Best AI Apps for Stock Trading: Stay Up-to-date With The Trends

- TECHVIFY Team

- 0 Comments

The stock market is always changing, with prices shifting quickly due to global events, company news, or economic data. To succeed, traders need to make timely and informed decisions.

Artificial Intelligence (AI) has transformed stock trading by analyzing vast amounts of data, predicting market movements, and even executing trades with minimal human input.

Whether you’re a seasoned investor or a newcomer, choosing the right AI app can significantly improve your trading performance. These apps use machine learning and predictive analytics to give you an edge.

In this article, we’ll highlight the best AI apps for stock trading, their key features, and how they assist in making more informed trading choices.

I. How is AI Changing Stock Trading?

AI has revolutionized the execution of trades, and strategies are developed within trading platforms.

In stock trading, AI employs advanced machine learning algorithms to carry out tasks that would typically require human traders. These tasks often include market analysis, spotting new trading opportunities, and utilizing automated trading strategies.

AI-driven trading applications rely on these algorithms to work with both historical and real-time market data. This allows them to detect patterns that can help forecast market trends and make predictions about future stock movements.

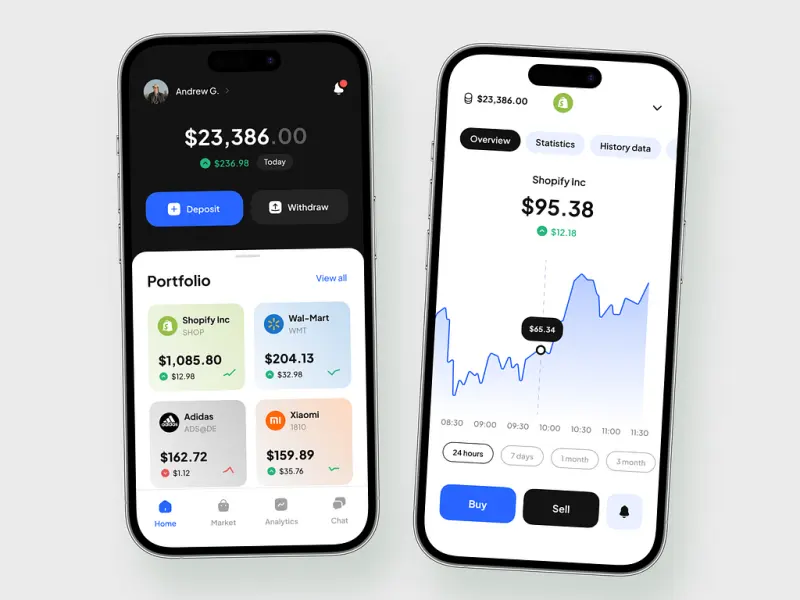

Best AI stock trading app

These insights are then used to generate trading signals and can also be applied to automatically execute trades on a trading platform. As a result, the trading process becomes more efficient and requires less human intervention.

In addition, AI stock trading apps save traders from the burden of processing massive datasets, giving them a competitive edge. With these tools, traders can identify trade ideas that might otherwise go unnoticed, leading to more opportunities and potentially higher profits.

Find out more insights about Banking, Financial Services, and Insurance industry:

II. How Does an AI Stock Trading App Work?

AI stock trading apps function by continuously collecting and analyzing data from multiple sources. These sources typically include historical market data, real-time market updates, and qualitative information such as news articles and social media content.

Once the data is processed, some apps utilize an AI robot or trading bot that employs algorithmic trading strategies to make decisions. These strategies are often backtested using historical data to predict how they might perform under various market conditions.

The app can then provide trade signals to the user or automatically execute trades based on predefined parameters within the platform.

