banking Features That Keep Customers Coming Back

- David Ho

- 0 Comments

In recent years, mobile banking apps have transformed into powerful, all-in-one tools for managing finances and beyond. As we move into 2025 and beyond, financial institutions must prioritize listening to modern consumers and delivering on their expectations. Today’s users demand mobile banking features that are not only convenient and accessible but also secure. With fewer people visiting physical bank branches, customers now expect seamless digital solutions that let them check savings, transfer funds, pay bills, and manage digital wallets—all with just a few taps on their smartphones.

To meet these demands and enable users to handle a wide range of banking tasks from anywhere in the world, finance companies need to rethink their approach to software development. Partnering with experts who can build versatile, cutting-edge tools is essential. But before diving into development, the first step is to carefully plan which features to include in the app.

This article serves as your go-to guide for the must-have mobile banking app features that will keep banking apps competitive and future-ready. We’ll explore which functionalities are worth adding to not only meet but exceed customer expectations. Plus, we’ll dive into why these features are in high demand and when it makes sense to introduce them for maximum impact.

Mobile Banking Market Overview

Before we dive deeper, let’s take a quick look at the mobile banking market. It’s no secret that this sector has experienced explosive growth over the past decade, and the momentum isn’t slowing down. In 2020, global mobile banking users hit 2.6 billion, and by 2024, that number is projected to soar past 3.6 billion. With a compound annual growth rate (CAGR) of over 23% and a market value expected to exceed $80 billion, the industry is thriving.

Several factors are driving this growth, including the post-pandemic shift toward smartphone reliance and remote services. Improved internet connectivity and a growing preference for digital banking over traditional methods are also key contributors.

Mobile banking app

Financial institutions are investing heavily in fintech and mobile banking apps, recognizing that every innovative feature of mobile banking plays a crucial role in staying ahead of the competition. In such a fast-paced market, neglecting your digital presence isn’t an option. Continuous innovation is critical to delivering the best user experience and introducing features that go beyond basic money management. But even the most advanced functionalities won’t resonate with users if the overall app experience falls short.

Key Stats to Know

-

87% of consumers use their mobile banking app at least once a month. (Chase)

-

The feature with the biggest increase in usage? Card replacement requests—54% of customers now use it, up 5% from the previous year. (Chase)

-

48% of consumers say mobile devices are their preferred way to manage bank accounts. (American Bankers Association)

-

Mobile banking is most popular among Gen Z (57%) and millennials (60%). (ABA)

-

Households with higher incomes and higher education levels are more likely to use mobile banking as their primary method for accessing accounts. (FDIC)

Why Improving Customer Experience in Mobile Banking Matters

In today’s digital-first world, customer experience is the cornerstone of any successful mobile banking app. Modern users—especially digital natives—expect apps that are easy to navigate, visually intuitive, and tailored to their needs. For financial institutions, delivering a seamless and personalised experience isn’t just a nice-to-have; it’s a must for building customer loyalty and staying competitive.

To truly stand out, banks need to deeply understand their customers—both new and existing—to deliver the best mobile banking app features that enhance user experience and satisfaction. This means diving into their preferences, behaviours, and pain points to create digital solutions that truly resonate. By leveraging advanced technologies like data analytics, banks can craft personalised services that not only engage users but also drive profitability.

For example, features like personalised financial advice, targeted product recommendations, and customised alerts can make users feel valued and supported in their financial journeys. A well-designed app should also make every task—from checking balances to transferring funds—quick and effortless. Information should be easy to find, and transactions should be completed in just a few taps.

But the work doesn’t stop at launch. Continuous usability testing and incorporating customer feedback are key to refining the app over time. By listening to users and iterating on their input, banks can ensure their app stays relevant, user-friendly, and ahead of the curve.

Best Modern Banking App Features

To stand out in today’s competitive and fast-evolving mobile banking market, financial institutions need to offer a robust suite of features that cater to the diverse needs of their customers. Here’s a breakdown of the must-have features for modern banking apps:

1. Security Measures

In an era where cybercrime is on the rise, security is non-negotiable. Customers need to trust that their financial data is safe from threats. Here are the key security features every banking app should include:

-

Two-Factor Authentication (2FA): Adds an extra layer of security by requiring two forms of identification, such as a password and a one-time code sent to the user’s device.

-

Multi-Factor Authentication (MFA): Takes security up a notch by combining multiple verification methods, like passwords, biometrics, and one-time codes, to prevent unauthorised access.

