Mastering Payment App Development: A Step-by-Step Guide

- TECHVIFY Team

- December 20, 2024

- Knowledge, Guides

- 0 Comments

The fintech industry is booming, and it’s no surprise that startups are racing to capitalize on the evolving financial landscape. Among the most exciting opportunities in fintech is payment app development, a segment that dominates the market in popularity. In fact, digital payments are projected to generate a staggering US$8,563 billion in total transaction value by the end of 2022.

But here’s the thing: building a successful P2P payment app isn’t a walk in the park. From navigating technical complexity to addressing legal and security requirements, there are quite a few hurdles to overcome. In this guide, we’ll walk you through the challenges and share an actionable approach to payment app development that is secure and user-friendly.

I. Why Are Payment Platforms Like PayPal So in Demand?

Take a moment to think about the way people interact with money today. The days of standing in line at a bank branch or dealing with hidden fees are fading fast. Instead, customers are flocking to nonbank financial providers like PayPal, and for good reason—they offer the kind of functionality traditional banks simply can’t match.

According to McKinsey, the global payments market revenue hit $2.2 trillion in 2022, with projections to grow at a steady 7% annually to $3 trillion by 2027. Payment providers are thriving because they meet modern customer needs, from fast transactions to seamless integrations with everyday tools.

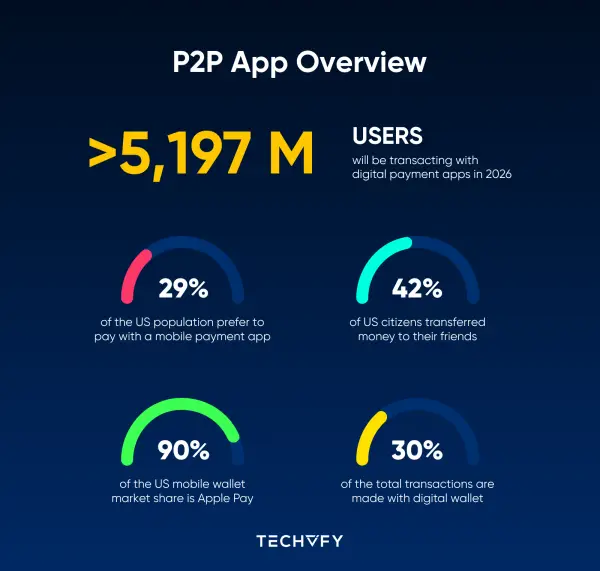

Payment App Development Overview

More importantly, they deliver something that traditional banks often lack: unparalleled convenience and transparency.

What Makes Payment Providers Different?

- Accessibility:

Unlike traditional banks that rely on physical branches, payment apps allow users to manage money directly from their smartphones. Whether you’re in a rural area or working long hours, you can make payments, transfer funds, or open accounts without needing to visit a branch during office hours. - Lower Fees:

Traditional banks often charge high and unexpected fees to cover their overhead costs. Meanwhile, payment platforms like PayPal offer low, transparent, or even free account-to-account (A2A) payments, saving users money while making transactions simpler. - Global Reach:

Payment providers excel in offering cross-border capabilities with low fees, making them ideal for international transactions—a feature essential in today’s globalized economy. - Merchant Benefits:

Businesses using tools like PayPal can access features like quick loan approvals, business management tools, and seamless integrations with e-commerce platforms. These offerings make payment providers far more appealing than traditional options.

Find out more insights about Banking, Financial Services, and Insurance industry:

II. 6 Key Steps in Creating A Payment App

Building a payment app that stands out requires careful planning, execution, and constant refinement. Whether you’re aiming to disrupt the fintech space or offer solutions for a specific audience, the process involves strategy and attention to detail. Let’s explore the six essential steps to create a payment app that users will trust and love.

Step 1: Research the Market and Define Your Strategy

Every successful app starts with a deep understanding of the problem it aims to solve. Before diving into development, it’s crucial to study the digital payment market and evaluate its current state. What are your competitors doing? What gaps can your app fill? Answering these questions will help you define your unique value proposition and explore opportunities to stand out.

In addition to market research, you need to perform technical research. Payment apps rely on secure architecture, smooth integrations, and compliance with regulations. Assess the available tech stacks and ensure they align with the functionality and scalability your app requires. This foundational step ensures you’re building a product that’s technically robust and ready for real-world use.

Step 2: Decide on the Type of Payment App

Once you’ve researched the market, it’s time to decide what kind of payment app you want to create. Your choice should align with your business goals, target audience, and the unique value you want to offer. For example, you might opt for a standalone payment app like PayPal, or you could focus on emerging opportunities like P2P lending, which is growing rapidly in popularity.

