Blockchain in Finance: An In-depth Guide

Blockchain technology might completely transform the banking sector, providing unmatched security, transparency, and efficiency. Investigate its many use cases, from expediting international payments to revolutionizing asset management and insurance. In this article, we discuss the fantastic benefits of blockchain in finance and the difficulties it will have in gaining mainstream use. With TECHVIFY, let’s find out how this ground-breaking technology will shape the future of finance.

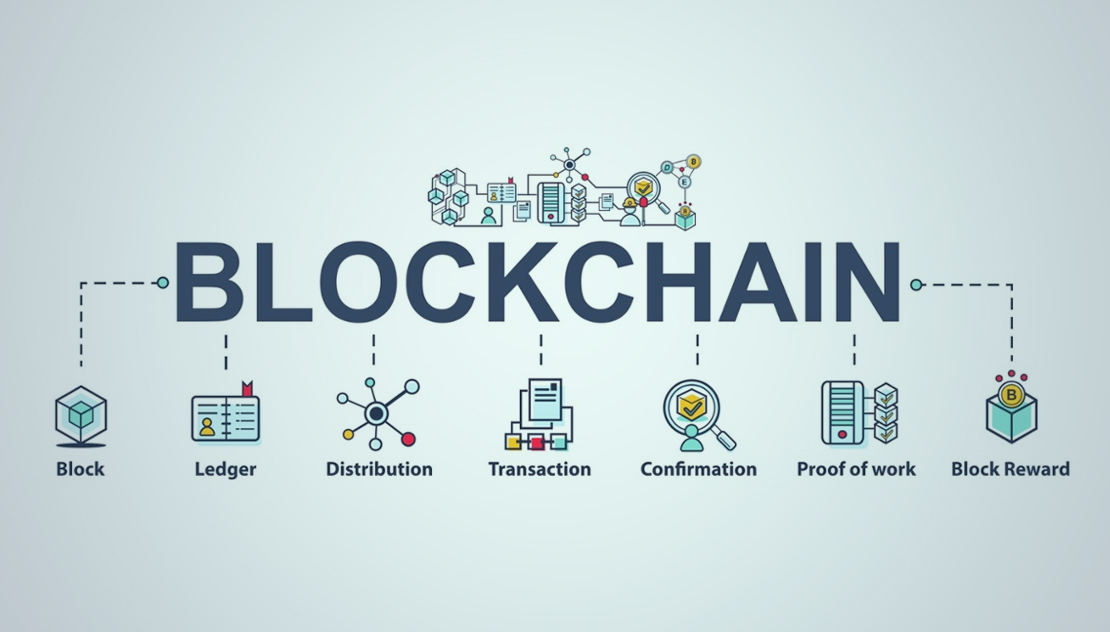

Blockchain technology in finance is a secure and transparent digital ledger technology that records and verifies financial transactions. It enables faster and more cost-effective cross-border payments, facilitates the creation of digital currencies, and automates financial agreements through smart contracts. It enhances security, reduces fraud, and has the potential to revolutionize traditional financial processes by eliminating intermediaries.

Applications of Blockchain in Finance

| Cross-border payments | Blockchain technology dismantles the barriers that have long hindered cross-border payments. Imagine sending money across continents with the same ease as sending an email. Blockchain’s decentralized nature ensures that transactions occur swiftly without needing multiple intermediaries. Furthermore, the immutable ledger guarantees that every transaction is safely recorded, removing worries about fraud or delays. |

| Supply chain finance | Supply chain blockchain integration brings efficiency and transparency. Every step of a product’s path is precisely documented on the blockchain, from the initial raw ingredients to the final customer. This openness reduces the possibility of receiving counterfeit items and ensures moral sourcing and environmental sustainability. |

| Regulatory compliance | Blockchain offers a lifeline to financial institutions by simplifying compliance procedures. It maintains a secure, unchangeable record of all transactions, streamlining audit processes and meeting regulatory requirements. This streamlined approach saves time and other resources, allowing institutions to focus on their core operations with confidence. |

| Asset management | Blockchain revolutionizes asset management by tokenizing traditionally illiquid assets like real estate, art, or private equity. These assets become divisible and tradable 24/7, opening investment opportunities to a broader audience. Smart contracts enable revenue distribution and automatically enforce ownership laws. Individuals can invest in high-value assets through fractional ownership without significant financial resources. |

| Insurance | The insurance industry, often criticized for its slow and opaque processes, is undergoing a much-needed transformation with blockchain. Claim processing becomes faster and more efficient thanks to automated smart contracts that trigger payouts when predefined conditions are met. Risk assessment becomes data-driven and transparent, reducing fraud and ensuring fair pricing. Policyholders gain real-time access to their coverage, enhancing trust and customer satisfaction. |

| Financial services | The blockchain’s impact extends beyond traditional finance, giving rise to a new wave of innovation. Peer-to-peer lending platforms allow individuals to lend and borrow without the involvement of traditional banks. Decentralized finance (DeFi) ecosystems create open and accessible financial services like borrowing, lending, and trading. Non-fungible tokens (NFTs) unlock new avenues for digital ownership and creativity, empowering artists and creators to monetize their work directly. |

Explore more Blockchain-related articles at TECHVIFY:

Blockchain Development Process and How to Apply It to Your Industry

Blockchain is a very secure technology. Transactions are protected and recorded on a distributed ledger, making them difficult to hack or tamper with. This trait makes blockchain ideal for storing and transferring sensitive financial data.

