Top 7 Fintech Trends Are Reshaping Finance 2025

- TECHVIFY Team

- 0 Comments

Fintech, short for financial technology, is changing how we manage money and business. In this article, we’ll explore fintech trends – the latest developments in the financial world. TECHVIFY will break them down into three parts: the overview to get the basics; top trends to discuss what’s hot right now; and the future where we’ll look ahead.

I. The Overview of Trends in Fintech

What are Fintech Trends?

These digital finance trends are the latest developments in financial technology. New technologies like AI & ML and blockchain often drive them. They can depend on consumer demands and regulatory changes.

Is fintech a growing industry?

The tech finance industry is accelerating; according to a report by Statista, the global market is expected to grow from $127.65 billion in 2022 to $332.3 billion in 2027. This growth is driven by many aspects, including the increasing adoption of online payments, the rise of embedded finance, and the growing demand for financial services from emerging markets.

This industry is also attracting significant investment. In 2021, global finance technology funding reached a record $210 billion, up from $132 billion in 2020. This investment is helping to fuel the development of new tech-driven financial products and services and to expand the reach of fintech companies into new markets.

II. Top Fintech Trends You Need to Know

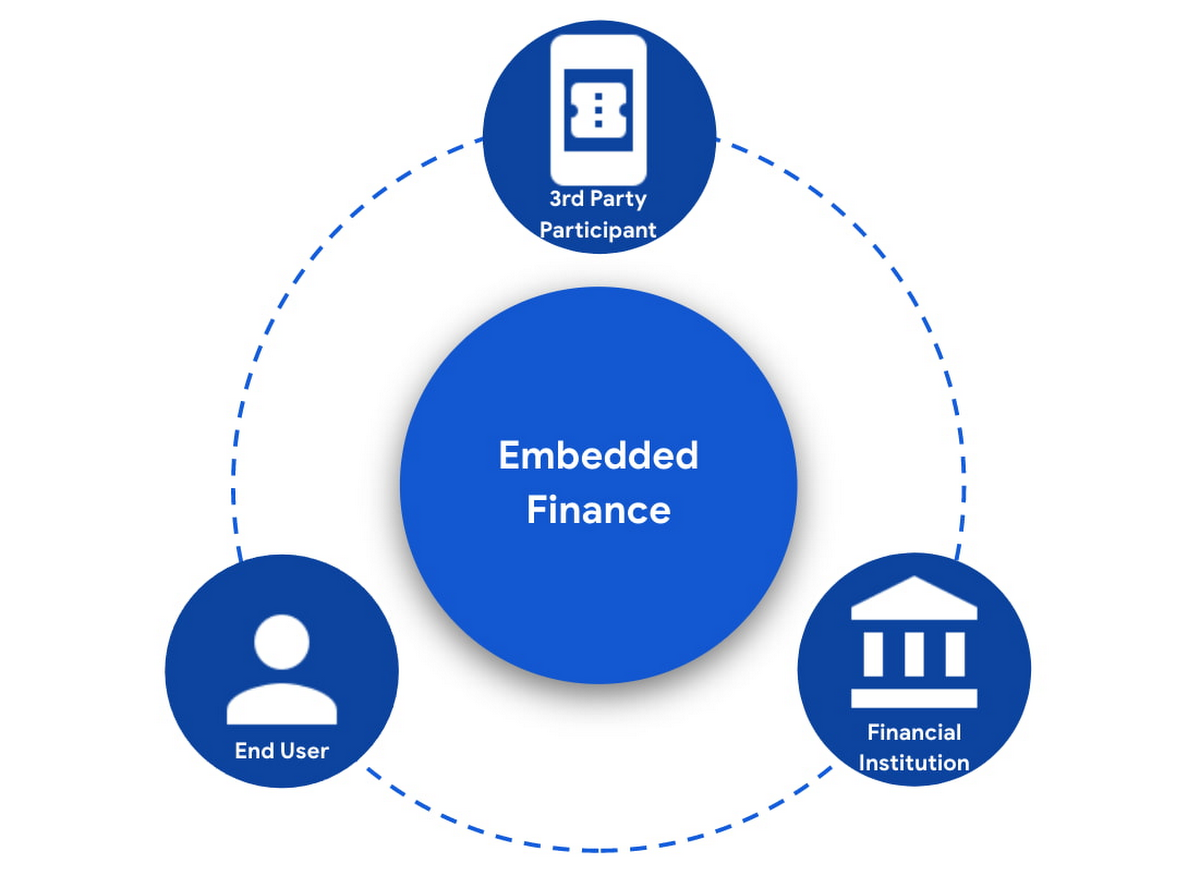

1. Embedded finance

Embedded finance is the integration of banking services into non-financial products and platforms. For example, consumers can now buy insurance through their e-commerce platform or get a loan through their ride-hailing app.

