The Full Breakdown of Money Transfer App Development Cost in 2025

- TECHVIFY Team

- 0 Comments

Traditional banks are notorious for their long lines and overwhelming paperwork. Unlike these conventional banks, online mobile banking allows people to open new accounts, carry out transactions, and manage various banking tasks from their phones, all within seconds. This convenience is why more and more business owners are now considering money transfer app development.

The global mobile payment market is rapidly expanding, with projections estimating it will reach $2,983.9 billion by 2032. This represents a massive increase from previous years. To put it in perspective, the market was valued at around $942.3 billion in 2022. This growth translates to a compound annual growth rate (CAGR) that exceeds 12%.

In this article, we’ll break down the main and hidden factors that contribute to the cost of a money transfer app development. Additionally, we’ll offer tips on how to lower the expenses of creating a money transfer app and discuss other important aspects you should consider.

I. Key Factors Influencing Money Transfer App Development Costs

Understanding the main cost factors is essential when planning a money transfer app development. By identifying these elements, you can make better decisions and optimize your e-wallet app development budget effectively.

Money Transfer App Development

Outsourcing allows you to access a diverse range of talent from around the world, allowing you to find experienced fintech developers at competitive hourly rates. For instance, Southeast Asian developers, including Vietnam, typically provide more competitive pricing compared to their peers in North America or Europe. This can substantially reduce your overall development costs compared to building an in-house team.

App Complexity

The type of money transfer app you decide to develop will play a significant role in determining the cost. The complexity and range of features required will differ depending on the app type, which in turn influences the overall expense. Here’s an overview of cost variations based on the type of e-wallet app in the context of Vietnam:

| Money Transfer App Type | Description | Estimated Cost |

|---|---|---|

| Simple App | Includes basic features like P2P transfers, bill payments, and integration with existing banking systems. | $15,000 – $25,000 |

| Medium App | Offers all the features of a simple wallet plus additional functionalities such as in-app purchases and multi-currency support. | $25,000 – $40,000 |

| Advanced App | Comes with a comprehensive set of features including P2P payments, multi-currency support, loyalty programs, in-app purchases, budgeting tools, and advanced security measures like biometric authentication. | $40,000 – $70,000 |

The cost of developing a money transfer app can vary widely depending on the selected features, the development approach, and the overall project scope. For a more accurate estimate that fits your requirements, it’s advisable to consult with a seasoned fintech app development partner in Vietnam.

Platform Selection

The platform you choose for your money transfer app is another crucial factor that will influence your development budget. Each platform has its own design guidelines, security standards, and user experience expectations, all of which require additional development and testing efforts.

Here are the main platform options to consider when developing your mobile wallet app:

-

Native Development (iOS & Android): This option provides the best user experience and full access to device-specific features, but it requires separate codebases for each platform. While it gives you the most control over the app’s design and functionality, it also comes at a higher cost. In Vietnam, the cost for native development typically ranges from $30,000 to $50,000 per platform.

-

Web-Based Development: Developing a money transfer app on a web platform offers flexibility and ease of access. It allows for quicker updates and simpler maintenance, but it may not fully leverage all the features of a mobile device, potentially limiting the user experience compared to native apps. The development cost for a web-based e-wallet generally ranges from $10,000 to $20,000.

-

Cross-Platform Development: Using frameworks like React Native or Flutter, cross-platform development enables you to create one codebase that functions on both iOS and Android platforms. This approach streamlines the development process and simplifies maintenance and updates, making it a cost-effective way to reach a broader audience. Cross-platform development costs usually between $20,000 and $40,000.

Note: Opting for cross-platform development can be a cost-effective strategy as it allows you to build a single codebase that functions on both iOS and Android platforms. This can greatly reduce both development and maintenance expenses while maintaining a uniform user experience across various devices in the Vietnamese market.

