Building a Trading Platform The Easy Way in 2025 – Full Guide

- TECHVIFY Team

- 0 Comments

Each year, traditional banks seem to be losing their influence among younger generations. It’s rare these days to find Millennials or Gen Z standing in line at a bank to deposit money. Instead, they’re more inclined to put their money into stocks of major companies and startups. Most of them prefer using mobile trading apps for these investments.

This makes developing a mobile trading platform a promising business opportunity! We have the expertise to guide you through it. Check out our article to learn about the challenges you face when building a trading platform.

I. Insights into the Trading Platform Market

Since 2016, the stock market app industry has been expanding consistently, with Robinhood leading the way. This trend is expected to continue, with an average annual growth rate of 6.4% over the next decade.

Smartphone usage is at an all-time high, with over 90% adoption, which supports the ongoing expansion of the user base. According to Motley Fool, a private financial and investing advice company, Gen Z and Millennials are the fastest-growing groups of investors.

Statista reports that the global online trading market continues to grow and is set to hit the $10 billion mark by 2024. Below, you’ll find forecasts for online trading market growth and some intriguing facts.

Building a Trading Platform

II. Advantages of Custom Trading Software

Creating custom software for trading helps users avoid using multiple disjointed solutions for daily tasks. Here are the main benefits of developing custom trading applications:

Tailored to Your Needs

A custom stock trading platform lets traders use a single system with features designed specifically for them. You can build a tailored trading app that fits perfectly with your workflows, automating tedious tasks. Additionally, you can customize the user interface (UI) and create personalized dashboards.

Adaptability and Scalability

By choosing custom solutions, you eliminate the limitations of off-the-shelf software. You can continually enhance your application with new features to streamline trading operations. Update your software to handle growing numbers of users, transactions, and data. This flexibility also allows for the integration of advanced technologies to gain deep market insights and process extensive historical data.

Find out more insights about Banking, Financial Services, and Insurance industry:

Enhanced Security

Keep your transactions and assets secure with custom software that incorporates the latest security measures. Employ advanced protocols like multi-factor authentication, safeguarding confidential financial data through encryption and routine security checks. You can also implement necessary security standards for integration with external services.

Optimized Performance

Experience fast transaction processing and real-time data updates. Adjust your system’s parameters, upgrade the architecture, or add measures to reduce the time needed to fetch and analyze financial data.

Third-Party Integration

Integrate software from other vendors to enhance your trading tool. Connect your application with financial data providers, payment gateways, and other business tools. Develop custom APIs to ensure seamless communication between systems for real-time trading.

III. Essential Features for Building a Trading App

When building a trading platform, ensure it includes these crucial features:

- Simple Sign-In Process

The registration form is key to a smooth user experience. It should be straightforward and quick, taking no more than 3-4 minutes to complete. A complex process can turn users away, so simplicity is crucial. - Prioritize User Security

Make sure users feel their personal and financial data are secure. Consider allowing sign-ins via social media or phone numbers to enhance security and reassure users about data protection. - Effective User Onboarding

Welcome users with a comprehensive onboarding process. This can include interactive elements, educational videos, and app demos. Onboarding helps users understand the app and ensures compliance with Know Your Customer (KYC) and data protection regulations.

