The Necessity of Data Science in Fintech: It’s More Important Than You Think

- TECHVIFY Team

- 0 Comments

Financial technology, also known as fintech, is among the fastest-expanding sectors worldwide, transforming our understanding of finance and money. The rise of fintech has led to an explosion of data available to financial services companies, which is being utilized to drive innovation, enhance customer experiences, and manage risk. Data science, which involves using advanced analytics and machine learning to derive insights from data, has become an essential tool for fintech companies aiming to stay competitive.

In this article, we will explore how data science is revolutionizing the fintech industry. By examining case studies of successful fintech companies, we will see how they have leveraged data science to enhance their operations and gain a competitive edge. By the end of this article, you will understand the importance of data science in fintech and how it is reshaping the financial industry.

I. The Importance of Data Science in Fintech

Data Science in fintech plays a crucial role in making informed decisions, identifying trends and patterns in financial data, and developing predictive models to support decision-making processes.

Companies use data science in banking and finance to gain a competitive advantage, streamline their operations, and enhance the accuracy and reliability of their technology. By leveraging artificial intelligence, these companies can analyze large datasets from various sources, such as customer transactions, market data, and social media. This analysis provides insights into customer behavior, market trends, and risks, which can guide decision-making, facilitate the development of customized financial products and services, and improve overall customer satisfaction.

Fintech application

Data science is applied in many areas of finance, including transaction monitoring, fraud detection, risk assessment, and algorithmic trading. By examining large datasets, data science helps financial firms identify patterns, trends, and anomalies that might be difficult to detect otherwise.

- Financial Transactions: Financial organizations utilize big data and data analytics to enhance transaction speed, accuracy, and security. Data science is fundamental in achieving these improvements.

- Fraud Detection: Data science is employed to create models that detect fraudulent activities. These models can identify anomalies and flag potentially fraudulent transactions by analyzing historical transaction data.

- Risk Analysis: Data science helps in developing models to identify and quantify various financial risks, including operational, market, and credit risks. By recognizing patterns and trends in large datasets, data scientists assist financial businesses in managing their risk exposure more effectively.

- Algorithmic Trading: Data science is crucial in creating algorithms that interpret market data and provide real-time insights into investment decisions. These algorithms leverage predictive analytics to identify patterns and trends, enabling informed trading actions.

More Data Science Articles to Feed Your Curiosity:

II. How Financial Businesses Benefit from Data Science in Financial Services

Financial organizations can leverage data science to improve internal corporate processes in several key ways.

Identifying New Opportunities

Analytical tools can uncover new growth and development opportunities. For example, analyzing market trends can help a business forecast the profitability of entering a new geographical market. Additionally, fintech data science can predict whether investing in a new product or enhancing an existing one is more cost-effective. This enables businesses to identify potential opportunities, forecast their profitability, and estimate the expected return on investment.

Increasing Staff Productivity

Data science helps organizations evaluate which tasks consume most of their employees’ time and identify processes that can be automated. By using technology to handle simple but repetitive tasks, employees can dedicate their time to more innovative and strategic tasks, thereby boosting overall productivity.

Improving Decision Making

Effective use of data analytics enables organizations to make well-informed decisions and develop successful business strategies. Analytical tools can provide real-time data and timely feedback, facilitating prompt action. Data scientists can also create models to predict the outcomes of specific business decisions, helping managers evaluate various options, select the best one, and formulate effective plans to achieve their goals.

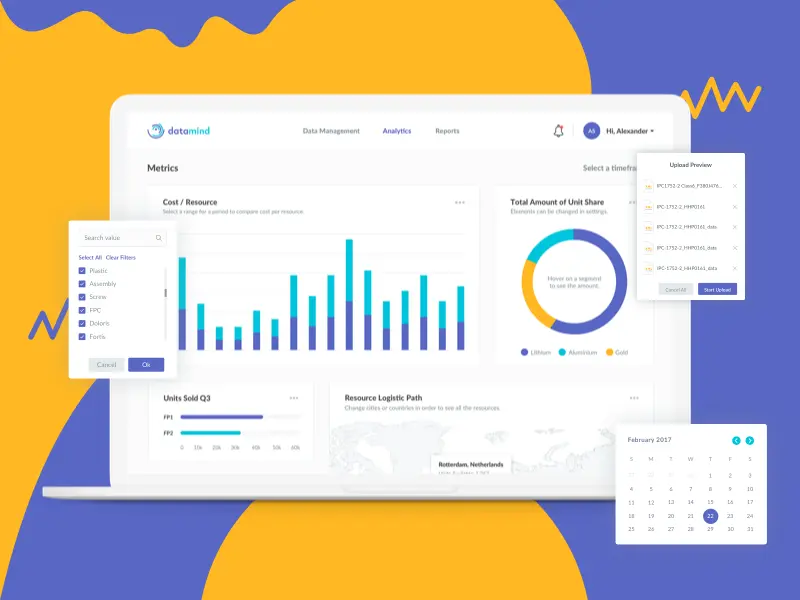

Data science in financial industry

Increasing Competitiveness

Data science in fintech helps gather customer data and information about competitors. Data analytic tools enable effective competitor research, allowing organizations to make informed pricing decisions, enter new markets, and refine business strategies to stay ahead of the competition.