Feature Sets and Integrations

When planning to develop a money transfer app, it’s essential to understand the feature set and integrations you might need, along with their associated costs. Below, we’ve outlined the various types of features and their estimated costs when developing.

| Feature | Description | Feature Examples | Approximate Development Cost |

|---|---|---|---|

| Basic Features | These core features form the foundation of any money transfer app and are relatively affordable to implement. | User registration, login, balance checks, money transfers, transaction history | $5,000 – $10,000 |

| Standard Features | These features enhance user experience and functionality, adding some complexity and cost to development. | In-app purchases, multi-currency support, basic budgeting tools | $10,000 – $25,000 |

| Advanced Features | Designed for tech-savvy users, these features require specialized expertise and significantly increase development costs. | Biometric authentication, loyalty program integration, P2P payments, AI-powered financial tools | $25,000 – $50,000+ |

| Custom Integrations | These personalized integrations enhance user experience but involve additional development efforts, depending on the complexity of the integration. | Integrations with specific financial institutions, loyalty programs, third-party services | $3,000 – $15,000+ |

This table offers a useful starting point for planning the feature set of your money transfer app in Vietnam. To ensure the features and integrations align with your particular needs and budget, consulting with an experienced fintech software development partner is recommended.

Technology Stack

Below is a consolidated table that outlines the various components of the technology stack typically used for developing money transfer apps in Vietnam. This includes mobile and web architecture, testing tools, design tools, project management tools, and release platforms.

| Category | Technology Options |

|---|---|

| Mobile Architecture |

– Android: Kotlin, Jetpack Compose, Android SDK<br>- iOS: Swift, SwiftUI, UIKit, Core Data – Cross-Platform: Flutter, React Native |

| Web Architecture |

– Backend: Node.js, Python (Express.js, Django, Flask) – Frontend: JavaScript, TypeScript (React.js, Angular) |

| Testing | – Tools: JUnit, XCTest, Mockito, Jest, Mocha, Chai |

| Design | – Tools: Figma, Sketch, Adobe XD |

| Project Tools |

– Version Control: Git, GitHub, GitLab – Project Management: Jira, Trello, Asana |

| Release | – Platforms: Google Play Store, Apple App Store |

The Role of IT Vendor Location

The location of your fintech software development vendor is a key factor in influencing costs due to differences in living expenses, labor markets, and economic conditions. Here’s a breakdown of nearshore and offshore money transfer app development costs when outsourcing to Vietnam:

-

Nearshore Development: Typically, nearshore vendors are in neighboring countries or regions with similar time zones. Nearshore development costs range from $25 to $50 per hour, providing a good balance between affordability and communication ease.

-

Offshore Development: Offshore vendors are located in countries with lower living costs, offering more competitive rates. In Vietnam, offshore development rates range from $15 to $40 per hour, though factors like time zone differences and possible language barriers should be considered.

For example, if your business is based in New York, partnering with a development team can offer a cost-effective solution. While offshore development may come with challenges like time zone differences and cultural barriers, these can be mitigated by choosing a skilled fintech app development provider who employs effective project management techniques and clear communication strategies.

Our fintech development experts excel at overcoming such challenges. We prioritize smooth collaboration and efficient project delivery by fostering open communication, using collaborative tools, and holding regular meetings to bridge any cultural gaps. With our established history in fintech app development, we deliver high-quality money transfer solutions on time and within budget, regardless of location.

Looking to Outsource Development?

Contact TECHVIFY – Vietnam’s Leading Offshore Software Development & Outsourcing Company, for consultation and development services.

II. Money Transfer App Development Costs by Stage

When working with an outsourcing vendor, it’s important to understand the costs associated with each phase of money transfer app development. Below is an overview of the estimated expenditures for each development stage.

Cost of the Discovery Phase

The Discovery phase involves gathering information, analyzing requirements, and defining the project scope for your money transfer app. Typically lasting one to three weeks, the cost for this phase is calculated by multiplying the total hours worked by the specialists’ hourly rates. The estimated cost generally ranges from $800 to $2,400.