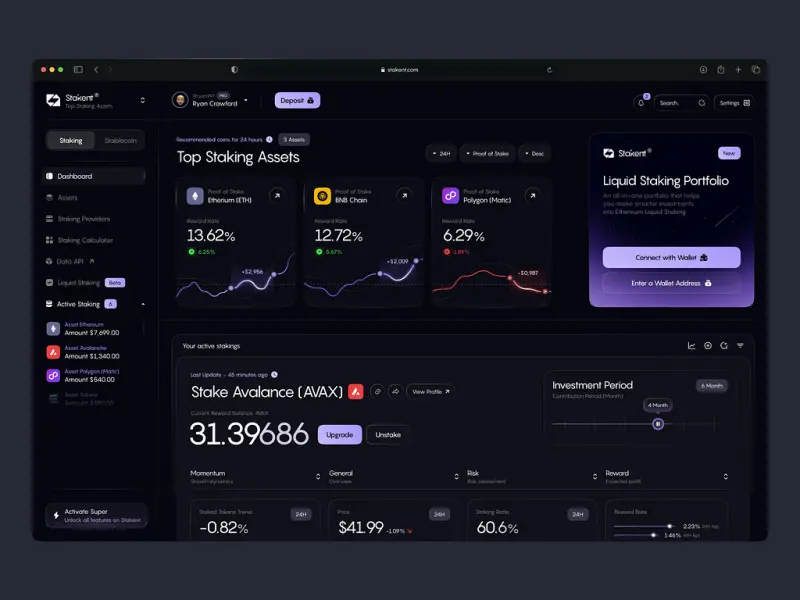

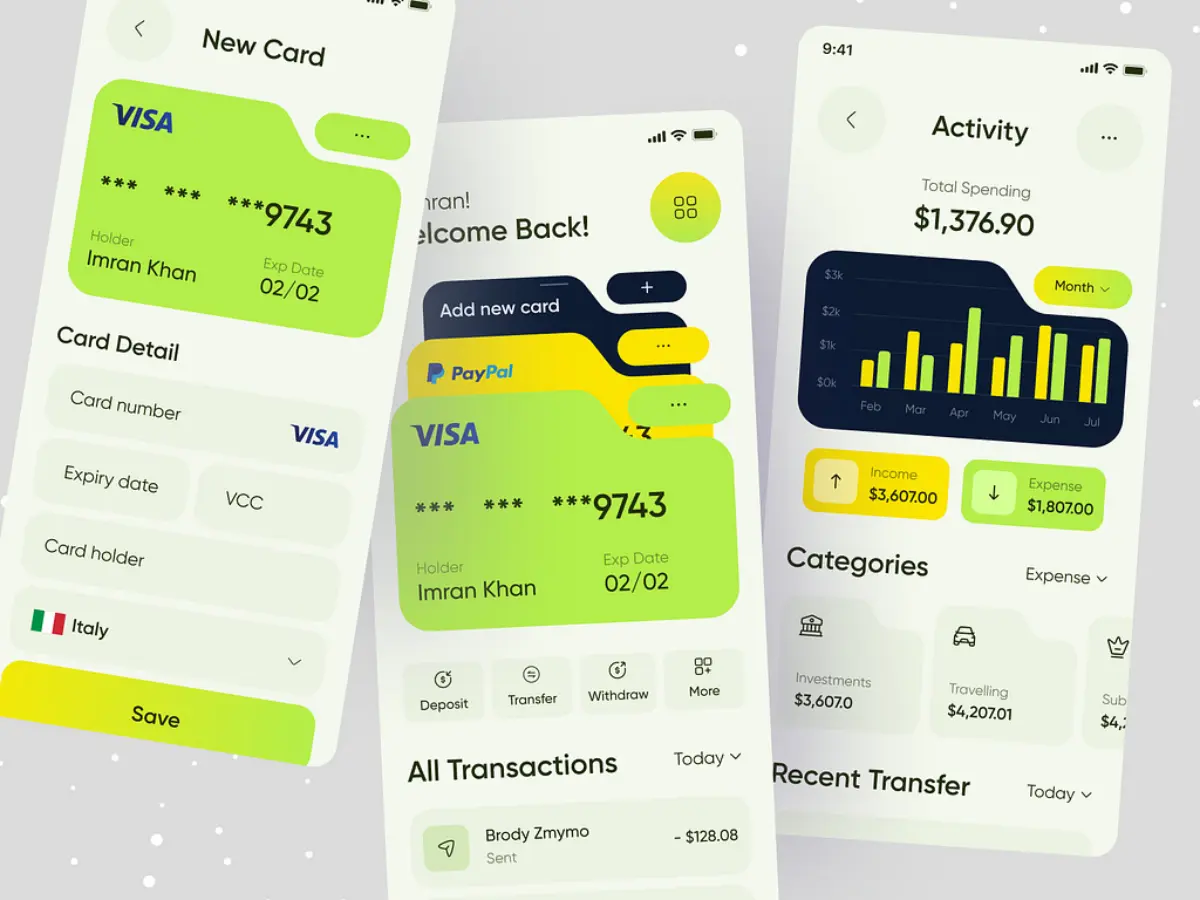

Trading platform visualization

- Informative User Profile

Ensure the user profile is complete with necessary details like name, picture, and language settings, making it easy for users to manage their information. - User-Friendly Dashboard

The dashboard should display key information such as account balance, owned stocks, and stock prices. It should also offer real-time charts and providing market insights that empower users to make well-informed trading choices. - Robust Trading Functionality

Include essential trading features like real-time graphics, company reviews, and other tools to help users make sound trading choices. - Secured Payments

Integrate certified payment gateways, like Stripe, to ensure secure transactions and protect user data. - Analytical Reports

Encourage more significant trades by providing users with personal statistics and automatic weekly or monthly reports to track their investments.