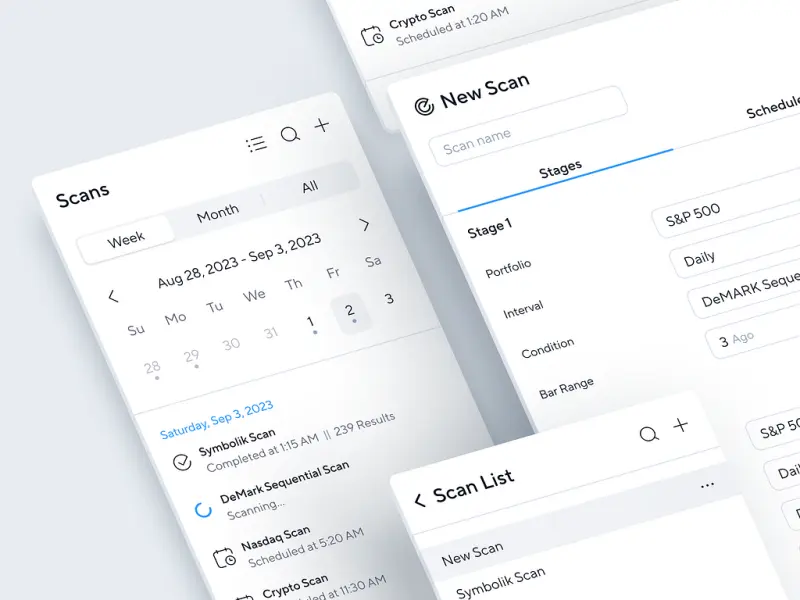

For experienced traders and seasoned investors, AI-powered tools like stock screeners or analysis modules can be invaluable. These tools filter stocks based on specific criteria—such as price movements, volume, or market sentiment—presenting potential trade ideas that align with the user’s strategy.

By integrating such tools into their trading routines, traders can refine their investment strategies and improve portfolio performance, ultimately enhancing profitability.

Moreover, AI in trading reduces the workload for active traders by automating repetitive tasks. From monitoring stock quotes to managing trading fees, automation simplifies many aspects of the trading process, freeing up traders to focus on higher-level decision-making.

III. 5 Best AI Apps for Stock Trading in 2025

In 2024, several AI-powered apps stand out for stock trading, catering to both beginners and seasoned investors. These platforms leverage cutting-edge technology to streamline the trading workflow and assist users in making well-informed choices.

1. TuringTrader

TuringTrader offers a distinctive approach to AI stock trading, focusing on long-term growth and comprehensive portfolio management. The app allows users to build diversified portfolios that adapt to evolving market conditions.

By utilizing automated trading strategies and backtested portfolios, TuringTrader aims to deliver consistent profits with minimized risks. This AI-driven platform employs advanced machine learning algorithms to manage user portfolios, with the option to rotate assets on a daily, weekly, or monthly basis.

Users can capitalize on profitable trading opportunities while protecting themselves from potential losses during market downturns. TuringTrader constantly monitors real-time market data and even sends rebalancing alerts to keep portfolios optimized.

The app also provides data-driven insights into investment performance, making it easier for traders to make informed decisions. Through technical analysis and fundamental data, TuringTrader helps users develop strategies based on solid market research, providing traders with an advantage in the fast-moving stock market.

2. Tickeron

Tickeron enhances the stock trading experience by allowing users to leverage AI trading bots, dramatically speeding up the trading process. These AI robots analyze vast amounts of real-time market data, providing users with actionable trade signals and insights into potential stock movements.

This rapid analysis allows traders to respond quickly to market trends, which is crucial in fast-moving environments. The app’s AI stock screener further improves its usefulness by enabling users to filter stocks based on price movements, volume, and market sentiment.

Tickeron focuses on high-potential stocks, including penny stocks and other volatile assets. This makes it a valuable tool for traders aiming to profit from short-term stock market opportunities.

3. TrendSpider

TrendSpider is designed to revolutionize how traders approach technical analysis. Offering deep market insights and advanced technical analysis tools helps both retail traders and professional investors enhance their trading performance.

One of TrendSpider’s standout features is its automated pattern recognition, which enables users to identify key trends and patterns across multiple timeframes without needing to manually chart them. This automation simplifies the process of spotting investment opportunities derived from past price trends and current market conditions.

Another key feature is the app’s robust backtesting and forward-testing capabilities. Users can test their strategies against over 50 years of historical market data, which is essential for fine-tuning strategies and boosting overall trading results.

Trading app visualize

4. Trade Ideas

Trade Ideas is renowned for its ability to provide in-depth stock market analysis and identify lucrative trading opportunities. Using advanced AI, the app scans the market in real-time, delivering timely insights into potential stock movements.

Traders can stay ahead of the curve by accessing trade signals generated by the app’s AI engine, “Holly.” These signals are based on a thorough analysis of both historical market data and current conditions.