During this phase, specialists typically provide both rough and detailed cost estimates for your money transfer app:

-

Rough Estimate: This initial cost estimate offers an overview of expected expenses and outlines the development stages. It usually includes two rounds of revisions—one after the initial Solution Workshop and another following the Discovery phase.

-

Detailed Estimate: A more precise assessment is made based on comprehensive documentation and requirements gathered during the Discovery phase. This estimate considers specific needs for each development sprint, enabling detailed planning and effective project management.

Money transfer app visualize

Cost of UI/UX Design

UI/UX design is critical to creating a user-friendly and engaging interface for your money transfer app. The cost of UI/UX design can vary significantly based on the complexity, scope, and level of customization required for the project. The estimated cost typically ranges from $2,500 to $25,000.

Cost of Money Transfer App Development and QA

Developing a money transfer app involves using various frameworks, libraries, and development tools for both the front and back end. These tools can either be open-source (free) or require licensing fees. Alternatively, you might use third-party providers for certain components of your e-wallet.

-

Development Cost: Building a minimum viable product (MVP) for a money transfer app with basic functionalities generally requires at least two experienced fintech developers working for about three months. Depending on the developers’ rates, their experience, and the project’s complexity, this translates to a starting cost of $15,000+.

-

Quality Assurance (QA) Cost: Rigorous QA testing is crucial to ensure your money transfer app is secure and reliable. QA services typically cost anywhere from $2,500 to $10,000+, depending on the app’s complexity and the scope of testing required.

The cost of maintaining and supporting a money transfer app can vary widely depending on the support plan you select and the size of your support team. Monthly expenses typically range from $500 to $5,000+, depending on whether you opt for a basic or comprehensive support plan. With thoughtful planning, these ongoing costs can be managed effectively.

Maintenance and Support

-

Adherence to Requirements: Operations need to comply with project requirements, service-level agreements (SLAs), security regulations, and standard cloud service infrastructure. Adhering to these guidelines is essential for keeping your app secure and compliant over time.

-

Continuous Updates: Regularly refreshing, upgrading, and optimizing your money transfer services is essential. Developers should implement updates using no-downtime deployment strategies, which help maintain continuous availability and prevent fragmentation within your user base.

-

Marketing Coordination: Effectively coordinating marketing and sales campaigns alongside your app’s launch is essential for driving user adoption and engagement.

In conclusion, developing a money transfer app is a multi-stage investment, with costs that vary based on the complexity of the project and the functionalities you choose. Planning ahead and considering factors such as development stages, team location in Vietnam, and ongoing maintenance needs can create a realistic budget for your e-wallet app. This careful planning will help ensure your app’s successful launch and sustained growth.

III. Cost of Money Transfer App Development You Might Be Unaware of

When budgeting for a money transfer app, several hidden costs can significantly impact your overall expenditure. Below, we explore some of these critical aspects that are often overlooked during the initial planning stages.

1. Regulatory Compliance

Adhering to financial regulations and compliance standards across different regions is not only complex but can also be costly. Each country or region may have specific requirements for data security, Anti-Money Laundering (AML), Know-Your-Customer (KYC) protocols, and user authentication methods. Meeting these standards requires additional development efforts, potential legal consultations, and ongoing updates to ensure compliance.

Breakdown of Costs Associated with Regulatory Compliance:

| Compliance Component | Description | Estimated Cost |

|---|---|---|

| Legal Consultations | Assistance in understanding and implementing required regulations across various markets. | $5,000 – $20,000+ |

| Certifications | Costs associated with obtaining necessary certifications for compliance. | $2,000 – $10,000+ |

| Ongoing Maintenance | Regular audits, updates to security measures, and continuous compliance management. | $5,000 – $15,000+ per year |

Non-compliance with these regulations can lead to hefty fines or legal battles, making these investments crucial for the long-term success of your money transfer app.