These features will help you create a reliable and user-friendly trading app.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

IV. Building A Trading Platform: Step-by-step Process

It’s time for the main part, here’s the full guide on how to create trading platform:

Phase 1: Define Your Objectives

Before diving into building a trading platform, it’s crucial to understand the needs, pain points, and challenges faced by traders. This understanding forms the bedrock of your platform, allowing you to tailor it to meet their specific requirements. Ask yourself: How can your platform provide solutions to their problems and enhance their trading experience?

To solidify your goals, organize brainstorming sessions with stakeholders and the product team. This collaborative approach will help you crystallize your trading app ideas, identify key business metrics, and define how you’ll measure the success of your platform.

During these sessions, consider the following factors:

- Order Execution Speed: Traders need a platform that executes orders swiftly, allowing them to capitalize on real-time market movements and secure the best possible prices.

- Market Analysis Capabilities: Your platform should empower traders with tools to analyze current and historical market data effectively. Intuitive data visualization is key here, making complex information easily digestible.

- Competitive Trading Fees: High fees can be a major deterrent for traders. Conduct thorough market research to determine a competitive fee structure that appeals to your target audience.

- Automated Trading Options: Traders can’t monitor the markets 24/7. Integrating automated trading features, such as bots that execute trades based on pre-defined parameters, can be a game-changer. For instance, bots can be programmed to react to signals from custom indicators, automating the trading process.

- Real-time Alerts and Notifications: Timely alerts and push notifications keep traders informed about important market events. This ensures they never miss a beat, even when they’re away from their trading screens.

Furthermore, define your target audience. Will your platform cater to seasoned professionals or newcomers to the trading world? This decision will guide your design and development process.

Finally, consider the pros and cons of centralized versus decentralized platforms. Centralized platforms utilize an order book to manage trades, while decentralized platforms facilitate direct peer-to-peer transactions. A clear grasp of these distinctions is crucial when determining the most suitable.

Phase 2: Outline Essential Features

Traders develop preferences for specific features based on their experiences with existing platforms. When designing your platform, it’s essential to consider these expectations and incorporate features that resonate with your target audience.

Here are 12 crucial features to consider:

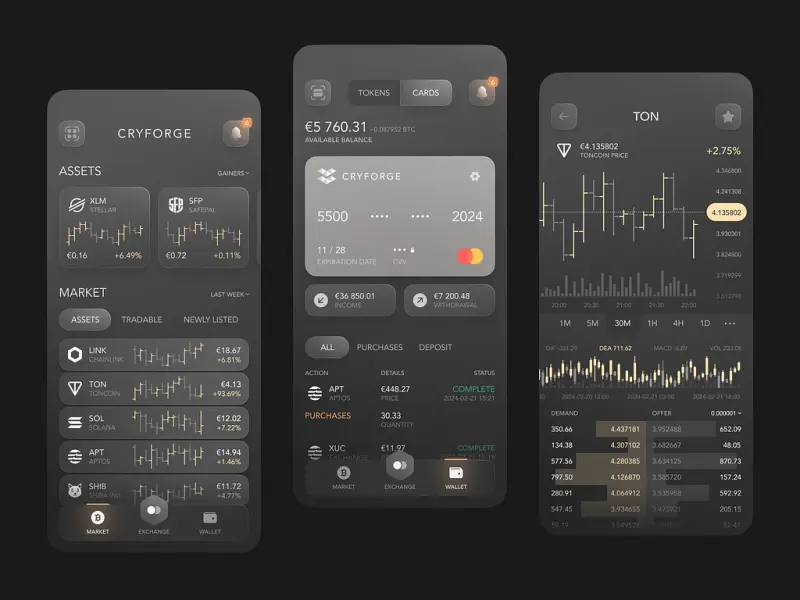

- Intuitive User Interface: A clean, user-friendly interface is paramount. Traders should be able to navigate the platform effortlessly and execute actions with ease.

- Low Spreads: Ensure sufficient liquidity to offer competitive spreads, especially on popular assets. Tight spreads translate to better pricing for traders.

- Reasonable Commissions: Transparent and competitive commissions are essential for attracting and retaining traders.

- Robust Analytical Tools: Empower traders with advanced charting tools, technical indicators, and the ability to export data for further analysis. Ideally, your platform should provide insights into potential market trends and projected returns based on different strategies.