One of Trade Ideas’ most innovative features is Stock Racing, which allows traders to monitor the real-time performance of multiple stocks simultaneously, helping them identify which stocks are gaining momentum. This feature is particularly valuable for traders who need to make quick decisions in volatile markets.

The app also includes a Market Explorer tool, offering pre-built scans that simplify the process of identifying trading opportunities. Additionally, Trade Ideas features “The OddMaker,” a backtesting tool that lets traders simulate their strategies against recent market conditions, enhancing their ability to refine strategies and optimize performance.

5. LevelFields

LevelFields brings high-level financial analysis to everyday traders, allowing stock and options traders to monitor and analyze thousands of stocks—something that was once only accessible to Wall Street professionals.

By analyzing millions of events from sources like financial filings, news reports, and company announcements, LevelFields helps traders discover highly profitable trades. The app’s AI focuses on identifying events that have a significant impact on stock prices, such as CEO changes, regulatory actions, or activist investments.

Users of LevelFields benefit from a modern interface equipped with over 100 actionable trading strategies. The app also offers customizable real-time alerts, notifying traders when major events align with their strategy or a company’s financials.

With the power of LevelFields, it’s like having 200 analysts working for you around the clock, providing key insights and opportunities that help everyday investors compete with large institutions.

The app also guides users on trade entry and exit points by analyzing historical data and price reaction patterns. Traders can even tailor strategies based on industry trends and company performance, allowing them to profit across varying market conditions, including bear markets.

LevelFields also offers a premium service for those who prefer expert guidance. Their analysts handpick the best stock and options trades each week, backed by AI alerts, macroeconomic data, and comprehensive analyses. These alerts provide detailed reasoning, complete with entry and exit points, making this service both a time saver and a learning tool for those looking to refine their investment skills.

Since the introduction of their premium service, LevelFields has generated over 4,000% gains for its loyal members, making it a top contender for traders seeking a powerful, AI-driven platform.

Looking to Outsource Development?

Contact TECHVIFY, Vietnam’s Leading Offshore Software Development & Outsourcing Company, for a consultation and development services.

IV. Benefits of Using AI in Stock Trading

One of the most significant benefits of AI in stock trading is that it eliminates the emotional biases often present in human decision-making.

Feelings such as fear and greed can impair decision-making, leading to poor trading decisions. In contrast, best ai apps for stock trading rely solely on data-driven insights, making decisions based on patterns identified through advanced predictive analytics.

This results in more consistent performance and improved risk management.

Another major advantage is the speed and efficiency that AI trading bots bring to the table. These bots can monitor multiple exchanges at once, processing real-time market data and executing trades in milliseconds.

This ability to respond instantly to market shifts is crucial, especially in volatile markets where swift actions can mean the difference between profit and loss.

AI trading apps also come equipped with sentiment analysis tools that monitor news, social media, and other information sources to evaluate market sentiment. This is particularly useful for predicting how external events or breaking news might impact the stock market, helping traders make more informed decisions.

V. Key Features to Look for in the Best AI App for Stock Trading

When choosing the best AI-powered stock trading app, it’s essential to look for features that enhance your trading experience and help you make better, more informed decisions. These functionalities can greatly influence your trading outcomes, so selecting an app that can adapt to the ever-changing financial markets is crucial.

Accuracy of AI Predictions

One of the most important features of best ai apps for stock trading is its ability to make accurate predictions using both historical and real-time market data. ML algorithms are built to identify and study patterns from past data and apply them to current market conditions.

The higher the accuracy of these predictions, the better you’ll be at identifying profitable trading opportunities. Accurate AI forecasts increase your chances of making successful trades and maximizing returns.