Choosing the right direction early on helps you stay focused as you move through the development process and ensures your app is designed to meet the specific needs of your chosen market.

Step 3: Get to Know Your Audience

Even the most innovative payment app can fail if it doesn’t resonate with its target audience. That’s why understanding your users is one of the most important steps in the development process. Conduct interviews, surveys, and market studies to gather insights into what your audience needs and values.

By engaging with users directly, you can uncover key details like the features they want, the pain points they face, and the solutions they’re looking for. This research minimizes the risk of launching an app that misses the mark and ensures you’re building something that delivers real value to your users.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

Step 4: Create a User-Centered Design

The design phase is where your app begins to take shape. Using the insights you’ve gathered, map out the app’s structure and user flow. The goal is to create a design that’s not only visually appealing but also intuitive and easy to navigate. This is crucial for a successful payment app development project.

Start with wireframes that outline the layout of each screen and the user journey through the app. Then, focus on improving user experience (UX) and user interface (UI). Every element of your app’s design should guide users toward their goals with minimal friction. By the end of this stage, you’ll have a clear blueprint for how the app will look and function.

Step 5: Build and Test a Minimum Viable Product (MVP)

Instead of launching a fully-featured app right away, start with a Minimum Viable Product (MVP). This scaled-down version of your app should focus on the core features necessary to solve your users’ primary needs.

Developers will handle coding, integrating payment systems, and testing functionality during this phase. Payment apps often require specialized expertise in API integrations and technologies like blockchain or AI to ensure smooth and secure transactions.

Testing is a critical part of this step. Work in small development sprints to address bugs, refine features, and incorporate feedback. Involve real users in the testing process to validate that your app meets their expectations and solves their pain points effectively. This feedback will guide you in making improvements before the full launch.

Step 6: Launch and Optimize Continually

The launch of your payment app is a major milestone, but it’s only the beginning. After releasing your app, monitor user feedback and performance metrics closely. This will help you identify issues, fix bugs, and ensure a smooth user experience.

Even after resolving initial issues, it’s important to keep improving your app to stay ahead of market trends and meet evolving user expectations. Regularly review analytics, gather suggestions from users, and work with your development team to introduce new features or optimize existing ones. Continuous improvement is key to keeping your app competitive and relevant in the fast-paced fintech space.

III. What Are the Different Types of P2P Apps?

Before diving into P2P app development, it’s essential to understand the various types of peer-to-peer payment apps and the unique markets they serve. Each type of P2P app is tailored to specific user needs, from simplifying local transactions to enabling cross-border payments.

Types of payment application development

Let’s take a closer look at the most common variants:

1. Standalone Payment Apps

Standalone payment apps operate as self-contained ecosystems, freeing users from traditional banking infrastructure.

Popular examples include PayPal, Venmo, Square Cash, and Alipay. These apps allow users to deposit money from their bank accounts into the app’s e-wallet, enabling seamless transfers to other users within the same app ecosystem.

Why users love them:

- Independence from banks.

- Quick and easy transfers within the app.

- Secure e-wallet functionality for everyday payments.

2. Foreign Exchange Payment Apps

As the name suggests, these apps specialize in transferring money internationally in foreign currencies, making global transactions faster and more affordable.

A standout example is Wise (formerly TransferWise), which supports 25+ currencies and is a favorite among users for its low exchange fees compared to traditional banks.

Why they’re important:

- Affordable cross-border payments.

- Transparent exchange rates.

- Perfect for expatriates, freelancers, and global businesses.

3. Bank-Centric Payment Apps

Some P2P payment apps are built directly on existing banking infrastructure. These apps cater to users who prefer the trust and reliability of banks while enjoying the convenience of cashless payments.

For instance, Zelle is a popular P2P app that integrates with most U.S. banks, allowing users to send money easily or make cashless purchases at retailers.

Why they stand out:

- Seamless integration with bank accounts.

- Familiarity and trust in the banking system.

- No need for additional e-wallets.

4. Social Media-Based Payment Services

Social media platforms are tapping into the P2P payment market by incorporating payment functionality directly into their apps.

For example:

- Facebook Pay allows U.S. users to send payments to friends and family without leaving the app.

- WhatsApp Pay is being tested in India, enabling users to make payments via UPI IDs or QR codes.

Why users are intrigued:

- Payments are embedded into their favorite social apps.

- No need to switch between multiple platforms.

- Convenient for casual transactions with friends and family.

5. Mobile OS Payment Services

Major players in the tech industry have created mobile OS-specific payment services to cater to their device users. These apps leverage built-in hardware capabilities like NFC (Near Field Communication) for contactless payments.

Examples include Apple Pay, Samsung Pay, and Google Pay, which are designed specifically for iOS and Android users.