- Automated Trading Capabilities: Allow traders to create and deploy custom trading bots that align with their strategies. This not only enhances convenience but also builds trust in your platform’s capabilities.

- Seamless Registration: Make the registration process quick, straightforward, and secure, leaving a positive first impression on new users.

- Customizable Notifications: Provide traders with the ability to personalize alerts and notifications based on their preferences. Timely and relevant notifications enhance the user experience.

- Comprehensive Research Tools: Equip traders with tools to research global markets, access financial news, and stay informed about market trends. Ensure your newsfeed sources are credible and reliable.

- Ironclad Security: Security is non-negotiable. Enforce stringent security protocols, including but not limited to two-factor authentication, cold storage for digital assets, and API key management, to safeguard user funds and data. If your platform operates under regulatory frameworks, clearly communicate these regulations and their implications to users.

- Transparent Deposits and Withdrawals: Provide a variety of convenient deposit and withdrawal options. Clearly outline any associated fees or processing times. If your platform is regulated, explain how this impacts user funds and data sharing with authorities.

- Seamless Cross-Platform Experience: Ensure a consistent and user-friendly a seamless and consistent user experience across a wide range of devices, from desktops to mobile phones.

- Responsive Customer Support: Provide diverse avenues for customer assistance, encompassing live chat, email correspondence, and telephone support. Promptly address user queries and concerns to build trust and loyalty.

Phase 3: Develop a Prototype

Before diving into full-fledged development, create a clickable prototype of your platform. Tools like Figma or Axure are excellent for this purpose. A prototype allows you to visualize the platform’s flow, test its usability, and gather valuable feedback from potential users.

User feedback is invaluable at this stage. It helps identify areas for improvement and ensures that the final product aligns with user expectations. Features that seem great on paper might not resonate well with actual users, so incorporating their feedback is crucial.

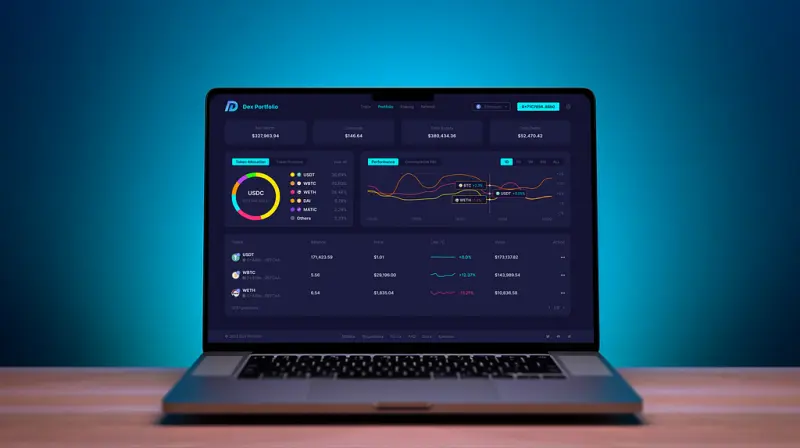

Create trading platform

Phase 4: Craft the UI/UX Design

With a solid prototype and user feedback in hand, you can move on to designing the user interface (UI) and user experience (UX). Strive for a balance between innovation and familiarity. Incorporate fresh design elements while adhering to established usability principles.

This iterative process of prototyping, testing, and refining ensures that your platform is both visually appealing and highly functional.

Phase 5: Platform Development and Launch

The final phase involves bringing your vision to life through development and launching the platform. The duration of this stage is contingent upon factors such as the platform’s intricacy, the development team’s scale and proficiency, and the selected technology.

For Android development, seek experienced developers proficient in languages like Java and Kotlin and frameworks like React Native. Requesting portfolios can help you assess their suitability for your project.

Similarly, front-end development requires skilled JavaScript developers, while dedicated testers are essential for identifying and resolving bugs.

Remember, launching your platform is just the beginning. Sustained growth and success hinge on ongoing refinement driven by user input and evolving market dynamics.

V. Crafting a Trading Platform: Key Considerations

In the previous section, we outlined our comprehensive approach to building a trading platform. This intricate process demands significant resources and time and requires the expertise of backend and frontend engineers, UX/UI designers, and product specialists. Our collaborative team structure ensures we address every facet of the platform, from functionality to user experience.

Now, let’s delve into crucial factors to keep in mind when developing a trading platform, particularly focusing on mobile applications. Given the competitive landscape, these insights will help you create a platform that stands out and attracts users.