Optimizing Resource Allocation

Financial institutions can use data science to analyze which operational areas should be prioritized to achieve economic efficiency. This ensures optimal resource utilization by directing them to high-priority tasks first.

Have a Project Idea in Mind?

Get in touch with experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

III. How Data Science Drives Innovation in Fintech

Data science has revolutionized the fintech industry, allowing companies to leverage big data to drive innovation and growth. Below are some examples of how data science in financial industry is being utilized in fintech companies to analyze financial data, simplify decision-making, and gain a competitive advantage.

1. Square

Squareup

Square, a US-based fintech company, offers a range of financial and payment services, including mobile payments, small business loans, and financial management tools. Founded in 2009 by Jack Dorsey, who also co-founded Twitter, Square uses data science in several key areas:

-

Loan Underwriting: Square Capital, the lending division of Square, uses data science to develop accurate credit underwriting models. By analyzing transaction data and bank account information, Square can create precise credit scoring models and extend loans to businesses that might not qualify for traditional bank loans.

-

Inventory Management: Square provides tools that help small businesses manage their inventory more efficiently. By analyzing transaction data and customer behavior patterns, these tools help businesses optimize inventory levels and reduce waste.

-

Fraud Detection: Square has implemented advanced fraud detection tools that analyze transaction data to identify fraudulent behavior. By detecting fraudulent transactions in real-time, Square can prevent losses and enhance the security of its payment platform.

2. Ant Financial

Ant Financial

Ant Financial, a Chinese fintech company, offers digital payment and financial services and has become one of the world’s largest digital payment platforms through the use of data science. Some key applications include:

-

Credit Scoring: Ant Financial has developed Sesame Credit, a credit scoring system that uses data science to analyze online shopping behavior, social media activity, and financial history, providing users with a credit score. This score helps users access various financial products and services, such as loans and insurance.

-

Personalized Financial Products: Ant Financial analyzes customer data to create personalized financial products and services. For example, the Yu’e Bao platform provides personalized investment portfolios based on users’ risk tolerance and investment goals.

-

Investment Management: Ant Financial utilizes data science to create tools that predict market trends and patterns. This helps the company make well-informed investment decisions and optimize their investment portfolios.

IV. Challenges and Limitations of Data Science in the Financial Industry

While data science in fintech has revolutionized the industry, it also presents several challenges and limitations. Addressing these issues is crucial to ensure customer data’s security, accuracy, and ethical use. Here are some key obstacles and how they can be managed to maintain customer trust and confidence.

Data Privacy and Security Concerns

One of the primary challenges of applying data science in fintech privacy and security. Fintech companies gather and store vast amounts of personal and financial data, making them prime targets for data breaches and cyber-attacks. Such incidents can result in substantial financial losses for both the company and its customers.

To mitigate these risks, fintech companies are implementing various security measures, including:

- Multi-Factor Authentication (MFA): Implementing an additional layer of security by requiring multiple forms of verification.

- Encryption: Ensuring data protection during transit and while stored to make it unreadable to unauthorized users.

- Biometric Authentication: Using unique biological traits (e.g., fingerprint, facial recognition) for secure access.

- Cybersecurity Training: Educating employees on best practices and potential threats.

- Partnerships with Cybersecurity Firms: Collaborating with experts to identify and address vulnerabilities.

Regulatory Compliance

Fintech businesses must adhere to numerous regulations, such as anti-money laundering (AML) and know-your-customer (KYC) laws. These regulations necessitate the collection and storage of sensitive customer information, which can be challenging to manage securely.

To ensure regulatory compliance, fintech companies are adopting several strategies, including:

- Data Encryption: Securing sensitive data to protect it from unauthorized access.

- Secure Data Storage: Using advanced technologies to safeguard stored data.

- Regular Security Audits: Conducting frequent checks to identify and fix security gaps.

- Collaborations with Regulatory Bodies: Working closely with regulatory agencies and compliance firms to stay up-to-date with the latest requirements and best practices.

Data Quality and Accuracy

Ensuring the quality and accuracy of data is another significant challenge in fintech. Managing the enormous volumes of data collected and analyzed can be challenging and may cause inaccuracies. Poor data quality can result in erroneous financial decisions, with severe financial repercussions.

To overcome this issue, fintech companies are investing in:

- Data Cleaning and Verification Processes: Ensuring data is accurate and free from errors before analysis.

- Machine Learning Algorithms: Using advanced algorithms to detect and correct errors in the data.

- Data Quality Management Systems: Implementing robust systems to consistently monitor and maintain data quality.

Conclusion

The rapid expansion of the fintech sector is fundamentally reshaping our interaction with finance and money. By integrating data science into their operations, fintech companies are driving innovation, enhancing customer experiences, and managing risk more effectively.

Data Science in fintech continues to be a powerful tool that propels this industry forward, fostering a more efficient, secure, and customer-centric financial landscape.

Ready to leverage the power of data science in financial services? Contact TECHVIFY today for expert consultation and services tailored to your needs!

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666