-

Biometric Logins: Lets users log in with fingerprint scans, facial recognition, or voice recognition—offering both convenience and enhanced security.

-

Encryption Protocols: Protects data during transmission and storage using advanced standards like AES and SSL.

-

Fraud Detection: AI-powered tools monitor transactions for suspicious activity and send instant alerts for unusual logins or transactions.

-

Play Integrity API: Detects harmful or unverified app versions to ensure app integrity.

-

Root and Jailbreak Detection: Identifies tampered devices to prevent security breaches.

-

Certificate Pinning: Ensures the app only communicates with trusted servers.

-

Data Confidentiality Features: Combines methods like Keychain Secure Storage and Symmetric Cryptography to protect sensitive information.

-

Request Signing: Verifies the authenticity of requests to prevent tampering and replay attacks.

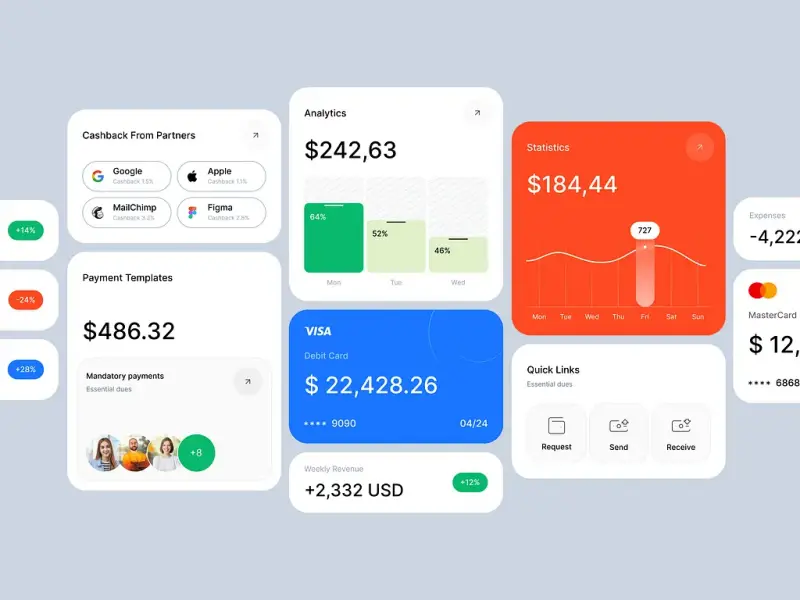

Best mobile banking app features

2. Bank Account Management

A great banking app, equipped with essential mobile banking features, makes managing finances effortless. Essential features include:

-

Account Opening: Allows users to open accounts online with secure authentication.

-

Real-Time Balance Updates: Provides instant access to account balances before and after login.

-

Transaction History: Offers a comprehensive, searchable record of past transactions with advanced filtering and categorisation.

-

Spending Insights: Visual representations of spending patterns help users track expenses and identify saving opportunities.

-

Downloadable Statements: Lets users download statements in PDF or CSV formats for easy record-keeping.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

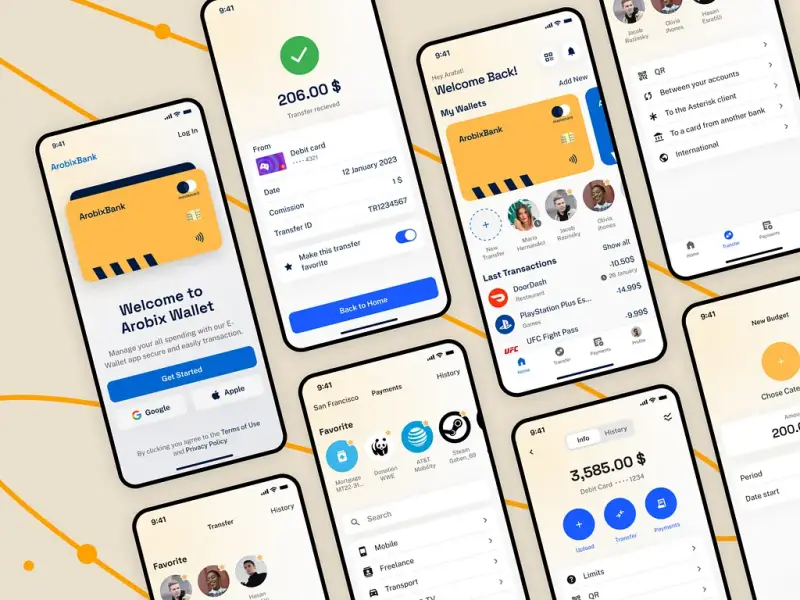

3. Transfers and Payments

Modern banking apps should include mobile banking app features that make sending money quick and hassle-free. Key features include:

-

Peer-to-Peer (P2P) Payments: Enables instant money transfers to friends or family using just a mobile number. Examples like Poland’s BLIK and Sweden’s Swish show how convenient P2P payments can be.