Streamlining Online Trading Features

While it might be tempting to pack your platform with numerous features, this approach can be counterproductive. Developing a feature-heavy platform not only strains your development resources and budget but also risks overwhelming users. Often, companies fall into the trap of incorporating features simply because they seem like industry standards, without considering their actual value to users.

Instead, prioritize features that directly address user needs and pain points. Conduct thorough market research and user analysis to identify features that will truly enhance the trading experience, rather than cluttering the platform with unnecessary bells and whistles.

Prioritizing User Experience (UX)

A seamless user experience is paramount. This encompasses intuitive navigation, a visually appealing and easy-to-understand interface, and clear, concise language. Unfortunately, many design agencies still overlook the importance of user-centric design, resulting in mediocre platforms that fail to engage users in the long run.

To create a truly user-friendly platform, consider these UX principles:

- Data-Driven Decisions: Base all design choices on user data and insights gathered through testing and feedback.

- User Research: Conduct thorough user interviews with your target audience to uncover pain points and unmet needs that competitor platforms fail to address.

- Prototyping and Testing: Before writing a single line of code, create prototypes and test your design solutions with users. This iterative approach quickly saves development time and costs by identifying usability issues.

- UX Research and Product Design: Conduct ongoing UX research and product design sprints to uncover areas where users struggle with your platform.

- Validated Design: Begin development only after you have a design solution that has been validated through user testing.

- Prioritized Features: Prioritize feature development based on their potential impact on the business and user satisfaction.

- Accessibility: Ensure that core features are easily accessible within a maximum of three clicks.

The Importance of a Robust Development Process

Building a trading platform presents unique challenges. It requires a specific tech stack, specialized skills, and experience that not all development teams possess. Depending on your platform’s complexity and your internal capabilities, partnering with a product development agency experienced in building trading platforms can be highly beneficial. Look for a team with a proven track record in your niche and a deep understanding of the intricacies of trading technology.

Trading platform examples

Ensuring Ironclad Security

Protecting user data and ensuring secure transactions are non-negotiable aspects of a trading platform. To enhance security:

- Two-Factor Authentication: To add an extra layer of security, implement two-factor authentication (2FA) for both web and mobile platforms.

- Secure Socket Layer (SSL): Utilize SSL certificates to encrypt all communication between the user’s browser and your platform’s servers.

- Secure Electronic Transactions (SET): Consider incorporating the SET protocol, which authenticates both merchants and cardholders while encrypting sensitive payment information.

- Billing Address Verification: Implement billing address verification to prevent fraudulent transactions by verifying the cardholder’s address.

Remember, users are entrusting you with their funds. Stringent security protocols are paramount in establishing user confidence and protecting both your users and your platform’s reputation.

Navigating the Legal Landscape

Before launching your platform, ensure you ensure adherence to all applicable regulatory frameworks and secure the required operational authorizations to operate in your target markets.

- USA: If targeting US-based users, adhere to regulations set forth by groups like FINRA (Financial Industry Regulatory Authority) and SIPC (Securities Investor Protection Corporation) that oversee the industry. Ensure all sensitive user data is encrypted according to industry standards.

- Europe: Compliance with the General Data Protection Regulation (GDPR) is mandatory for European markets. Familiarize yourself with data protection laws and user rights within the EU.

Additionally, determine which regulatory body will oversee your operations, such as the Securities and Exchange Commission (SEC) in the USA. Compliance with these regulations fosters trust among investors and demonstrates your platform’s legitimacy and adherence to industry best practices. This is particularly crucial for attracting institutional investors and high-volume traders.

Remember, regulatory requirements can vary significantly depending on your platform’s features, target audience, and geographical reach. Consulting with legal experts specializing in financial technology and securities law is essential to ensure compliance and avoid potential legal issues.

Conclusion

The world of finance is changing faster than ever. This isn’t just a trend; it’s the future of finance unfolding before our eyes. Building a trading platform is your ticket to ride this wave. As we’ve explored, it’s a journey that demands careful planning, a keen understanding of user needs, and a commitment to robust security and regulatory compliance.

But let’s be honest, building a trading platform isn’t a simple task. That’s where TECHVIFY comes in.

We’re not just another development company; we’re your strategic partners in navigating the exciting, ever-evolving world of fintech. We’ve got the experience, the expertise, and the passion to help you build a trading platform that not only meets but exceeds user expectations.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666