What Is a Neobank? A New Era in Mobile Banking

- TECHVIFY Team

- 0 Comments

Traditional banks have long dominated the financial market, but they were often inaccessible to consumers in rural or low-income areas. This is where neobanks, or fintech banks, come in. These digital-only institutions offer services online, providing benefits like lower fees, faster loan approvals, and early access to paychecks.

Neobanks are growing rapidly. For example, Chime, which had 13 million customers in 2021, now has over 21 million. As they continue to expand, neobanks are reshaping the financial landscape, offering consumers more accessible and flexible banking options. This article will answer the question “what is a neobank?” and find out what makes them different from traditional banks and the most popular neobanks in the market right now.

I. What is a Neobank?

A neobank is a financial technology company that provides digital banking services in collaboration with one or more traditional banks. Unlike traditional banks, neobanks don’t hold a banking charter, which means they rely on partner banks to offer insured checking or savings accounts. The Federal Deposit Insurance Corporation (FDIC) insures accounts at neobanks through these partnerships, but the insurance mechanisms may differ slightly compared to those at conventional banks.

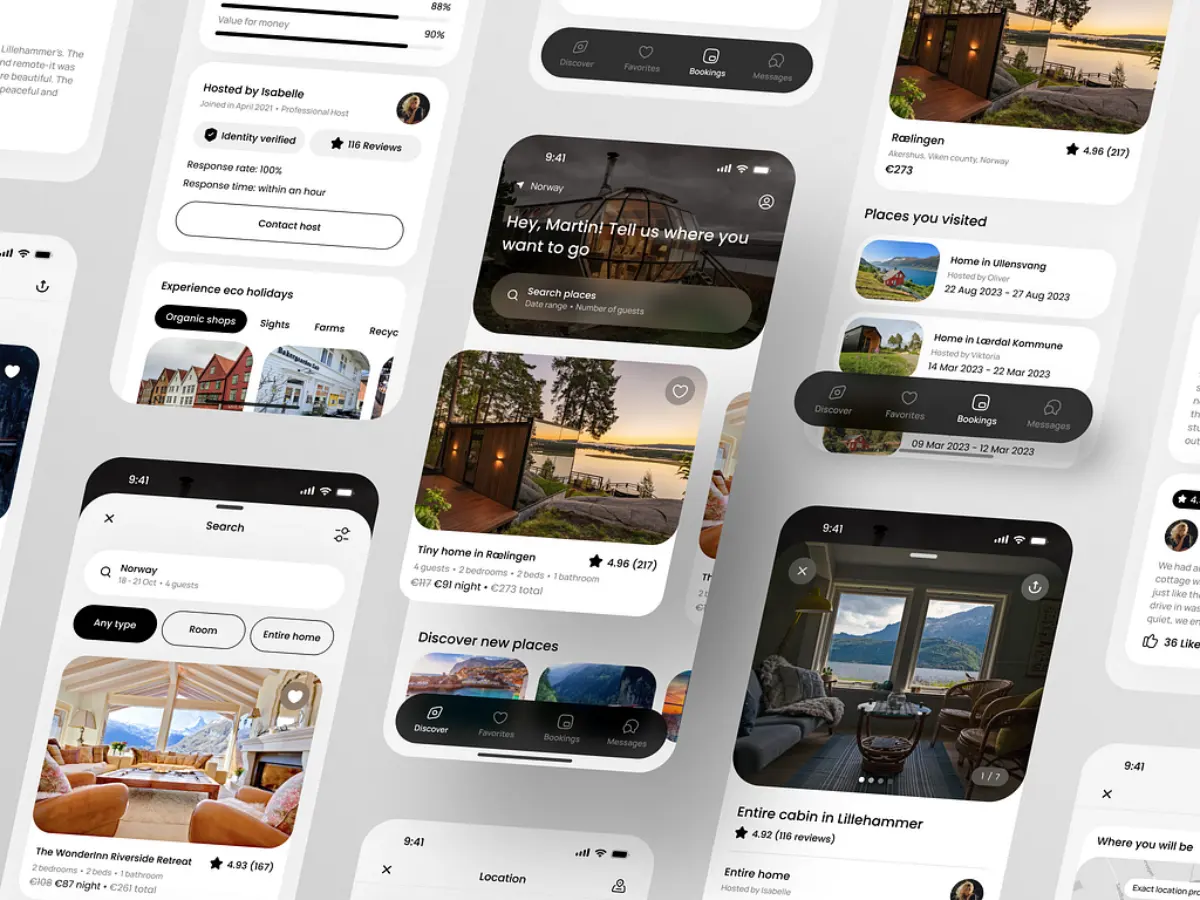

What is a neobank?