2. Infrastructure and Scalability

The backend infrastructure is the backbone of your money transfer app, and it requires careful planning to ensure smooth operation and future scalability. The costs associated with creating and maintaining this infrastructure can fluctuate based on the scale of your user base, transaction volumes, and the complexity of your app.

| Infrastructure Component | Description | Approximate Cost (Per Month) |

|---|---|---|

| Cloud Services | Costs depend on usage, data storage, and the specific cloud services provider. | $1,000 – $10,000+ |

| Database Management | Varies based on the complexity of the database and the solution used (e.g., SQL, NoSQL). | $1,000 – $5,000+ |

| Server Maintenance | Costs depend on the size of the server and the resources required for smooth operation. | $500 – $2,000+ |

| Load Balancing | Distributes incoming traffic across multiple servers to ensure optimal performance. | $500 – $2,000+ |

| Disaster Recovery | Ensures business continuity in case of unexpected outages or data loss. | $1,000 – $5,000+ |

Investing in scalable infrastructure from the outset is vital to accommodating future growth and avoiding costly upgrades later. Proper planning in this area ensures that your money transfer app can handle increasing user demands and transaction volumes, providing a seamless experience for users.

IV. Expert Tips to Reduce the Costs of Money Transfer App Development for Your Business

Creating a money transfer application for your business can be a significant investment, but there are several approaches you can take to make the most of your budget. Here’s a list of expert tips to help you reduce development costs effectively.

1. Prioritize Features

While it may be tempting to develop a feature-rich app, each additional function adds complexity, development time, and costs. The key is to strike a balance between offering a compelling user experience with essential features and effectively managing your budget.

TECHVIFY Tip: Conduct thorough market research to identify the core functionalities that are most important to your target audience. Start with a streamlined approach, focusing on secure payments and transfers. Working with an experienced IT vendor who offers qualitative fintech software development services can help you prioritize features that add the most value while controlling costs.

2. Consider Cross-Platform Development

Building separate apps for iOS and Android can significantly increase your development workload and resources, leading to higher costs and a longer time to market. Additionally, maintaining and updating two separate codebases can be complex and time-consuming.

TECHVIFY Tip: Opt for cross-platform development frameworks like React Native or Flutter, which allow you to create a single codebase that is deployable on both platforms. This approach can drastically reduce development time and costs compared to building native apps for each operating system. Cross-platform development also simplifies ongoing maintenance and updates.

