What is KYC verification? Why does it matter? This article helps you answer those questions.

I. What is KYC?

KYC verification or, by its acronym, Know Your Customer verification is the practice carried out by companies to verify the identity of their clients in compliance with legal requirements and current laws and regulations. The procedures fit within the broader scope of a bank’s anti-money laundering (AML) policy.

KYC procedures defined by banks involve all the necessary actions to ensure their customers are real, assess, and monitor risks. These client-onboarding processes help prevent and identify money laundering, terrorism financing, and other illegal corruption schemes.

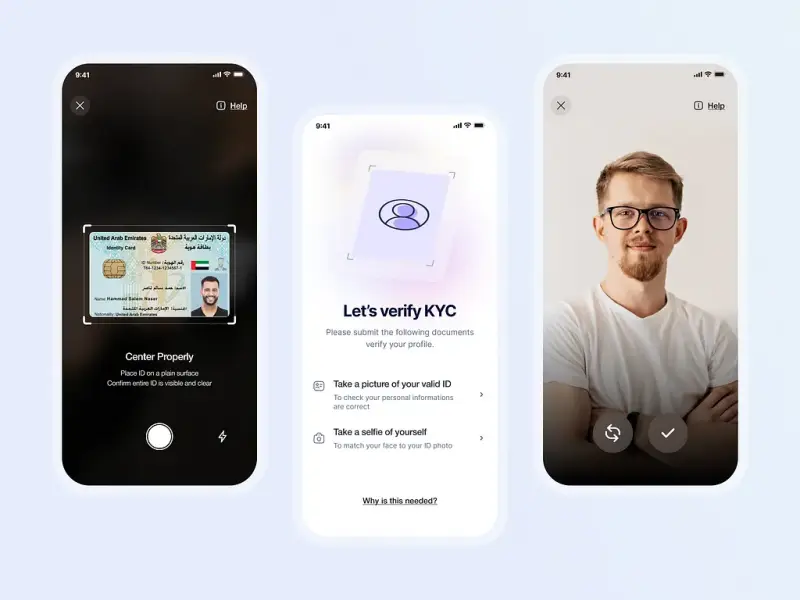

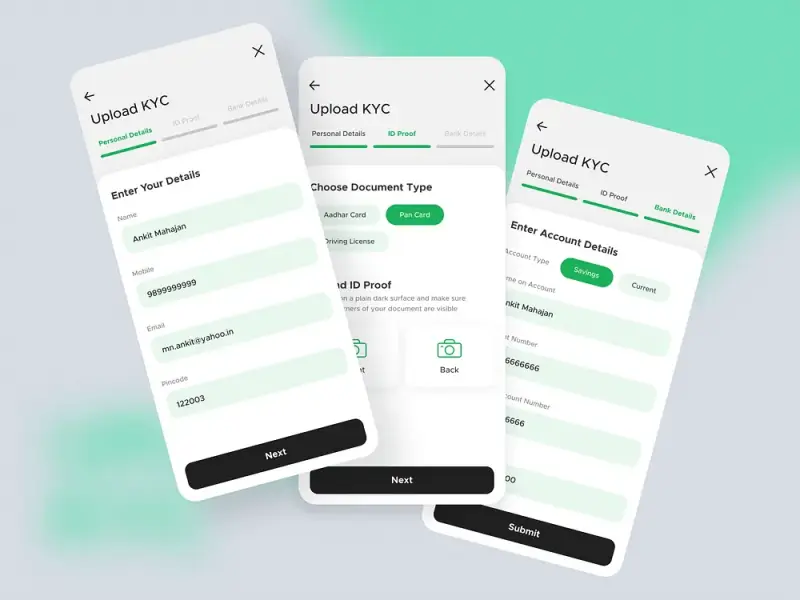

KYC verification

KYC process includes ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification. Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud. KYC compliance responsibility rests with the banks. In case of failure to comply, heavy penalties can be applied.

Learn more:

II. Why is KYC important?

If the last decade has taught us anything, it’s that a person’s online identity isn’t always what it appears to be. Data breaches, phishing schemes, identity theft, money laundering, and other digital scams have wreaked havoc on organizations from every sector of the economy — from fintech services to dating sites to players in the sharing economy.

To lessen the likelihood of these financial crimes, not to mention to protect their brand reputations, financial services organizations have a clear monetary incentive to accurately verify their users’ online identities through the use of KYC procedures.

III. Who needs KYC?

KYC is required for financial institutions that deal with customers during the opening and maintaining of accounts. When a business onboards a new client, or when a current client acquires a regulated product, standard KYC procedures generally apply.

- Financial institutions that need to comply with KYC protocols include:

- Banks

- Credit unions

- Wealth management firms and broker-dealers

- Finance tech applications (fintech apps), depending on the activities in which they engage

- Private lenders and lending platforms

KYC regulations have become an increasingly critical issue for almost any institution that interacts with money (so, just about every business). While banks are required to comply with KYC to limit fraud, they also pass down that requirement to those organizations with whom they do business.

IV. What are the three components of KYC?

The three components of KYC include:

- Customer Identification Program (CIP): The customer is who they say they are

- Customer Due Diligence (CDD): Assess the customer’s level of risk, including reviewing the beneficial owners of a company

- Continuous monitoring: Check client transaction patterns and report suspicious activity on an ongoing basis

Components of KYC verification

Customer Identification Program (CIP)

To comply with a Customer Identification Program, a financial institution asks the customer for identifying information. Every financial institution conducts its own CIP process based on its risk profile, so a customer may be asked for different information depending on the institution.

Customer Due Diligence (CDD)

Customer due diligence requires financial institutions to conduct detailed risk assessments. Financial institutions examine the potential types of transactions a customer will make in order to then be able to detect anomalous (or suspicious) behavior. Based on this, the institution can assign the customer a risk rating that will determine how much and how often the account is monitored. Institutions must identify and verify the identity of any individual who owns 25% or more of a legal entity, and an individual who controls the legal entity.

Continuous monitoring

Continuous monitoring means that financial institutions must monitor their client’s transactions on an ongoing basis for suspicious or unusual activity. This component embraces a dynamic, risk-driven approach to KYC. When suspicious or unusual activities are detected, the financial institution is obligated to submit a Suspicious Activities Report (SAR) to FinCEN and other relevant law enforcement agencies.

Conclusion

KYC regulations have far-reaching implications for consumers and financial institutions alike. Financial institutions are required to follow KYC standards when working with a new client. These standards were set up to fight financial crime, money laundering, terrorism funding, and other illegal financial activity.

Money-laundering and terrorist financing often relies on anonymously opened accounts, and the increased emphasis on KYC regulation has led to increased reporting of suspicious transactions. A risk-based approach with KYC can help eliminate the risk of fraudulent activities and ensure a better customer experience.

Hope this article has helped you answer the question “What is KYC verification?”. Subscribe to TECHVIFY to get more tech news and knowledge.