-

QR Code Payments: Lets users make instant payments by scanning QR codes—perfect for bill payments or fund transfers.

-

Digital Wallet Integration: Supports popular wallets like Google Pay and Apple Pay, allowing users to store and manage multiple payment methods in one place.

-

NFC Payments: Enables contactless payments with a simple tap of the phone, making transactions faster and more convenient.

4. Personal Finance Management

Helping users take control of their finances is a game-changer. Key tools include:

-

Budget Tracking: Lets users set spending limits, track income and expenses, and receive alerts when they’re close to exceeding their budget.

-

Spending Analysis: Provides insights into spending habits by categorising expenses and highlighting areas where users can save.

-

Goal Setting: Helps users set and achieve financial goals, whether it’s saving for a holiday, a new car, or an emergency fund.

-

Automated Savings: Uses AI to analyse spending patterns and automatically transfer small amounts into savings accounts.

5. Customer Support

Exceptional customer support is key to a great user experience. Essential features include:

-

Chatbots: AI-powered assistants that provide 24/7 support for common queries and tasks.

-

Live Chat: Connects users with human agents for more complex issues.

-

In-App Appointment Scheduling: Lets users book meetings with bank representatives directly from the app.

-

Omnichannel Support: Ensures consistent support across multiple channels, including chat, phone, email, and social media.

-

Personalisation: Tailors support based on user profiles and past interactions, making customers feel valued and understood.

6. Card Management

Card management features are all about making life easier—and safer—for users. Imagine being able to instantly freeze a lost or stolen card right from your banking app, preventing unauthorised transactions before they happen. Or, if you’ve just misplaced your card, you can temporarily suspend all ATM transactions until you find it.

Other handy features include:

-

Ordering Replacement Cards: Skip the hassle of visiting a branch—order a new card directly from the app.

-

ATM Locator: Find the nearest ATM in seconds.

-

Spending Controls: Set limits on daily spending or disable international transactions for added security.

-

PIN Management: View or update your PIN with ease.

These tools not only enhance security but also give users more control over their finances.

7. Loan and Credit Services

Integrating loan and credit services into your banking app can take it from good to great. Here’s what users are looking for:

-

Loan Applications: Simplify the process with quick, easy-to-follow steps that let users apply for loans in minutes.

-

Credit Score Monitoring: Provide regular updates and tips to help users improve their credit health.

-

Loan Management: Offer clear payment schedules and payoff projections to help users stay on track.

-

Loan Recommendations: Use real-time data to suggest pre-approved loan offers tailored to each user’s financial situation.

These features not only make banking more convenient but also empower users to make smarter financial decisions.

9. Bill Payments

Nobody likes missing a bill payment. Modern banking apps can make this process seamless with features like:

-

Recurring Payments: Set up automatic payments for regular bills, so users never miss a due date.

-

One-Time Payments: Quickly pay one-off bills without the hassle.

-

Bill Categorisation: Organise bills by type (utilities, subscriptions, etc.) for better tracking.

-

Notifications and Reminders: Send timely alerts to help users stay on top of their payments.

With these tools, users can manage their bills effortlessly and avoid late fees.

10. Notifications and Alerts

Timely, relevant notifications keep users informed and engaged. Key features include:

-

Transaction Alerts: Real-time updates for every account activity, helping users spot unauthorised transactions instantly.

-

Balance Updates: Notify users when their balance hits a certain threshold.

-

Promotional Offers: Share updates about new products, services, or special deals.

-

Customisation: Let users choose which alerts they want to receive.

-

Smart Device Integration: Deliver notifications to smartwatches or other devices for added convenience.

These alerts ensure users are always in the loop, no matter where they are.

