This article tells you everything you need to know about fintech application development.

Fintech is a newly coined term that is for anything comprised of finance and technology from the platform of transferring money to budgeting apps. It is one of the fastest-growing technologies across the globe as it offers top-notch security and convenience of traditional practices of finance.

In 2020, the Fintech market valuation was $127 billion. As per the Business Research Company, by 2022, it will reach a valuation of $309.98 billion with a CAGR of 24.8%.

Fintech Application Development: An Introduction

“Fintech” is a combination of the terms “finance” and “technology”. It refers to software and other modern technologies used by businesses that provide automated and improved financial services.

When you think about fintech, you’re probably imagining startups that use cutting-edge technologies. But traditional finance companies and banks are now adopting fintech services as well.

Types of Fintech Apps

The term “fintech” is relatively broad, and since the industry is growing rapidly, we see new services and applications emerge every year for both consumers and businesses. From InsurTech and cryptocurrency to mobile banking and investment apps, expect fintech to take on many shapes and sizes. Here are some of the most popular ones.

1. Payments

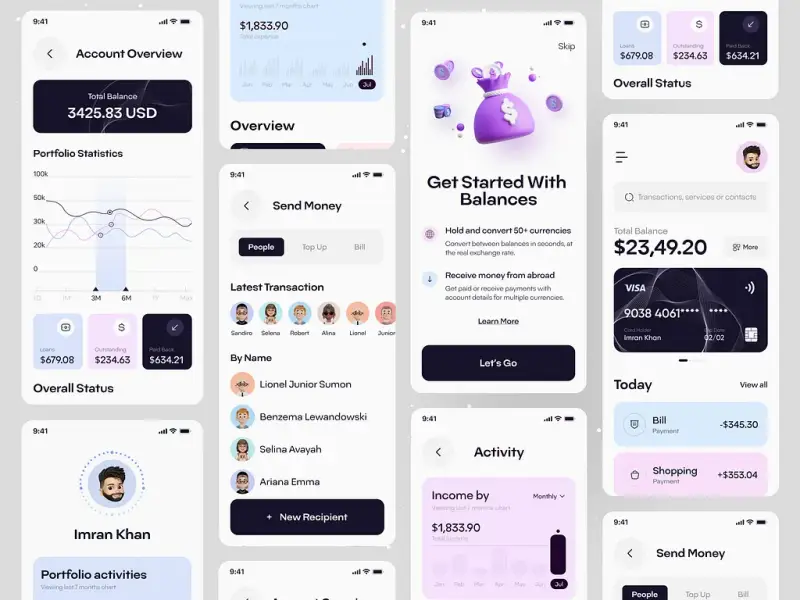

It’s hard to remember what life was like before mobile apps allowed us to pay friends or merchants with a few taps. Payment applications are changing the entire industry thanks to new digital processing solutions and networks. They facilitate better digital connectivity, lower processing costs, and ensure consumer identity protection.

2. Personal wealth management

Personal wealth apps are mobile applications that deliver a broad range of functionalities to help people manage their finances securely and quickly. Consumers and companies use them to manage their investment processes and portfolios.

3. Banking

Many traditional banking institutions are embracing digital technologies to improve their services. They invest in mobile apps that offer accessible banking products and services.

Learn More On:

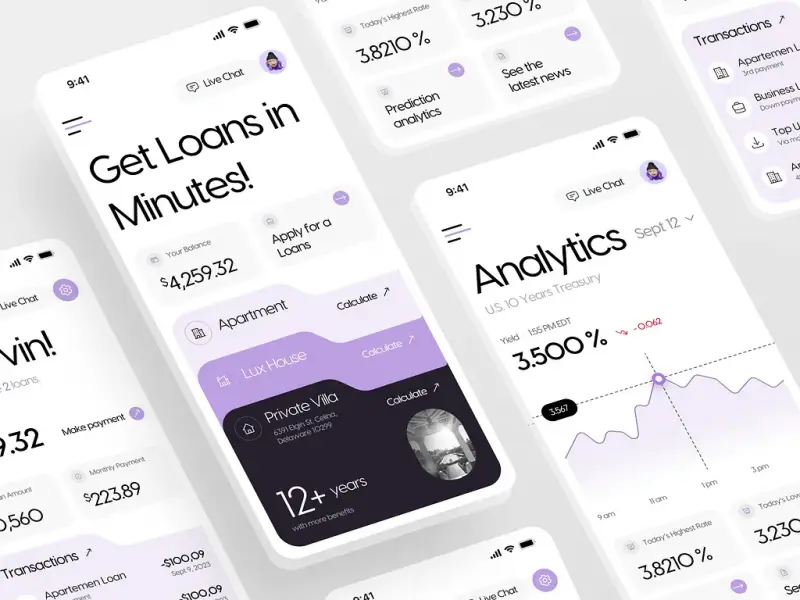

4. Money Lending

Money lending apps have become amongst the most trending tech in the Fintech world.

There is no participation of intermediaries such as loan brokers, banks, or any other financial institution. As there are no intermediaries, the interest rate is not as high and investors gain more profit. They have features such as credit score, loan application form, billing, payment, etc.

5. Others

There are many other financial services that have gone fintech, such as insurance, trading, and regulatory applications.

Fintech Application Development Stages

It might be tempting to choose the quickest way possible when developing your app to bring it to market before anyone else does. However, if you don’t dedicate enough time to planning, it might impact your short and long-term success.

Fintech application development varies greatly from project to project. Many apps use machine learning algorithms, data science technologies, and cutting-edge solutions like blockchain to carry out various tasks such as processing credit risks or running hedge funds.

Here are the main stages in fintech app development:

1. Define your purpose

It is of utmost importance to find out what you are aiming for.

You should outline a plan for your app, including the outlook of the interface and the features that it is going to offer. Also, the scope of MVP (Minimum Viable Product) and all the features should be clearly stated.

2. Build a Development Team

The size of the team will depend on timing, technology, and project size. Basically, you’ll need experts in the following niches:

- UI Designing

- Web developing (Node.js skills)

- Android Developing (Java Skills)

- iOS Developing (Swift Language)

- Software Testing

- DevOps Engineering

3. Design UI/UX

The design will play a major role in attracting users and retaining them on your app. Make an appealing yet simple design, so users have a smooth experience. And since this is finance, it is essential that your app looks professional to increase trust.

All necessary features should be available on the dashboard, so users don’t have to go around looking for them.

4. Test launch

It is important to first launch a Beta version. You can make it accessible only to your local customers, or to people at your workplace. The feedback will help you improve a lot of irregularities. When it is bug-free, your app is then ready to be launched officially!

5. Update

There’s something new every day in the IT world. With so many innovations, you have to update the app on a regular basis to keep up with new technologies as well as new demands from users.

Fintech is one of the most exciting technology fields today because it attracts a broad range of cutting-edge solutions that offer new products and reinvent traditional banking services.

The best way of fintech app development is to outsource as not only will it save time and money, but you will get a team of highly experienced developers. If you’re thinking about bringing your financial business to the next level, don’t hesitate to contact TECHVIFY.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666