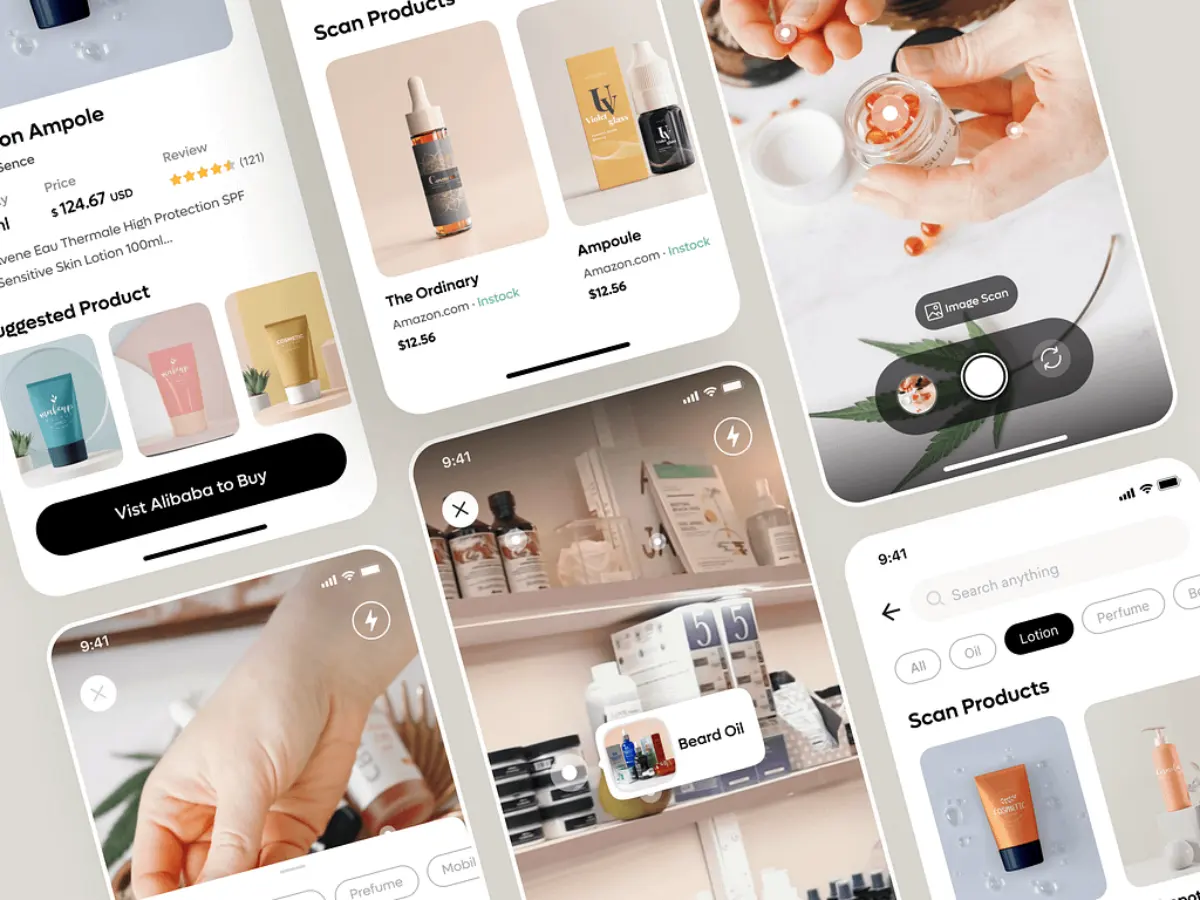

Stock trading app

User-Friendly Interface

An intuitive interface is crucial for ensuring that traders, whether beginners or experienced, can navigate the app with ease. The best AI stock trading apps should offer intuitive dashboards and clear visuals, simplifying the trading process for users.

An easy-to-use interface reduces the learning curve, helping you focus more on making trades and less on figuring out how to use the app itself.

Real-Time Data Analysis and AI Insights on the Stock Market

Access to real-time data is vital for making timely and well-informed trading decisions. The best AI stock trading apps continuously monitor market movements and provide instant updates on price changes, stock quotes, and other key market data.

These apps should also offer real-time analysis, enabling rapid responses to unexpected market shifts. This helps keep you ahead of the competition and seize opportunities as they arise.

Customizability and Flexibility

Every trader has their own unique investment strategy, so the AI trading app you choose should offer customizability. Whether it’s setting up personalized alerts, tweaking trading strategies, or integrating the app with other trading platforms, flexibility is essential.

This level of customization will allow you to align the app with your investment approach, helping you manage your portfolio more effectively.

Automated Trading and Algorithmic Strategies

Automation is one of the key benefits of AI trading. A good app should allow for automated trading based on predefined criteria, such as trade signals, price targets, or risk thresholds.