Mobile banking app features

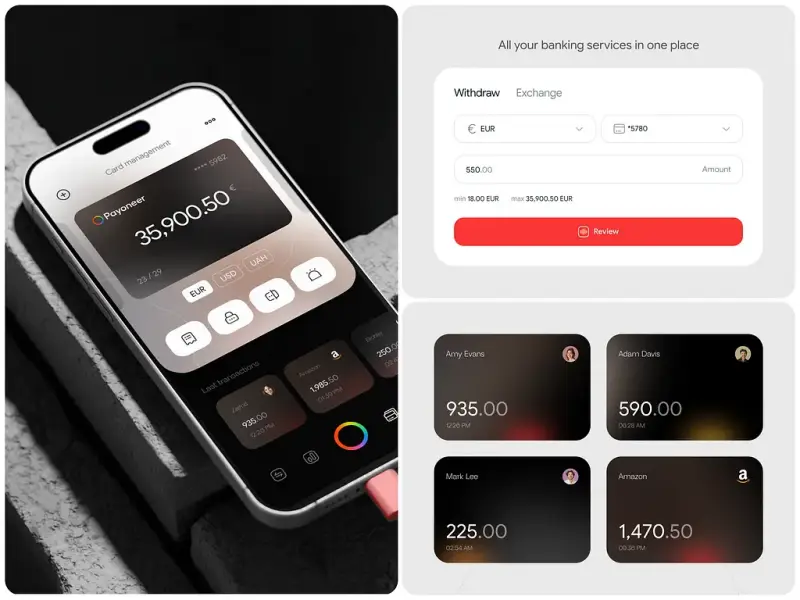

11. Multi-Currency Support

For users who deal with multiple currencies, these features are a game-changer:

-

Currency Conversion: Provide real-time exchange rates to help users make informed decisions.

-

Multi-Currency Accounts: Let users hold and manage multiple currencies in one place.

-

International Transfers: Make sending money abroad quick, easy, and cost-effective.

-

Trading Platforms: Offer real-time currency rate alerts and allow users to perform exchange transactions directly from the app.

With multi-currency support, one of the most in-demand mobile banking features, users can manage global finances with ease and confidence.

12. Open Banking Integration

Open banking is a game-changer for mobile banking apps, and API support is at its core. By integrating APIs, banks can seamlessly connect with a wide range of external solutions, unlocking new functionalities and enhancing the user experience. Customisable API settings, real-time data sharing, and support for multiple API standards are key features that make this integration smooth and efficient.

But open banking isn’t just about money management—it’s about creating a financial hub that goes beyond the basics. Think value-added services like investments, insurance, and fintech solutions, as well as integrations with tools for transport, entertainment, and shopping. By partnering with popular third-party services, such as budget planners or bill-splitting apps, banks can enhance a key feature of mobile banking—seamless financial integration.

13. Subscription Management

Let’s face it: managing subscriptions can be a headache. A modern banking app can simplify this by integrating directly with subscription providers, allowing users to track and manage all their recurring payments in one place.

Key features include:

-

Subscription Tracking: Keep an eye on all active subscriptions to avoid unnecessary charges.

-

Easy Cancellations: Let users cancel unwanted subscriptions with just a few taps.

-

Payment Reminders: Notify users about upcoming subscription payments to help them stay on top of their finances.

These tools not only save users money but also make their lives easier—a win-win for everyone.

14. Crypto Exchange & Payments

With cryptocurrencies gaining traction, integrating crypto features into your banking app can attract a tech-savvy audience. Here’s what users are looking for:

-

Crypto Trading: Offer in-app cryptocurrency trading and exchange services, complete with real-time price alerts to help users make informed decisions.

-

Crypto Payments: Allow users to make payments using cryptocurrencies, giving them more flexibility in how they transact.

-

Crypto Wallets: Provide secure storage for various cryptocurrencies, with support for a wide range of coins to meet diverse user needs.

By embracing crypto, banks can position themselves as forward-thinking and innovative, offering one of the best mobile banking app features to attract digital-savvy customers.

Conclusion

The future of mobile banking is all about innovation, security, and seamless user experiences. As customer expectations evolve, staying ahead requires more than just basic functionality—it demands a well-designed, feature-rich app that enhances convenience while ensuring top-tier security.

Whether you’re looking to develop a new mobile banking app or upgrade an existing one, partnering with the right experts can make all the difference. TECHVIFY specializes in building cutting-edge financial solutions tailored to your needs.

TECHVIFY – Global AI & Software Solutions Company

For MVPs and Market Leaders: TECHVIFY prioritizes results, not just deliverables. Reduce time to market & see ROI early with high-performing Teams & Software Solutions.

- Email: [email protected]

- Phone: (+84)24.77762.666