Opacity has no place in the world of blockchain technology. Every transaction is disclosed in an open book for everyone to view. This openness is a constant watchdog, monitoring money movement and discouraging any hints of fraud. By doing this, financial institutions and their clients can coexist in an environment of trust that protects their money.

Blockchain can streamline and automate financial processes, making them more efficient and cost-effective. For example, blockchain can be used to automate the clearing and settlement of securities transactions.

By dismantling the traditional gatekeepers, like banks and clearinghouses, the use of blockchain widely appears in the finance industry. A period of lean, cost-effective economic exchanges begins as the overheads and fees that traditionally weighed down transactions disappear.

This technology opens the way for a financial environment that is more accessible and where everyone can access services regardless of location or condition. Imagine the emergence of microlending platforms where even those without a traditional bank account can borrow modest amounts to accomplish their goals.

Please feel free to contact us for a free consultation: Blockchain Software Development Services

Blockchain in finance industry

One of the biggest challenges is regulation. There is yet to be a clear regulatory framework for blockchain in most jurisdictions. This uncertainty is making it difficult for financial institutions to adopt blockchain technology.

Another challenge is adoption. Blockchain is still a relatively new technology, and it will take time for financial institutions and consumers to adopt it. This downside is especially true for complex applications, such as cross-border payments and trade finance.

Here are some other challenges of blockchain in financial services:

To maintain competitiveness, banks must automate processes and enhance their digital services for customers. The use of blockchain in finance presents a revolutionary solution for banks to improve their offerings and customer satisfaction.

Moreover, blockchain can cut bank transaction expenses while enhancing security by maintaining consistent records across various systems. It also establishes a secure environment, mitigating the risk of cyberattack fraud and data breaches.

We foresee a bright future for blockchain in the banking sector, where service providers will collaborate with banks and financial institutions to foster trust, offer technological infrastructure support, and enable innovation through tailored services, bringing progress to both parties.

In conclusion, blockchain technology in finance holds immense potential, promising security, transparency, and efficiency. It can revolutionize cross-border payments, supply chain finance, regulatory compliance, asset management, and insurance. However, challenges like regulation, adoption, scalability, complexity, security, and privacy must be overcome. Despite these obstacles, blockchain’s benefits are clear, offering a transformative path toward inclusive, efficient finance. As it evolves, blockchain will shape the future of finance.

Contact us for further guidance on your company’s blockchain strategy. TECHVIFY Software, a Global AI and Software Solutions Company with a dedicated team of 300+ professionals, is here to assist you. We provide efficient services, tailored support, and cost-effective solutions. Reach out to us today for insights and tailor-made solutions.

Table of ContentsI. What is Blockchain in Finance?II. Explore Diverse Applications of Blockchain in FinanceIII. Remarkable Benefits of Blockchain Innovations in FinanceSecurityTransparencyEfficiencyCost savingsFinancial inclusionIV. Challenges of Blockchain in the Finance SectorV. Future of Blockchain in FinanceConclusion Technological advancements are paving new paths for companies across different sectors, and the logistics industry is no exception. According to a survey by Gartner, 87% of supply chain professionals plan to invest in enhancing the resilience of their platforms. Logistics encompasses a broad and complex array of processes that demand the utmost precision and continuous optimization. Companies can automate and streamline these processes through…

26 July, 2024

Table of ContentsI. What is Blockchain in Finance?II. Explore Diverse Applications of Blockchain in FinanceIII. Remarkable Benefits of Blockchain Innovations in FinanceSecurityTransparencyEfficiencyCost savingsFinancial inclusionIV. Challenges of Blockchain in the Finance SectorV. Future of Blockchain in FinanceConclusion The technology sector is advancing at an unprecedented pace, and the HR landscape is evolving right alongside it. To attract top talent, HR professionals and organizations need to stay ahead of emerging technology hiring trends. This year, we are witnessing significant shifts in hiring practices that will redefine our understanding of the future workforce. According to a Microsoft study, the number of technology jobs…

25 July, 2024

Table of ContentsI. What is Blockchain in Finance?II. Explore Diverse Applications of Blockchain in FinanceIII. Remarkable Benefits of Blockchain Innovations in FinanceSecurityTransparencyEfficiencyCost savingsFinancial inclusionIV. Challenges of Blockchain in the Finance SectorV. Future of Blockchain in FinanceConclusion Customized software plays a major role in managing various tasks within the telecom industry. It is essential for allocating numbers to subscribers and managing networks through optimized and AI-enabled routing protocols. Additionally, it aids in detecting fraud with intelligent telecom software development solutions and maintaining detailed subscriber profiles, including comprehensive call recording reports. I. A Quick Look into the Telecommunication Industry The telecommunications industry…

24 July, 2024

Thank you for your interest in TECHVIFY Software.

Speed-up your projects with high skilled software engineers and developers.

By clicking the Submit button, I confirm that I have read and agree to our Privacy Policy