What makes them unique:

- Integration with device hardware for secure payments.

- Contactless payment functionality.

- Convenience for users within the device’s ecosystem.

Find out more insights about Banking, Financial Services, and Insurance industry:

IV. Essential Features of a Successful P2P App

Creating a P2P payment app isn’t just about enabling money transfers. It’s about delivering a smooth, secure, and user-friendly experience that inspires trust and keeps users coming back. To achieve this, your app must be designed with a range of critical features that cater to user needs. Let’s dive into what makes a P2P payment app truly successful.

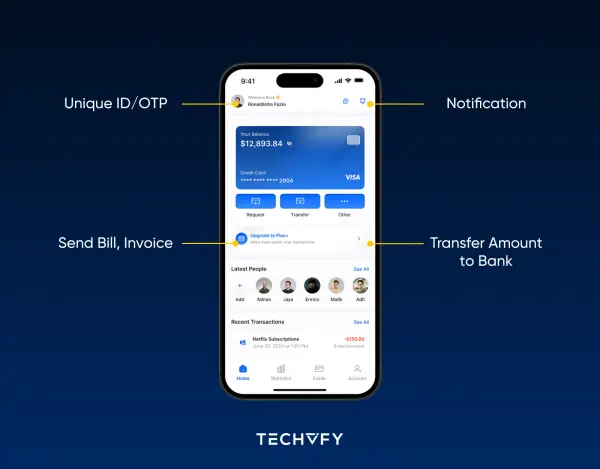

Unique ID/OTP for Security

Security is at the core of any financial application, and for P2P apps, it’s absolutely non-negotiable. By implementing a unique ID or One-Time Password (OTP) system, you ensure every transaction is verified by the sender before any money changes hands. Many apps even enhance security further by requiring an OTP every time the app is opened, creating an additional layer of protection. Features like these don’t just keep accounts safe—they also build user confidence in your app’s reliability, which is essential for long-term success.

Features needed when creating a payment app

Notifications for Payment Updates

Keeping users informed is another cornerstone of a great P2P app. Real-time notifications make it easy for users to stay updated on their transactions, whether it’s a payment initiation, a successful transfer, or an account activity alert. Some apps take this a step further by sending reminders for upcoming payments or balance updates, helping users manage their finances with ease. These notifications ensure users always feel in control, while also adding a personal touch that enhances the overall experience.

Send Bills and Generate Invoices

Managing shared expenses can be a hassle, but a P2P app with the ability to send bills makes it effortless. This feature allows users to scan and send bills directly to others, simplifying payments for everything from splitting a dinner check to dividing rent or utility costs. On top of that, both parties automatically receive a detailed invoice for every transaction, which is saved within the app for easy reference. This level of transparency not only simplifies payments but also helps users keep their financial records organized.

Transaction History for Financial Clarity

A comprehensive transaction history is one of the most appreciated features of any P2P app. It provides users with a clear summary of all their past payments and transfers, offering insight into their spending habits. Whether users need to verify a completed transaction or resolve a dispute, having access to an intuitive transaction history ensures they always have the information they need. This feature plays a vital role in helping users feel in control of their finances while adding an extra layer of trustworthiness to your app.

Chatbot for Instant Customer Support

No matter how well-designed an app is, issues can occasionally arise, and users need fast solutions. A built-in chatbot can act as a 24/7 customer support agent, ready to resolve common problems like failed transactions or incorrect deductions. By guiding users through troubleshooting steps or escalating issues when needed, the chatbot ensures a smooth and frustration-free experience. This instant support feature demonstrates that your app prioritizes the needs of its users, which is key to building loyalty and satisfaction.

Transfer Funds to Bank Accounts

One of the most sought-after features in a P2P app is the ability to transfer funds from the app’s wallet to a user’s bank account. This functionality gives users complete control over their money, whether they want to withdraw a portion of their balance or cash out entirely. By offering this flexibility, your app appeals to a broader audience, from casual users to business professionals, ensuring it meets a variety of financial needs.

Conclusion

The fintech industry is evolving at breakneck speed, and P2P payment apps are at the forefront of this transformation. With their ability to deliver unparalleled convenience, accessibility, and transparency, these apps are reshaping the way we interact with money. However, creating a payment app that stands out takes more than just a good idea—it requires a deep understanding of the market, technical expertise, and a relentless focus on user experience.

At TECHVIFY, we specialize in turning ambitious fintech ideas into reality. From market research to MVP development and beyond, our team of experts is here to guide you every step of the way. With our proven track record in building secure, scalable, and user-friendly apps, we’ll help you create a P2P payment app that stands out in this competitive landscape.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666