Neobanks, often referred to as “challenger banks,” focus on a streamlined set of financial services and frequently provide features that go beyond traditional banking offerings. Common services include:

- Electronic money transfers

- Mobile check deposits

- Bill payments and direct deposit

- Fee-free overdraft protection

- Early access to paychecks

- Budgeting and savings tools

While their services are largely app-based, many neobanks also offer web access and physical debit cards to ensure flexibility.

Find out more insights about the Banking, Financial Services, and Insurance industry:

II. What Makes Neobanks A Better Choice Compared to Traditional Banks

Service Delivery

The most significant difference lies in how services are delivered. Neobanks operate entirely online, emphasizing mobile and digital interfaces, while traditional banks combine digital services with in-person experiences at physical branches.

Services and Revenue

Neobanks typically focus on core financial services like budgeting, savings tools, and early paycheck access, designed to improve financial health. On the other hand, traditional banks offer a broader range of products, including:

- Mortgages

- Credit cards

- Investment accounts

Revenue generation also differs. Traditional banks often rely on fees and interest from lending, while neobanks frequently generate revenue through interchange fees, subscriptions, or partnerships.

Expanding Financial Inclusion

Neobanks play a pivotal role in addressing the needs of underserved populations, such as the 13% of Americans who are underbanked. These institutions eliminate common barriers like high fees, minimum balance requirements, and branch inaccessibility. Through their digital-first approach, users can download an app, open an account, and start banking without traditional hurdles.

By focusing on consumer-centric features, such as no-fee structures and financial health tools, neobanks have successfully attracted users who previously avoided traditional banks. This includes younger users, individuals with limited credit, and those disillusioned by conventional banking practices.

People Benefit Most from Neobanks

Neobanks and traditional banks often cater to different demographics and needs:

- Traditional Banks: Better suited for consumers requiring a wide array of financial services or those less comfortable with digital technology.

- Neobanks: Ideal for tech-savvy users, younger demographics, and individuals seeking accessible, fee-free banking solutions.

Neobanks have gained popularity for their ability to provide an easy, user-first experience, often at no cost. As their user base grows, these institutions are broadening their service offerings while retaining their customer-focused approach.

Neobanks Drive Digital Transformation for The Banking Industry

The rapid rise of neobanks has intensified competition in the banking sector, compelling traditional banks to innovate and enhance their services. This digital transformation includes:

- Improving mobile apps

- Integrating online and in-person experiences

- Expanding product offerings

- Reducing or eliminating overdraft fees

For consumers, this competition translates into improved services and accessibility across all banking institutions. By offering tools like budgeting apps and savings accounts, neobanks and traditional banks alike are helping underserved populations improve their financial health and build wealth.

III. Top Neobanks by Consumer Accounts

The rise of neobanks has been a remarkable trend in the financial industry. In 2020, these digital-first banks had 14.4 million U.S. account holders. By 2024, projections estimate that over 40 million Americans will maintain at least one neobank account. With an anticipated compound annual growth rate (CAGR) of 54.8% from 2023 to 2030, the industry’s rapid expansion underscores its growing appeal and the increasing shift toward digital banking solutions.

The most popular neobanks among consumers include:

1. Revolut

Established in 2015, Revolut has grown into one of the largest European neobanks, boasting over 18 million customers and generating more than $1 billion in annual revenue. Its strategic push into the U.S. market positions it as a potential global leader in the digital banking space.