While embedded finance enhances accessibility and convenience for consumers, its implementation can be intricate, raising pertinent data privacy and security concerns.

2. Open banking

Open banking is a framework that enables consumers and companies to share their financial data with third-party providers. This trend has opened opportunities for fintech companies to develop innovative financial products and services. For example, robo-advisors use open banking to access customer data and provide personalized investment advice.

This trend empowers consumers with greater control over their financial data and fosters the development of personalized digital payment solutions. Nonetheless, open banking necessitates investments in technology and security while grappling with data privacy challenges.

3. Blockchain

Blockchain is a distributed ledger technology underpinning the development of new financial products and services, such as cryptocurrencies and decentralized finance (DeFi). For example, some banks are using blockchain to streamline cross-border payments.

Blockchain is also enhancing the efficiency and security of traditional financial processes. Banks are employing blockchain for streamlined cross-border payments, bolstering security and transparency. However, blockchain’s complexity, nascent stage of development, and regulatory hurdles pose challenges.

Have a Project Idea in Mind?

Get in touch with experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

4. Artificial intelligence (AI) and machine learning (ML)

Fintech companies are using AI and ML to improve the efficiency and accuracy of various financial services, from fraud detection to risk assessment to personalized financial advice. AI-powered chatbots, for example, facilitate customer support and financial inquiries.

These technologies enable companies to cut costs, enhance efficiency, and deliver tailored solutions. Data privacy, security, and algorithmic fairness concerns must be addressed.

5. Cybersecurity

Cybersecurity is one of the biggest trends in fintech for financial companies, as cybercriminals increasingly target them. Fintech companies invest heavily in cybersecurity to protect their customers’ data and financial assets. For example, some companies use artificial intelligence to detect and prevent fraud.

Some companies employ AI to detect and prevent fraud. Cybersecurity measures are vital for thwarting fraud and financial losses, but they require continuous adaptation and investment to outpace cybercriminals.

6. Buy now, pay later (BNPL)

The BNPL trend allows consumers to purchase products and services and pay for them in installments. BNPL services have become increasingly popular recently, especially among younger consumers.

While BNPL enhances affordability and credit history for consumers, it can lead to debt if spending exceeds means. Failure to meet payment deadlines can negatively impact credit scores.

7. Digital-only banking

Digital-only banks, also known as neobanks, are online banks that offer various financial services, such as checking accounts, savings accounts, and loans.

These banks are famous for their convenience, user-friendly interfaces, and competitive fees. They offer accessibility 24/7, boast intuitive websites and mobile apps, and often charge lower prices. However, they may need more physical branches and a comprehensive suite of financial products compared to traditional banks.

The Future Trends in Fintech

As we look ahead to the future of fintech, it’s essential to consider whether the current fintech trends will continue to rule this landscape in the next decade or if new technologies will disrupt them.

The trends in fintech 2023, such as AI, blockchain, and personalized services, will likely remain influential in the industry. AI’s role in enhancing efficiency and security, blockchain’s impact on transparency, and customized services meeting consumer needs will continue shaping tech finance. However, finance technology is not immune to disruption. Emerging technologies like quantum computing and decentralized finance (DeFi) could challenge the status quo. Quantum computing can disrupt existing encryption techniques, posing new security challenges. DeFi, with its decentralized and automated financial systems, could redefine how financial services are delivered and regulated.

The regulatory environment will play a pivotal role. Maintaining a balance between innovation and consumer protection will be crucial. Regulatory changes can either encourage or hinder fintech’s evolution.

Conclusion

This article about the latest fintech trends in 2024 shows how quickly the sector is developing. Fintech has the potential for sustained expansion thanks to technologies like open banking, blockchain, and artificial intelligence. It is evident from looking ahead that these tendencies will continue to shape the financial landscape. The secret to fintech’s long-term success is its capacity for innovation and adaptability, which will keep your company at the forefront of financial services in the rapidly evolving digital era.

If you want to explore how trends in the financial technology sector can benefit your business, contact TECHVIFY. We’re a global leader in AI and software solutions, with a dedicated team of over 300 experts. We specialize in guiding companies on their blockchain strategies, offering efficient services, personalized assistance, and budget-friendly options. Contact us today for valuable insights and tailored solutions.

TECHVIFY – Global AI & Software Solution Company

From Startups to Industry Leaders: TECHVIFY prioritizes results, not just deliverables. Accelerate your time to market and see ROI early with high-performing teams, AI (including GenAI) Software Solutions, and ODC (Offshore Development Center) services.

- Email: [email protected]

- Phone: (+84)24.77762.666