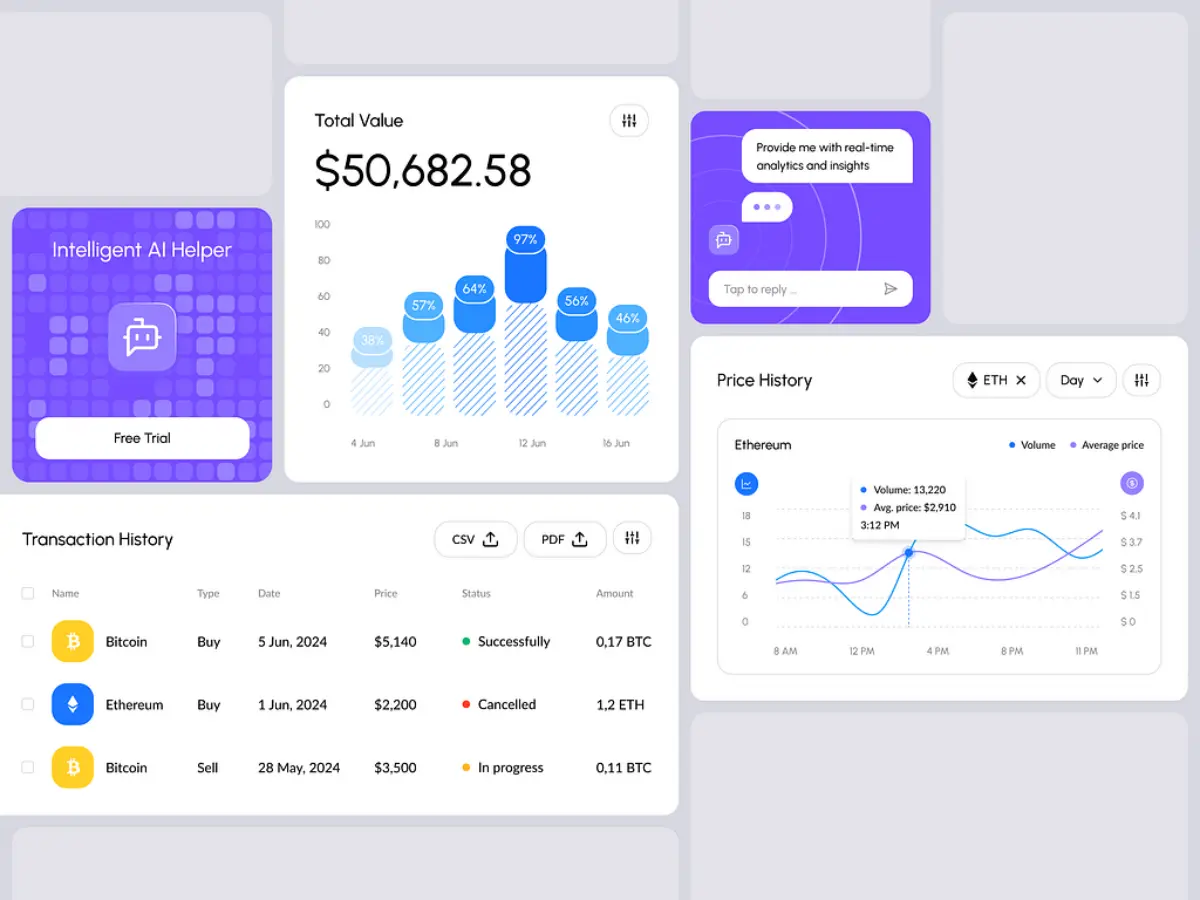

Money transfer app development cost

3. Outsource Money Transfer App Development

While in-house development offers complete control, it may not be the most cost-effective solution for all businesses. In-house development is ideal for large companies with the resources to maintain a dedicated team, but for startups or businesses with limited budgets, outsourcing can provide a more economical option.

TECHVIFY Tip: Consider strategically outsourcing specific aspects of development to experienced fintech developers in regions with competitive rates. For example, outsourcing to Southeast Asia, including Vietnam, where developer rates are often more affordable compared to North America or Europe, can significantly reduce costs. When outsourcing, choose reputable partners with expertise in money transfer app development, strong communication skills, and a solid history of delivering top-quality work within financial constraints

By applying these expert strategies, you can fine-tune your money transfer app development process, reduce unnecessary expenses, and still deliver a high-quality, feature-rich product that meets the needs of your users.

Conclusion

Developing a money transfer app is a complex, multi-stage investment that requires careful planning and consideration of both visible and hidden costs. However, by understanding these elements and prioritizing essential features, you can optimize your budget and still deliver a high-quality, feature-rich e-wallet app.

Given the rapid growth of the global mobile payment market, now is the perfect time to invest in a money transfer app that meets the evolving needs of users.

At TECHVIFY, we specialize in delivering top-notch fintech software development services customized to meet your business objectives. Our skilled developers are prepared to assist you bring your money transfer app idea to life, ensuring that it meets all regulatory requirements and industry standards while staying within your budget.

TECHVIFY – Global AI & Software Solutions Company

For MVPs and Market Leaders: TECHVIFY prioritizes results, not just deliverables. Reduce time to market & see ROI early with high-performing Teams & Software Solutions.

- Email: [email protected]

- Phone: (+84)24.77762.666