Revolut offers a broad suite of financial services, including:

- Bank accounts and debit cards

- Currency exchange across 30+ currencies

- Stock trading and cryptocurrency transactions

- Peer-to-peer payments

Unlike many of its competitors, Revolut serves both individual and business users, aiming to expand access to financial services globally, regardless of location or currency.

2. Chime

Founded in 2012, Chime has redefined overdraft fees and financial accessibility by partnering with FDIC-insured banks and prioritizing consumer financial health. Its offerings include:

- Mobile-first checking and savings accounts

- A Chime Visa Debit Card

- Competitive annual percentage yields (APYs)

- No overdraft fees

One standout feature is SpotMe, which allows users to access up to $200 in overdraft credit without fees. Additionally, Chime delivers early direct deposit access, enabling users to receive funds two days earlier than traditional banks. By providing these services, Chime not only helps users save on fees but also empowers those without credit cards to access small credit lines, reducing reliance on high-interest loans.

Looking to Outsource Development?

Contact TECHVIFY, Vietnam’s Leading Offshore Software Development & Outsourcing Company, for a consultation and development services.

3. Varo

Varo Bank distinguishes itself as the first self-chartered neobank, focusing on reducing financial stress and expanding access to premium banking services. Launched in 2015 as Varo Money, it achieved a national bank charter in 2020—a milestone in the industry.

Key benefits include:

- Checking accounts and high-yield savings options

- Up to $100 in fee-free cash advances

- No credit checks, minimum balances, or overdraft fees

Varo’s Believe program offers a secured credit card with no fees, enabling users to build credit responsibly while earning cashback rewards—a feature typically reserved for traditional credit card holders. These services support individuals with limited or no credit history, empowering them to improve their financial standing.

4. SoFi

Initially launched in 2011 to help students secure college funding, SoFi has evolved into a leading neobank with over 5.7 million users. Its comprehensive offerings include:

- Checking and savings accounts

- Loans, credit cards, and investment options

- Student loan refinancing

SoFi sets itself apart by prioritizing customer success in all aspects of life—whether at home, work, or school. By combining traditional banking services with modern financial tools, SoFi appeals to users seeking a holistic approach to managing their financial futures.

IV. Is a Neobank the Right Choice for You?

Neobanks are transforming the traditional banking industry by offering easily accessible accounts, lower fees, and innovative digital-first services. Their unique structure and technology-driven approach make them an attractive alternative for those dissatisfied with conventional banking—particularly if you’re tech-savvy and prioritize convenience.

Is Neobank meaning you have to use it?

Below are some scenarios where choosing a neobank might align with your financial needs:

1. You Value Digital Convenience

For individuals who rely heavily on mobile devices and want to avoid the inconvenience of visiting physical branches, neobanks provide a seamless, app-based experience. With robust mobile platforms, these institutions cater to users who prioritize on-the-go banking solutions for tasks like deposits, transfers, and bill payments.

2. You’re Looking to Reduce Fees

Neobanks are a go-to option for those aiming to cut down on traditional banking fees. By eliminating charges like overdraft fees, monthly service fees, and minimum balance penalties, they offer a cost-effective way to manage your finances without hidden costs.

3. You’re a Global Citizen or Non-U.S. Resident

Neobanks often appeal to international users due to their simplified account setup process and accessibility. Unlike traditional banks, which may require a Social Security number or Individual Taxpayer Identification Number (ITIN), some neobanks accept alternative identification, such as a U.S. visa. This makes them particularly attractive to expatriates, digital nomads, or others navigating cross-border financial needs.

Conclusion

Neobanks are reshaping the financial landscape, offering flexible, low-fee banking solutions with the convenience of digital-first services. Their growth is a testament to the increasing demand for accessible, tech-driven banking options, and they continue to expand their services to meet a wide range of consumer needs. Whether you’re looking for lower fees, early paycheck access, or a more mobile-friendly experience, neobanks are proving to be a valuable choice for many.

If you’re ready to dive into the world of neobanks, or if you’re planning to build your own cutting-edge fintech solution, TECHVIFY can help you every step of the way. We specialize in designing and developing innovative, secure, and scalable digital banking solutions. Reach out for a free consultation today, and let’s bring your vision to life with innovative, user-centric solutions.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666