Automated trading saves you time—there’s no need to constantly monitor the market, as the app will execute trades on your behalf. Additionally, algorithmic trading enables the app to perform trades at speeds far beyond human capability, letting you seize opportunities the moment they emerge.

Risk Management and Security Features

Strong risk management is an essential element of any successful trading strategy. Your AI trading app should come equipped with risk management tools like stop-loss orders, automated exit strategies, and volatility alerts. These features protect your investments by minimizing potential losses.

Security is another critical aspect. Best AI apps for stock trading should offer strong encryption and other measures to safeguard your financial data, ensuring your personal information remains secure.

Forecasting Tools for Market Reactions

In addition to identifying profitable trades, it’s crucial to know when to exit a position. That’s where price forecasting and stock market analytics come into play.

The best AI apps provide forecasting tools that help predict future price movements, enabling you to plan exit strategies more effectively. Knowing the win rates and the amount of data behind trade signals gives you greater confidence in the strength of your trades.

Technical and Fundamental Analysis

A well-rounded AI trading app should include both technical and fundamental analysis to support your trading decisions.

Technical analysis involves studying price charts, trends, and indicators to identify potential trading opportunities. Meanwhile, fundamental analysis looks at a company’s financial health, earnings reports, and other key metrics.

Having access to both types of analysis within the app ensures that you’re making decisions based on a comprehensive understanding of the market.

Cost and Accessibility

Cost is always a factor to consider when choosing an AI trading app. Pay attention to any fees involved and make sure that the app offers good value for your specific trading needs.

Accessibility is equally important. The app should be available on multiple devices and platforms, allowing you to stay connected to your trades no matter where you are.

Let’s talk

A consultation with the Client Relationship Manager, who represents TECHVIFY, without any commitment from your side, will give you:

- Structured and clear vision of your future application

- Information about how our software development company guarantees 100% on-time and on-budget delivery

- Recommendations for choosing the tech stack

- Advice on further steps

- Business-side recommendations

- Rough project estimation on software development

TECHVIFY is right where you need. Contact us now for further consultation:

VI. Best Practices for Using AI Apps in Stock Trading

To get the most out of your AI trading app, it’s important to follow best practices that can help optimize your trading experience and improve your performance in the market.

Analyze Data Regularly

Make it a habit to analyze the vast datasets provided by your AI trading app. Review both historical market data and real-time information, and keep an eye on market sentiment by following news articles and social media posts.

Staying informed about market trends will help you align your trading strategies with current conditions, increasing your chances of making profitable trades.

Diversify Your Portfolio

Diversification is a key risk management strategy. Use your app’s AI stock screener to explore different sectors, asset classes, and trading opportunities. Spreading your investments across various areas of the financial market can help mitigate risk and protect your portfolio from volatility.

By diversifying, you also increase your exposure to multiple sectors, maximizing your potential for profit in different market conditions.

Stock trading app example

Pay Attention to Trade Signals

AI-generated trade signals and alerts are valuable tools for pinpointing potential trading opportunities. These signals are based on machine learning algorithms, but it’s still important to combine them with your own analysis to make well-rounded decisions.

Review and Adjust Strategies

The stock market is constantly evolving, so regularly reviewing and adjusting your trading strategies is essential. Your AI app should offer backtesting and forward-testing features that allow you to evaluate how your strategies perform under different market conditions.

By staying adaptable and refining your approach, you can improve your trading performance over time.

Utilize Trading Alerts for Automation

Setting up trading alerts and utilizing trading bots can further automate your trading process. These tools enable you to carry out trades according to predefined rules, helping you remain disciplined and capitalize on opportunities even when you’re not actively watching the market.

Automation also ensures that you can stick to your strategy and react to market movements in real-time, without missing out on potential profits.

Conclusion

AI has revolutionized stock trading, offering powerful tools that allow traders to make data-driven decisions, automate strategies, and manage risk more effectively. Whether you’re a seasoned investor or new to the market, incorporating AI into your trading can give you a significant edge. From real-time data analysis to automated trading bots and AI-driven financial advice, these best AI apps for stock trading are designed to help you easily navigate the complexities of the stock market.

Stop wasting time and resources on slow, underperforming apps. TECHVIFY is here to help. Contact us now for a free consultation, and let’s build your custom AI trading platform.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: contact@techvify.com.vn

- Phone: (+84)24.77762.666